While growth dynamics varied between national markets, 16 of them achieved double digit growth, mainly to the south and east of the EU as well as in Denmark, Ireland, Luxemburg and the Netherlands. Accordingly, Dublin (+17.5%), Barcelona-El Prat (+16.1%), Copenhagen (+13.2%), Amsterdam-Schiphol (+12.4%) and Madrid-Barajas (+11.9%) led passenger growth amongst the EU’s largest airports.

Brussels European airport trade body, ACI Europe released its air traffic report for March and Q1. The report is the only air transport report which includes all types of civil aviation passenger flights: full service, low cost and charter. It reveals that during the first quarter of this year, passenger traffic at Europe’s airports grew by an average +7.8%.

More specifically, passenger traffic in the EU during Q1 grew by an impressive +8.2% – more than 4.5 times the bloc’s forecasted rate of GDP growth for 2016.

16 EU countries report double-digit growth

While growth dynamics varied between national markets, 16 of them achieved double digit growth, mainly to the south and east of the EU as well as in Denmark, Ireland, Luxemburg and the Netherlands. Accordingly, Dublin (+17.5%), Barcelona-El Prat (+16.1%), Copenhagen (+13.2%), Amsterdam-Schiphol (+12.4%) and Madrid-Barajas (+11.9%) led passenger growth amongst the EU’s largest airports. Conversely, the core markets of France, Germany, Italy and to a lesser extent the UK performed below the EU average.

These figures, as well as passenger traffic results for March (+7.6% for the EU) reveal that the impact of the Brussels terrorist attacks appears to be contained to Belgium, with Brussels airport bearing the brunt of it (-29.1% in March & -5.3% in Q1). This mostly local/national impact is consistent with we have seen in the wake of the Paris terrorist attacks of last November.

A different speed for non-EU airports in Europe

Meanwhile, non-EU airports in Q1 posted less dynamic – although improving – passenger traffic growth of +6.2%. Traffic is rebounding in Ukraine (+14.4%) and appears to be stabilising in Russia. It has reached new peaks in Iceland (+36.8%) while it remains fairly resilient in Turkey (+8.4%) – although Turkish airports serving tourist destinations are underperforming.

Freight traffic across the European airport network increased moderately by +2.1% in Q1, with all of that growth going to EU airports (non-EU airports: -0.2%). Aircraft movements were up +4.0%, reflecting airlines adding more capacity to the market.

Q1 Results

Olivier Jankovec, Director General of ACI Europe said “Europe’s airports have delivered an excellent performance in terms of passenger traffic over the first quarter of 2016. While the additional day in February and Easter happening in March helped, the magnitude of the traffic increase at many airports has defied economic gravity. To some extent, it has also flown in the face of an increasingly adverse geopolitical and security environment. As long as these risks remain in check and with oil set to remain affordable, we remain positive about the traffic outlook for the rest of the year. The fact that airports are now keenly focused on improving their competitive positions and are fighting to attract new traffic also plays an important – and often overlooked – role in maintaining the growth momentum.”

“All this means that passenger traffic should continue to outperform GDP. While passenger growth rates might soften on the back of already robust figures in 2015, security concerns also mean that part of the leisure demand to external markets will continue to shift towards EU leisure destinations and their airports.”

