The benefits of U.S. Open Skies policy have been stunning for airlines’ shareholders and employees, for travel and tourism jobs, airports, cargo carrier customers, community and economic development and for consumers.

Major U.S. airlines have worked overtime in the media, on Capital Hill, at the White House and at the Transportation, State and Commerce Departments to communicate that they feel threatened by foreign carrier new entrants and disadvantaged by new customer-service oriented business models and by airlines in whom governments hold equity stakes. The overall impression is that the big U.S. network airlines want to lock out independent airlines that offer lower fares, newer airplanes, faster connections, more destinations, and better service.

Now, it’s been said that no mass transportation system in the history of mankind has ever been profitable over time. Well, the good news is that U.S. carriers have cheated fate. It all started with guaranteed mail contracts and protection from competition that enabled U.S. carriers to become established, and indeed, world leaders.

Without doubt, a financially viable air transportation system is vital to the U.S. national interest. Indeed, airlines are the one industry that virtually every other industry depends on to service its customers and grow its businesses. And as individual consumers we need airlines to visit our families and friends and get our children home from college for holidays.

Every country has its unique collection of direct and indirect subsidies and structural advantages. The U.S. is no different. U.S. carriers can reduce expenses in bankruptcy proceedings, shift pension liabilities to the Pension Benefit Guaranty Corporation, benefit from general revenues from the U.S. Treasury that flow into the Airport and Airway Trust Fund and avoid ticket taxes on billions of dollars in revenues from ancillary fees and carrier-imposed charges. What’s more, the market has been reduced to 3 very economically and politically powerful airlines operating in and from the largest aviation market in the world and the most important and stable country – and a country whose greenback serves as the world’s reserve currency.

The list goes on and on and U.S. airlines have logically and deftly leveraged all these powerful advantages to become financially viable. However, the one benefit that dwarfs all others, and one that airlines fought hammer and tongs to achieve, is antitrust immunized alliances and metal-neutral joint ventures. This ability to set prices and capacity jointly with foreign airlines, a practice that massively reduced the number of independent competitors and would otherwise trigger civil and criminal sanctions under U.S. law, was premised on marketplace liberalization—specifically on functioning Open Skies agreements with the countries in question. Antitrust immunity is considered sound public policy and beneficial to consumers only insofar as our U.S. markets remain open to foreign carrier entry and expansion.

The benefits of U.S. Open Skies policy have been stunning for airlines’ shareholders and employees, for travel and tourism jobs, airports, cargo carrier customers, community and economic development and for consumers. However, if those benefits are threatened, then the antitrust immunity granted to U.S. airlines should be reconsidered. The antidote to normally anti-consumer agreement among competitors is new entry. Antitrust immunity is serious business; airlines should not take it for granted. We do not need to return to the dark anti competitive and anti consumer practices of earlier times.

When Southwest began to grow from a small airline in Texas to the national powerhouse it is today, the established network airlines sought to beat it through regulatory restrictions. Fortunately for consumers, they failed. Later, when ValuJet established a successful base in Atlanta, the implication was that Delta Air Lines had made a serious, strategic mistake in allowing the carrier to gain a foothold at Atlanta. The industry mantra became: “There will never be another ValuJet!” The major carriers subsequently went to war with low-cost airlines and began flooding those carriers’ markets with tens of thousands of cheap seats to prevent them from achieving break-even load factors.

Today, in BTC’s, the Norwegian Air International’s (NAI) business model and application before the DOT is perceived in the same threatening way. “Let’s stop NAI before its business model is tested and proven. For if we do not, other carriers will endeavor to emulate their success. There will be Ryanair ads in Washington and Tiger Airways ads in Los Angeles.” The problem with that thinking is, of course, that it contravenes 20 years of U.S. aviation policy and international agreements. And it is a slap in the face of the American consumer.

BTC is optimistic that the U.S. government will uphold its commitment to Open Skies and in so doing move soon to approve the NAI application. As the Editorial Board of the New York Times noted on February 17, 2015, Open Skies policy has been breathtakingly beneficial for U.S. consumers and businesses, and likewise for communities around the world. New NAI services would add to those benefits, especially vis-a-vis a radically consolidated domestic airline industry. And, there is so much additional Open Skies work to do and benefits to be generated.

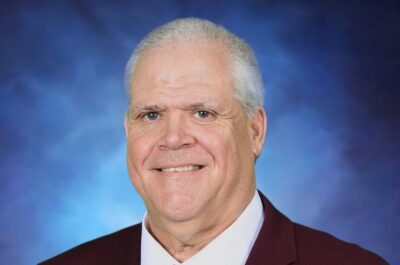

Kevin Mitchell is Chairman, Business Travel Coalition.

Mitchell is the founder of the Business Travel Coalition.