Compared with Q1 2015, Europe reported a 0.8% increase in occupancy to 61.1%, a 2.3% rise in average daily rate to 102.98 euros and a 3.1% lift in revenue per available room to 62.94 euros. Compared with Q1 2015, the Middle East subcontinent reported a 3.3% decrease in occupancy to 71.9%. Average daily rate for the quarter was down 8.1% to US$188.55. Revenue per available room dropped 11.1% to US$135.63.

LONDON — The European hotel industry recorded positive results in the three key performance metrics when reported in euro constant currency, according to Q1 2016 data from STR.

Compared with Q1 2015, Europe reported a 0.8% increase in occupancy to 61.1%, a 2.3% rise in average daily rate to 102.98 euros and a 3.1% lift in revenue per available room to 62.94 euros.

Performance of featured countries for Q1 2016 (local currency, year-over-year comparisons):

Croatia posted double-digit increases across the three key performance metrics: occupancy (+14.9% to 26.6%), ADR (+16.0% to HRK534.14) and RevPAR (+33.3% to HRK142.12). The first quarter is a traditionally slow season in Croatia. In comparison to a low base from 2015, the country’s performance was significantly driven by March, with RevPAR at +55.4% (HRK173.39).

Germany recorded modest growth in the three key performance indicators: occupancy (+0.8% to 62.4%), ADR (+2.2% to 99.78 euros) and RevPAR (+2.9% to 62.22 euros). Germany’s March ADR (101.58 euros) and RevPAR (67.96 euros) were the highest on record for the month. The country’s March occupancy (66.9%) was the second-highest level STR has benchmarked for the month.

Ireland saw a 4.8% rise in occupancy to 66.4% as well as double-digit growth in ADR (+17.6% to 107.84 euros) and RevPAR (+23.2% to 71.63 euros). The quarterly performance follows recent trends in the country with March being the 16th consecutive month with a year-over-year RevPAR increase. The absolute level of 86.67 euros was a March record for the country, helped by a busy week that included St. Patrick’s Day and the RBS 6 Nations rugby final weekend. STR analysts point to continuous demand growth and stagnant supply as the reason behind the RevPAR trend in Ireland. Demand has been driven by Tourism Ireland’s efforts to build on overseas tourism, as reflected by a record 25 million passengers travelling through Dublin Airport in 2015.

Portugal reported increases in occupancy (+6.2% to 49.7%) and ADR (+8.4% to 74.39 euros), leading to a double-digit lift in RevPAR (+15.1% to 36.98 euros). Q1 is a traditionally slow season for Portugal, but the month’s 62.4% occupancy level and ADR of 75.99 euros were the highest for March since 2008. STR analysts believe that Mediterranean visitors have diverted to countries like Portugal which are viewed as more secure destinations.

Performance of featured markets for Q1 2016 (local currency, year-over-year comparisons):

Amsterdam, Netherlands, experienced a 3.9% increase in occupancy to 68.5% as well as double-digit growth in ADR (+12.3% to 122.92 euros) and RevPAR (+16.7% to 84.15 euros). STR analysts labelled Amsterdam as a standout in March with RevPAR growth at +25.8. Occupancy for the month eclipsed 90.0% on Friday and Saturday, 25-26 March, during the Food Festival Amsterdam. ADR and RevPAR also reached their highest levels for the month on those two days.

Brussels, Belgium, saw decreases in occupancy (-9.8% to 57.4%) and RevPAR (-8.1% to EUR65.06). ADR was up 1.9% to 113.27 euros. Performance in the market was significantly affected by the terror attacks of 22 March, as occupancy dropped from 81.8% on the day before the 22nd to a low of 19.5% on the 28th. Occupancy for the month was down 19.6% to 57.7%.

Geneva, Switzerland, reported decreases across the board: occupancy (-3.1% to 63.5%), ADR (-1.1% to CHF300.01), RevPAR (-4.2% to CHF190.52). According to STR analysts, Geneva saw a positive impact from the Geneva International Motor Show (3-13 March), but the event wasn’t enough to counter a slow time around Easter as many left the market to travel elsewhere. In addition, Geneva likely saw some impact from the closing of the Brussels airport.

Milan, Italy, experienced slight decreases in occupancy (-2.0% to 59.8%) and RevPAR (-0.6% to EUR79.18). ADR was up 1.4% to EUR132.45. Performance in the market has slowed since the end of the fourth quarter of 2015, but in general, Milan seems less affected by the Brussels attacks when compared with other European markets.

Europe performance for March 2016 (Euro constant currency, year-over-year comparisons):

Compared with March 2015, Europe reported a 0.3% increase in occupancy to 66.2%, a 1.9% rise in average daily rate to 105.28 euros and a 2.2% lift in revenue per available room to 69.71 euros.

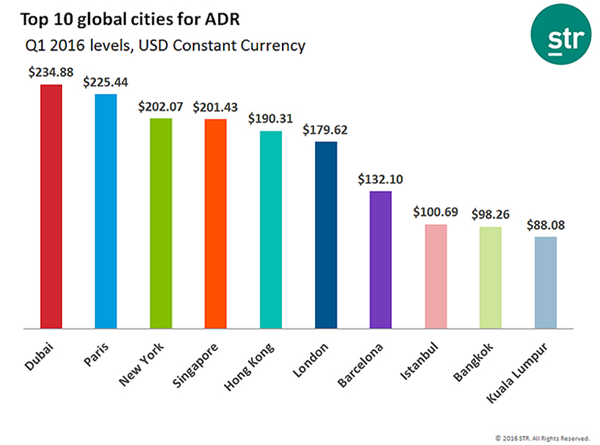

Dubai a world leader in Q1 ADR

STR data shows that Dubai, United Arab Emirates, recorded 2016’s highest first-quarter average daily rate (ADR) among major markets around the world. This marked the 12th consecutive year that Dubai has led this group of markets in Q1 ADR when reported in U.S. dollar constant currency.