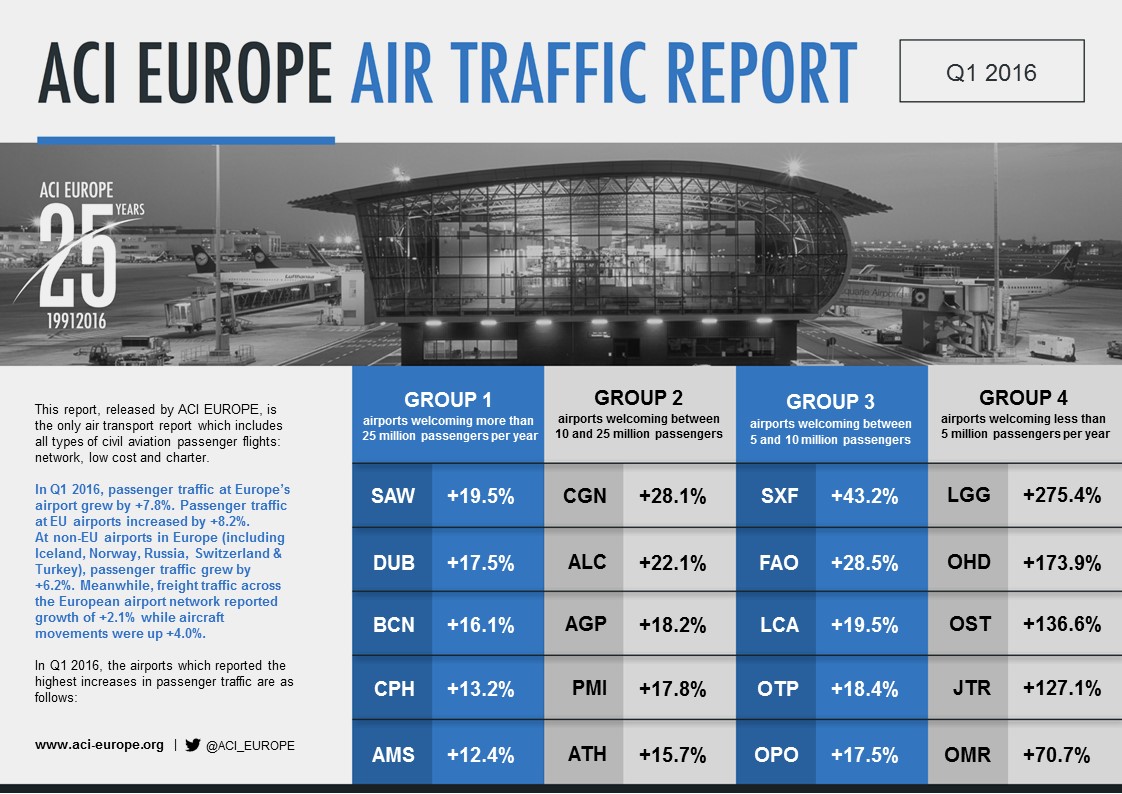

During Q1, airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between 5 and 10 million passengers (Group 3) and airports welcoming less than 5 million passengers per year (Group 4) reported an average adjustment +6.8%, +7.6%, +11.2% and +8.9%.

The airports which reported the highest increases in passenger traffic are as follows:

- GROUP 1: Istanbul SAW (+19.5%), Dublin (+17.5%), Barcelona (+16.1%), Copenhagen (+13.2%) and Amsterdam (+12.4%)

- GROUP 2: Cologne-Bonn (+28.1%), Alicante (+22.1%), Malaga (+18.2%), Palma de Mallorca (+17.8%) and Athens (+15.7%)

- GROUP 3: Berlin SXF (+43.2%), Faro (+28.5%), Larnaca (+19.5%), Bucharest OTP (+18.4%), Porto (+17.5%)

- GROUP 4: Liege (+275.4%), Ohrid (+173.9%), Ostend (+136.6%), Santorini/Thira (+127.1%) and Oradea (+70.7%)

March figures

During the month of March, average passenger growth was +5.5%, while freight reported a fall of -1.8% and movements were up +2.3%.

Airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between 5 and 10 million passengers (Group 3) and airports welcoming less than 5 million passengers per year (Group 4) reported an average adjustment +6.1%, +6.2%, +11.2% and +9.5%.

For March, the airports which reported the highest increases in passenger traffic are as follows:

- GROUP 1: Dublin (+18.1%), Istanbul SAW (+9.3%), Barcelona (+14.2%), Amsterdam (+13.1%), Copenhagen (+11.2%)

- GROUP 2: Palma de Mallorca (+26.1%), Alicante (+25.2%), Cologne-Bonn (+23.2%), Malaga (+21.8%) and Edinburgh and Athens (+17.1%)

- GROUP 3: Faro (+40.7%), Berlin SXF (+39.2%), Larnaca (+24.0%), Heraklion (+23.4%) and Charleroi CRL (+20.2%)

- GROUP 4: Oradea (+4,136.6%), Liege (+587.0%), Ostend (+294.7%), Ohrid (+242.6%) and Kharkiv (+121.3%)

The 'ACI Europe Airport Traffic Report – March & Q1 2016’ includes 206 airports in total representing more than 88% of European air passenger traffic.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.