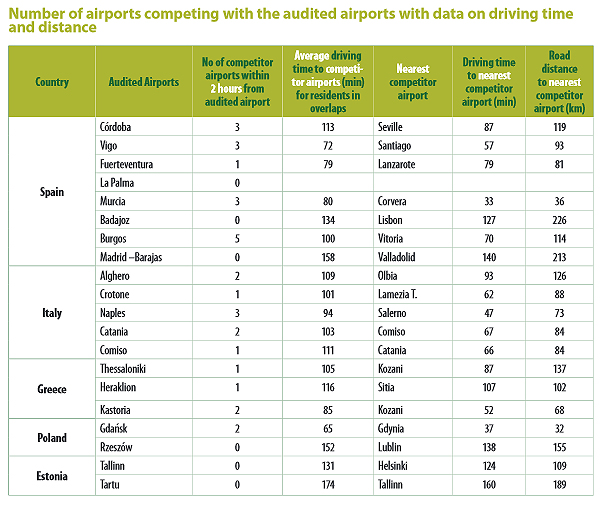

According to JLL, in 2016 international hotel operators are planning to open 7,400 rooms in Russia and CIS, 64% of which – 4,700 – are scheduled to enter the Russian market. Among other leaders in terms of new supply this year are: Kazakhstan (876 rooms), Armenia (549 rooms), Uzbekistan (533 rooms) and Belarus (414 rooms).

In 2015 the quality hotel supply of Russia, CIS and Georgia increased by 6,000 rooms, slightly more than a half of which – 3,300 – was in Russia, JLL reports. More than 8,900 rooms were scheduled for opening last year, including 5,200 rooms in Russia.

The second market with largest new supply in 2015 was Azerbaijan (three internationally managed hotel projects with total room count of slightly below 1,200 keys), third – Kazakhstan (three hotel projects with 569 keys in total), fourth – Georgia (three hotel projects with 463 keys).

“The main reason why a third of all announced projects got postponed is obviously the economic situation, which has a ripple effect on the whole region” Tatiana Veller, Head of JLL’ Hotels & Hospitality Group, Russia & CIS, said. “In some cases we witness the lack of funding necessary for project completion, in others – investors prefer to freeze their projects instead of continuing to put money into construction and fit-out without having certainty in future operational indicators.”

Branded hotel openings in 2015 (number of rooms)

According to JLL, in 2016 international hotel operators are planning to open 7,400 rooms in Russia and CIS, 64% of which – 4,700 – are scheduled to enter the Russian market. Among other leaders in terms of new supply this year are: Kazakhstan (876 rooms), Armenia (549 rooms), Uzbekistan (533 rooms) and Belarus (414 rooms).

“Although investors are being very cautious these days with starting new hotel projects due to current political and economic instability, the amount of internationally managed hotel rooms planned to open in 2016 in the region is still high,” Tatiana Veller says. “New branded openings are not expected in Ukraine for the second consecutive year: that market still has some way to go before it returns to pre-crisis indicators, and many investors hesitate to start new projects given the circumstances”.

Of 4,700 rooms announced in Russia, almost half (or 2,200), are supposed to enter the Moscow market. If all goes according to schedule, the quality Moscow supply will reach 25,000 rooms. Notably, the largest project in Moscow in 2016 will be the project near Kievskiy railway station, a triple-brand by Accor – Adagio, Ibis and Novotel (701 keys in total). St. Petersburg, which did not see any new branded openings last year, is expected to receive three new hotels – the city’s first Hampton by Hilton Expoforum and the country’s first Jumeirah and Wyndham; the total room count of 395 keys.

Planned branded hotel openings in 2016 (number of rooms)

Other regional cities with over a million population (excluding Moscow and St. Petersburg) are expected to add about 1,000 rooms. Two hotels with 360 rooms in total will open in Nizhniy Novgorod, one project per city is expected in Voronezh (220 rooms), Novosibirsk (218 rooms), Volgograd (158 rooms) and Rostov-on-Don (81 rooms).

Another 1,100 keys are supposed to be introduced to the smaller regional markets, with Krasnodar leading by a wide margin (three hotels with 684 rooms in total). The cities of Tyumen (195 rooms), Pereslavl-Zalesskiy (150 rooms) and Tver (65 rooms) are also expecting to get one new hotel each.

“Considering the recent trends in demand patterns, developers today start focusing attention on lower segments; according to our estimations, almost a third of 2016 new supply will contribute to this category; that is about 2,400 keys. It is worth mentioning that development of projects scheduled for this year started long before the ruble devaluation of 2014. Taking into account the length of an average hotel construction cycle (3-4 years), the implications of the current economic situation will likely only show by a gap in supply in 2018-2019” Tatiana Veller concludes.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.