Even with a 10.1% drop in year-over-year comparisons, Dubai’s ADR for Q1 2016 was US$234.88. Only three other major markets finished the quarter with ADR levels above $US200.00 in constant currency: Paris, France; New York, New York; and Singapore.

“January through March is typically a slower time for other popular markets like New York, London and Paris,” said Philip Wooller, STR’s Middle East and Africa area director. “But these are peak months for Dubai, as temperatures are more moderate, drawing in visitors from around the world. Dubai also has been one of the top five markets for year-end ADR levels every year since 2002, proving itself as the premier hotel market in the Middle East and as one of the top hotel markets in the world.”

During Q1 2016, Dubai’s performance was helped by major events including the Omega Dubai Desert Classic (golf), the Dubai Duty Free Tennis Championship, the Dubai World Cup (horse racing), the Dubai International Boat Show, Gulfood (global food and hospitality trade event) and the Arab Health Exhibition & Congress.

Wooller will attend the Arabian Hotel Investment Conference (AHIC) in Dubai from 26-28 April. Wooller and other STR representatives will be available to further discuss data and insights on Dubai and Middle East hotel performance.

*Constant currency is an exchange rate that eliminates the effects of exchange rate fluctuations and is used when calculating financial performance numbers. All calculations use 31 January 2016 exchange rates.

Middle East and Africa hotel performance for Q1 2016, March 2016

Hotels in the Middle East reported negative results, while hotels in Africa reported mixed results for the three key performance metrics when reported in U.S. dollar constant currency, according to Q1 2016 data from STR.

Compared with Q1 2015, the Middle East subcontinent reported a 3.3% decrease in occupancy to 71.9%. Average daily rate for the quarter was down 8.1% to US$188.55. Revenue per available room dropped 11.1% to US$135.63.

The Northern Africa and Southern Africa subcontinents experienced a 4.4% decrease in occupancy to 53.5%. However, average daily rate was up 9.0% to US$107.58, and RevPAR increased 4.2% to US$57.56.

Performance of featured countries for Q1 2016 (local currency, year-over-year comparisons):

Lebanon reported decreases in each of the three key performance indicators: occupancy (-8.4% to 44.3%), ADR (-9.3% to LBP215, 601.32) and RevPAR (-17.0% to LBP95, 422.47). According to STR analysts, political unrest and security concerns played a major role in the lowest Q1 ADR in Lebanon since 2008. Travel to the country has declined, reflected by a 5.1% decrease in demand for the quarter, while supply grew 3.7%.

Mauritius experienced a 4.7% lift in occupancy to 76.7% as well as double-digit growth in ADR (+11.4% to MUR7, 416.66) and RevPAR (+16.6% to MUR5, 687.28). The absolute occupancy level was the highest for a quarter in Mauritius since the first three months of 2008. The performance can be attributed to a 4.7% increase in demand combined with flat supply. March was the top RevPAR month of the quarter at +23.7%.

South Africa posted increases across the three key performance metrics: occupancy (+2.8% to 65.0%), ADR (+9.7% to ZAR1, 238.43) and RevPAR (+12.8% to ZAR805.32). With demand outpacing supply, hoteliers were able to raise rates to further drive RevPAR. STR analysts point out that first quarters have been particularly strong in South Africa since 2012, driven primarily by rate. The weakening of the South African Rand against the U.S. dollar, euro and British pound has made the country a more affordable destination.

Performance of featured markets for Q1 2016 (local currency, year-over-year comparisons):

Amman, Jordan, saw a 3.8% increase in occupancy to 50.3%, but a 3.4% decrease in ADR to JOD111.13 left RevPAR nearly flat (+0.3% to JOD55.86). Supply went basically unchanged for the quarter, while demand grew 3.8%, leading to the increase in occupancy. According to STR analysts, Jordan’s hotel industry is being affected by regional conflicts in Syria and Iraq, thus, rates have continued to fall.

Cairo, Egypt, recorded positive results in the three key performance measurements. Occupancy rose 7.8% during the quarter to 56.7%; ADR was up 5.9% to EGP837.72; and RevPAR increased 14.1% to EGP474.77. March was a particularly strong month with double-digit increases across the key metrics, including a 26.7% spike in RevPAR. STR analysts cite an 11.1% increase in group business during the quarter as reason for a 10.2% overall lift in demand. After a weak fourth quarter in 2015, revenue managers have confirmed a strong demand increase, especially with airport properties.

Jeddah, Saudi Arabia, reported decreases across the key performance metrics: occupancy (-9.9% to 67.3%), ADR (-5.0% to SAR868.76) and RevPAR (-14.4% to SAR584.42). Occupancy and ADR during the quarter were hurt by a 4.2% increase in supply. At the same time, demand dipped 6.1%, and the pipeline in the market remains robust.

Middle East and Africa performance for March 2016 (U.S. dollar constant currency, year-over-year comparisons):

Compared with March 2015, the Middle East subcontinent reported a 0.4% decrease in occupancy to 75.4%. Average daily rate for the month was down 6.1% to US$188.06. Revenue per available room dropped 6.5% to US$141.74.

The Northern Africa and Southern Africa subcontinents experienced a 5.9% decrease in occupancy to 56.4%. However, average daily rate was up 10.3% to US$107.21, and RevPAR increased 3.8% to US$60.49.

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.