The 2024 Reward Seat Availability Survey reviews Alaska, American, Delta, JetBlue, Southwest, and United flight rewards.

SHOREWOOD, WISCONSIN, USA – The IdeaWorksCompany Reward Seat Availability Survey answers the question, “How costly is points redemption for the most popular basic reward type offered by top US airlines?” This year’s survey assesses six US airlines and repeats the same methods used 5 years ago in 2019.

Key overall findings include:

- Prices of rewards (in miles or points) have increased significantly since 2019 and, moreover, by 7 points above the rate of inflation for the same period.

- Reward payback for 2024, which measures the reward value provided per dollar spent on base fares, dropped overall more than half from 2019.

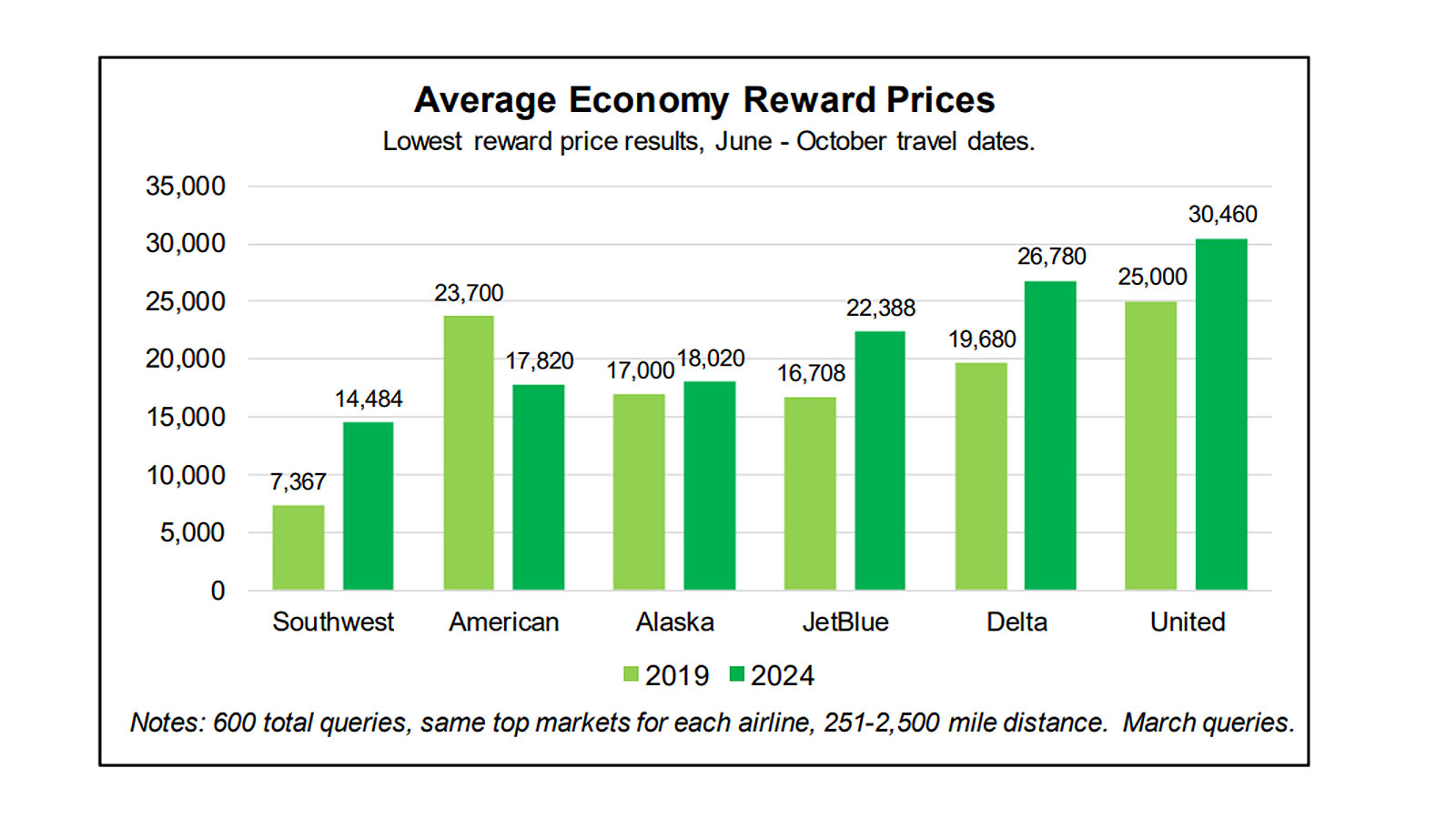

- Basic economy fares are disrupting the value provided by frequent flyer programs through policies which reduce or eliminate mileage/points accrual. The graph below displays the average economy reward price for each carrier for 2019 and 2024.

Basic economy fares have a significant influence on the results of this survey. Network airlines, such as American and Delta, position these as their lowest fare and as a tool to compete with low cost carriers. Basic economy has been embraced as an important source of revenue and new customers, and yet airlines actively discourage sales with policies designed to deter consumers from buying these fares. For example, basic economy is non-refundable and often does not accrue miles/points in the same manner as other fares. Nevertheless, this survey focuses on the lowest prices available because that’s what most consumers seek.

Basic economy fares have a significant influence on the results of this survey. Network airlines, such as American and Delta, position these as their lowest fare and as a tool to compete with low cost carriers. Basic economy has been embraced as an important source of revenue and new customers, and yet airlines actively discourage sales with policies designed to deter consumers from buying these fares. For example, basic economy is non-refundable and often does not accrue miles/points in the same manner as other fares. Nevertheless, this survey focuses on the lowest prices available because that’s what most consumers seek.

For the average reward price metric, it’s important to remember lowest price is best. Southwest leads US airlines with the lowest overall average reward price. Simply said, consumers can enjoy the perks of reward travel more rapidly on Southwest. The airline does have an inherent advantage because it focuses on short- and medium-haul routes and frequent flights. Reward prices tend to be lower for shorter flights and demand is more readily met with more flights. The airline has a long tradition for the lowest reward price results in the 15-year history of this survey.

Mileage/point prices have climbed 28% overall since the last survey five years ago. The US Consumer Price Index has increased 21% during this period, and this can explain some of the increases posted by frequent flyer programs. The primary reason is the larger flow of miles/points from co-branded credit card accrual, which created more demand and prompted airlines to increase reward prices.

