The Travel and Tourism industry remains one of USA's strongest industries, although the third quarter of 2013 (latest available data) saw a deceleration in its growth rate. According to the BEA, lower air passenger travel as well as all other transportation-related commodities affected the industry during the quarter.

CHICAGO – Although retail ecommerce is the segment that most of us are interested in, it is in fact just a part of the overall ecommerce market. Retailers and service providers generate just 4.7% and 3.0%, respectively of their revenues online, a slightly higher percentage than they did in the prior year. The U.S. Census Bureau categorizes these two segments as business-to-consumer.

According to the U.S. Census Bureau, the manufacturing sector is the largest contributor to e-commerce sales (49.3% of their total shipments), followed by merchant wholesalers (24.3% of their total sales). These two segments make up the business-to-business category.

This places the business-to-business category at 90% of total ecommerce sales, with the balance coming from the business-to-consumer category. The latest numbers from the Bureau suggest that the fastest-growing segments were retail and wholesale. [All the above data from the U.S. Census Bureau relate to 2011, as published in May 2013.]

The industry is evolving very rapidly, so data collection and evaluation are particularly difficult. Consequently, one has to rely largely on surveys by both government and private agencies.

Travel

The U.S. Commerce Department expects international travel to the U.S. to continue increasing over the next few years. Visitor volume is currently expected to increase 3.7-4.2% a year from 2013 to 2017 leading to a 26% increase in the number of users by 2018. Visitors from the Caribbean are expected to be the slowest-growing (1%). The Middle East, Asia and South America are expected to grow 67%, 60% and 52%, respectively.

The fastest growth is expected to come from China (229%), Saudi Arabia (191%), Russian Federation (79%), Brazil (66%), Argentina (65%) and Columbia (54%).

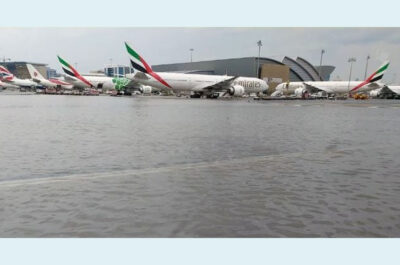

The Travel and Tourism industry remains one of the country’s strongest industries, although the third quarter of 2013 (latest available data) saw a deceleration in its growth rate. According to the BEA, lower air passenger travel as well as all other transportation-related commodities affected the industry during the quarter. As a result, the industry grew 2.5% in the quarter, below the real GDP growth of 3.6% (in the second quarter it grew 3.5% compared to GDP growth of 2.5%).

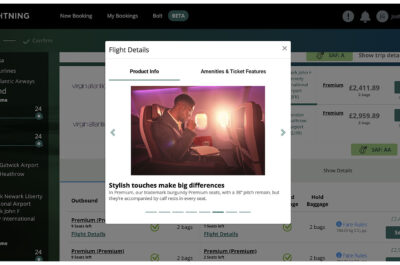

The top travel booking sites are Booking.com, Expedia.com, Hotels.com, Priceline.com, Kayak.com (acquired by Priceline), Travelocity.com, Orbitz.com and Hotwire.com. Since Booking.com and Kayak are part of Priceline (Nasdaq: PCLN-Free Report) and both Hotels.com and Hotwire.com part of Expedia (Nasdaq: EXPE-Free Report), this narrows down the top companies in the segment to Priceline, Expedia, Orbitz Worldwide (NYSE: OWW-Free Report) and Travelocity. However, there are several others worth considering that include Ctrip International (Nasdaq: CTRP-Free Report), MakeMyTrip (Nasdaq: MMYT-Free Report), among others.

Global outbound trips grew 4% in the first eight months of 2013 and are expected to grow 4-5% this year. The Asia/Pacific region is expected to see the strongest growth (up 9%), with China alone growing 18%. South America will follow with 6% growth followed by Europe at 3-4% and North America thereafter at 3% [World Travel Monitor 2013].

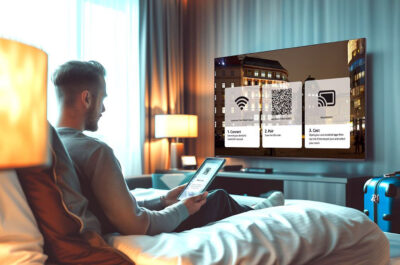

According to the TravelClick North American Hospitality Review (NAHR), both occupancy and average daily rates (ADRs) in North America have been growing steadily through the end of 2013 and into 2014. The occupancy rate for 2013 was flattish in the Group segment and up across most categories within the Transient segment, with the only weakness attributable to government spending. The ADR increased across all categories and was helped by much stronger leisure spending. The trends going into 2014 were positive for both occupancy and ADR.

Online travel agents (OTAs) continue to grow the fastest: up 15.2% in 2013, according to TravelClick. The hotels’ own websites were up 7.6%, with direct walk-ins and calls to the hotel down 0.4% and 4.3%, respectively. The global distribution system used by travel agents was up 3.5%.

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.