Sochi City

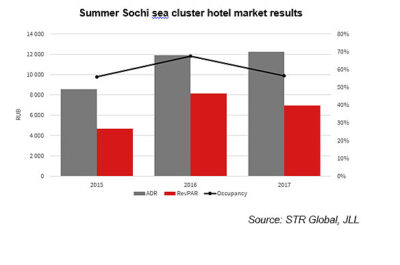

Year to date comparison gives the Sochi market reasons to be proud – 52% occupancy in the sea cluster vs. 42% last year, combined with the RUB 2,800 growth in ADR from January to August allowed RevPAR to increase by RUB 2,200 vs. 2015.

According to Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia & CIS, “this summer quality hotels in Sochi continued benefitting from the interest of travelers from Russia to the domestic destinations. Both the sea cluster and the mountain hotels showed unprecedented levels of occupancy and room rates. In the valley, the occupancy has averaged 68% from June to August (summer 2015 saw just 54%). In August, in fact, it reached 74% – highest number ever in the 3-year history of observation.”

Surprisingly, though, Krasnaya Polyana hotels also received a lot of tourists – average summer occupancy this year ranged around 59% (that is a 30 p.p. increase over the summer of 2015). In August, coincidentally, the mountain cluster hotels were seeing equal demand to the seaside accommodation – 74% of rooms were occupied. This number is very close to the typical occupancy of the high (ski) season for this region – in January and February this year 77 and 79% of rooms there were taken.

“The strongest rate positions, this summer, obviously have been recorded in the sea side hotels in the downtown Sochi and Imeretinskaya Valley – ADR they received was almost RUB 12,000. Compared to RUB 8,500 last year and RUB 4,800 in summer of 2014, this is a drastic improvement, which shows that the higher-paying demand also started favoring local destinations in their vacation time”, – Tatiana Veller says.

“Hotels in the mountains, obviously, had to be more flexible with setting their rates in order to bring guests in – but their ADR also grew compared to last year, albeit by more modest RUB 300.” – Tatiana Veller adds. – “Considering that this is the market with very high seasonality, the financial results we are seeing are a very good achievement.”

Year to date comparison also gives the Sochi market reasons to be proud – 52% occupancy in the sea cluster vs. 42% last year, combined with the RUB 2,800 growth in ADR from January to August allowed RevPAR to increase by RUB 2,200 vs. 2015. In the higher planes, mountain hotels overperformed their previous summer by 18 p.p., having reached 57%. Supported by the very strong rate positions – YoY ADR increased in these properties by RUB 800, RevPAR brought in RUB 1,300 more to the bottom line.

“The shoulder season in 2015 saw still solid occupancy (63% by the sea in September) and good rates, so we hope that summer also extends in the market.” – Tatiana Veller notes. – “Mountains should now drop off until the snow falls, or the casino opens in Gorky Gorod – seems like the date of summer 2016 has been postponed. Possibly, the higher than usual level of business in the mountain cluster hotels can be partly explained by the officials, construction and operational management visiting in preparations for the opening.”

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.