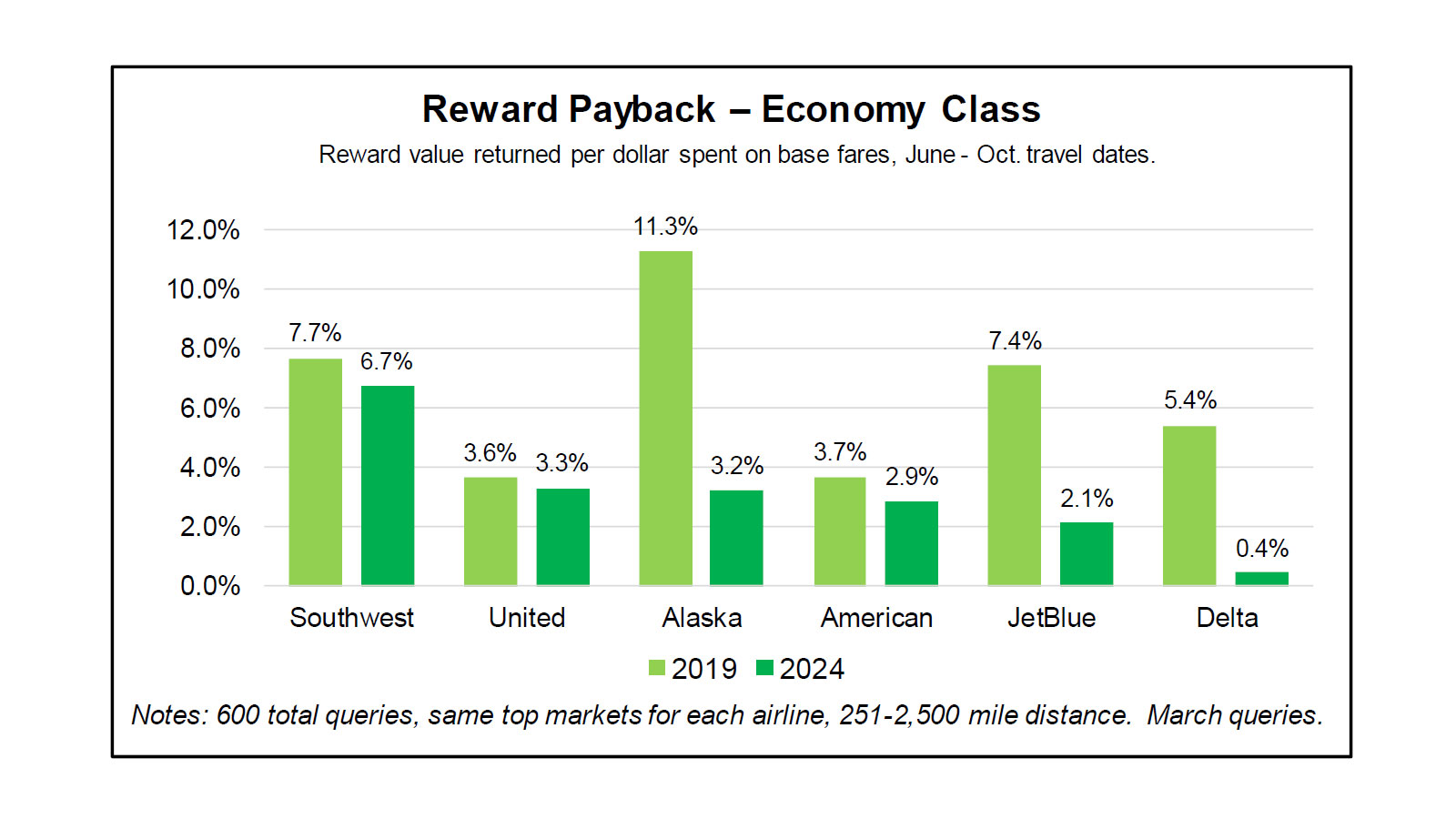

Reward payback exposes accrual value decay

Frequent flyer programs traditionally perform their best revenue magic for their airline masters when members are encouraged to buy more tickets and fly more often. This logic seems lost in an era where the loyalty factor has been disrupted by the rush to generate billions from co-branded card portfolios. Reward payback is a metric that reflects the reward value returned per dollar spent on base fares. The below graph displays reward payback results for 2019 and 2024. Southwest has the top result of 6.7% for 2024 which represents reward value of $6.70 for every $100 spent on base fares. Reward payback decreased since 2019 and the reason at most carriers is the arrival of basic economy fares. Queries performed in March for the June through October period sought the lowest fares, and these were often basic economy. Accrual policies established by frequent flyer programs for these fares have changed dramatically since 2019.

Southwest has the top result of 6.7% for 2024 which represents reward value of $6.70 for every $100 spent on base fares. Reward payback decreased since 2019 and the reason at most carriers is the arrival of basic economy fares. Queries performed in March for the June through October period sought the lowest fares, and these were often basic economy. Accrual policies established by frequent flyer programs for these fares have changed dramatically since 2019.

Alaska, American, and JetBlue significantly reduced accrual rates. For example, basic economy fares on Alaska now accrue mileage at 30% of standard fares. Alaska started selling Saver Fares (their version of Basic Economy) at the end of 2018 and Saver Fares originally featured full mileage accrual. This explains the large drop since 2019 from 11.3% to 3.2% for 2024. Likewise, Basic Economy on American accrues 2 miles per dollar spent, versus the usual multiplier of 5. Delta is the most dramatic, and completely prohibits accrual for basic economy travel.

Kudos are due United, which applies the same accrual policy for all of its fares. Southwest does not offer a basic economy fare, but uses distinct point multipliers for each of its four fare types from Wanna Get Away to Business Select. Reward Payback is most beneficial for members focusing on flight-based accrual to build their account balances.

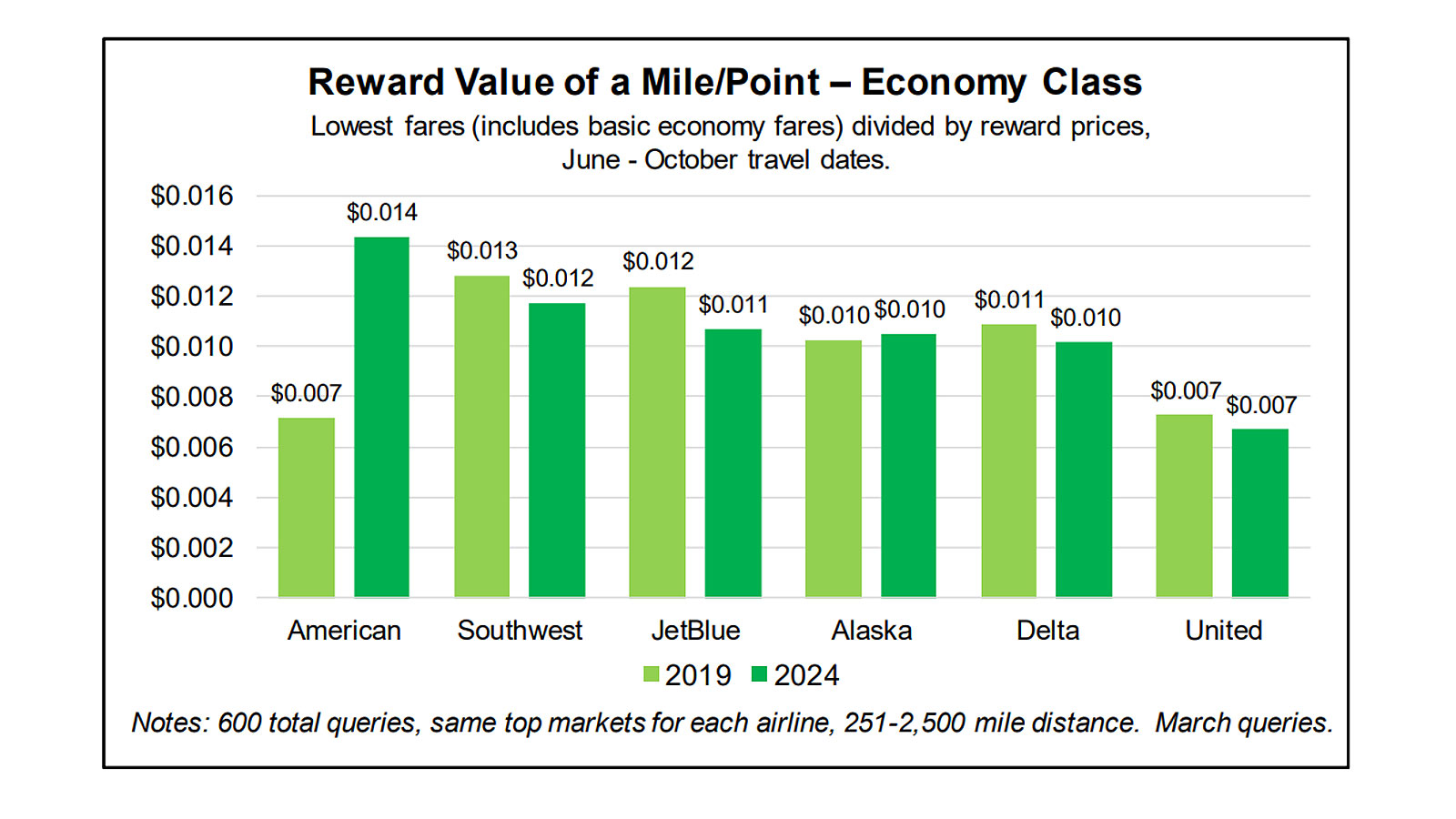

Reward value of a mile/point focuses on partner accrual

For many members, co-branded credit cards have become the primary method for building frequent flyer mileage/point balances. Similar to Reward Payback, this metric compares the lowest reward prices and lowest fares found for each date and city pair queried. American leads the way with a top result; AAdvantage miles provide 1.4 cents of coach travel value based upon queries which include basic economy fares. The 2024 result doubles the 2019 rate and reflects an obvious change in reward pricing strategy since 2019. When frequent flyer programs appeared in the 1980s, buying a ticket on an airline was the only way to accrue miles. The industry’s embrace of co-branded credit cards has changed this outcome. Now the majority of mileage accrual originates from partner transactions and the minority is generated flying the airline. Financial disclosures made by American, Delta, and United during 2020 reveal this change. Now these airlines are earning billions from the revenue provided by their bank partners. This makes the reward value of a mile/point a helpful metric for members focusing on accrual through a co-branded credit card.

When frequent flyer programs appeared in the 1980s, buying a ticket on an airline was the only way to accrue miles. The industry’s embrace of co-branded credit cards has changed this outcome. Now the majority of mileage accrual originates from partner transactions and the minority is generated flying the airline. Financial disclosures made by American, Delta, and United during 2020 reveal this change. Now these airlines are earning billions from the revenue provided by their bank partners. This makes the reward value of a mile/point a helpful metric for members focusing on accrual through a co-branded credit card.

The survey measures low-priced everyday reward availability

The IdeaWorksCompany Reward Seat Availability Survey is based upon 600 booking and fare queries made by the IdeaWorksCompany at the websites of six frequent flyer programs to assess low-priced everyday reward seat availability. Lowest-price rewards are an important benefit for most members and the primary topic of this survey. The city pairs included in the survey are among each carrier’s top markets based upon passenger traffic.

The methodology used in 2019 was repeated for 2024 with departure and return dates evenly distributed during June, July, August, September, and October. The queries were conducted in early March. The lowest reward price or fare, to include basic economy fares, was tallied. The 2024 survey is limited to US domestic flights of 251-2,500 miles and economy class rewards. The survey does not evaluate close-in bookings; it is limited to vacation-style bookings months before departure.

Frequent flyer programs have weakened their promise

Consumers achieve the best reward value by using a carrier’s co-branded credit card and remaining loyal to the airline for flight purchases. This combination is more crucial today than 5 years ago. The co-branded credit card usually includes valuable benefits such as earlier boarding and the waiver of checked baggage fees.

The banks issuing co-branded credit cards are becoming major travel retailers. Airlines may someday regret relinquishing so much marketing power to their bank partners. Frequent flyer programs are losing sight of their mission. The best programs seek to build consumer loyalty, boost member communication, and generate cash in equal measure. But these programs are well along the path of becoming just travel reward delivery tools for co-branded credit cards- and cash delivery tools for airline income statements. They can be much more.

Accrual of miles/points for buying tickets from the airline should continue to be the top priority. Consumers who spend $1,000 on flight tickets have far more positive impact on an airline’s income statement than those who charge $1,000 at Walmart on a co-branded credit card. The original appeal of frequent flyer programs remains just as valid today as four decades ago: Offer consumers a reason to be loyal repeat customers who spend money on the carrier’s basic product – seats on the plane. That’s how durable sales relationships are created, and yes . . . that’s how members can also find reason to apply for that cash-cow credit card.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.