This article will uncover everything about the business travel tax deduction and how to take advantage of it.

The business travel tax deduction can be a great way to save money on your taxes, but it can be tricky to navigate.

Are you a business owner who frequently travels for work? If so, you may be able to benefit from the business travel tax deduction.

This article will uncover everything about the business travel tax deduction and how to take advantage of it. We'll also provide some tips on maximizing your savings. So, if you're looking to reduce your taxable income, keep reading!

The business travel tax deduction: What you need to know

The business travel tax deduction allows business owners and self-employed individuals to deduct the cost of their business travel expenses from their taxes. The business can use these deductions to offset the cost of travel, lodging, meals, and other expenses incurred while traveling for business purposes.

To take advantage of the deduction, you'll need to keep track of your expenses and save receipts. When it's time to file your taxes, you'll need to itemize your deductions and include your business travel expenses on your tax return.

However, it would help to consider a few key things when claiming your business travel tax deductions. First, the primary purpose of your trip must be to conduct business activities such as meeting with clients, attending conferences, or visiting customers.

Second, you can only deduct the expenses considered "ordinary and necessary" for your business. As a result, you can't deduct personal or expenses that are not essential to your business.

Finally, you can only deduct the expenses that you actually paid for. This means that you can't deduct the cost of travel if your employer reimbursed you or if you used points from a frequent flyer program.

What are the examples of deductible expenses

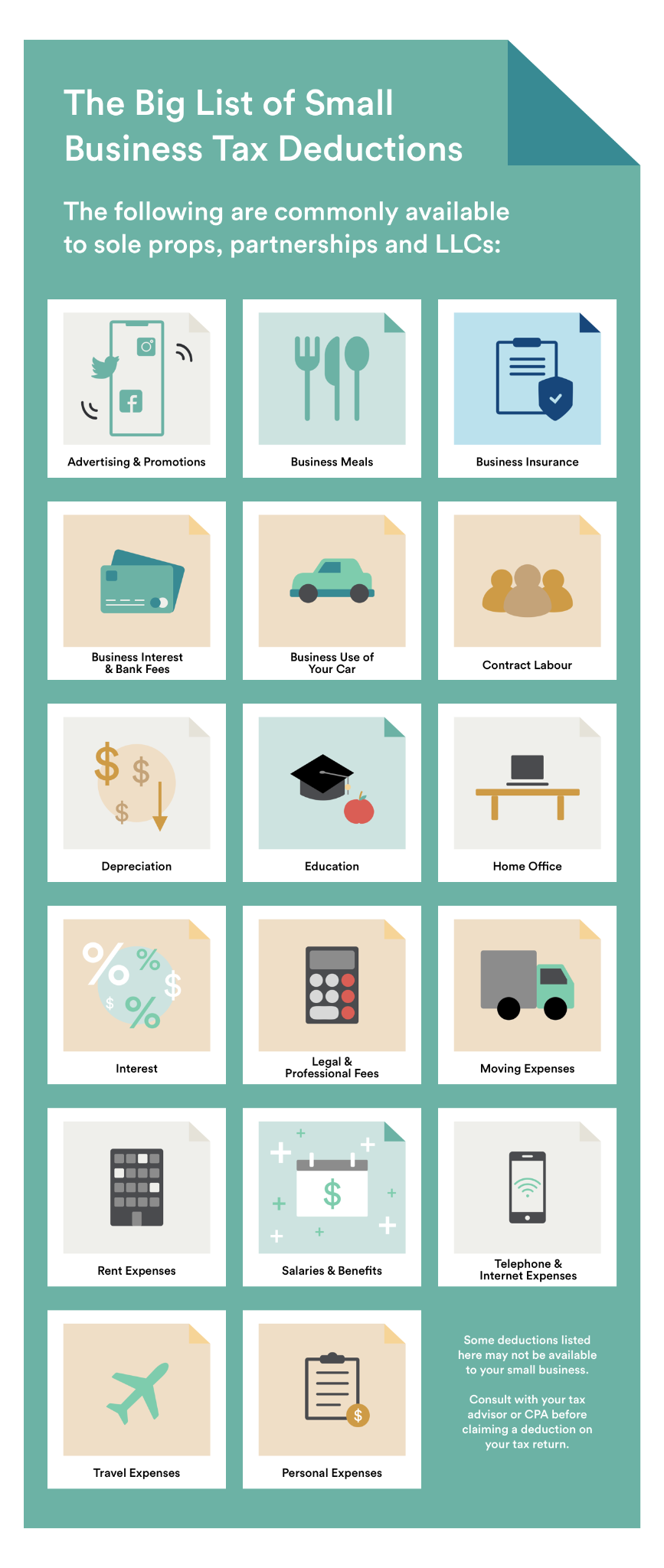

Source: https://bench.co/blog/tax-tips/small-business-tax-deductions/

Now that we've covered the basics of the business travel tax deduction. Let's look at some of the specific expenses eligible for the deduction.

Generally, any necessary and ordinary expense related to business travel is eligible for the deduction. These include airfare, hotel stays, car rentals, taxi fares, and meals.

You can also deduct the cost of attending business-related conferences, conventions, and seminars.

Other deductible expenses may include telephone calls, internet access fees, and the cost of shipping business-related materials.

David Reed, the Co-Founder of LLCStars, offers the following advice: "If you are planning on claiming the business travel tax deduction, it is important to keep track of your expenses and save all of your receipts. The correct documents will help you if you are audited by the IRS."

It is also good to keep a daily log of your business travel activities and expenses. This can be in the form of a diary, an electronic spreadsheet, or even handwritten notes.

When should you deduct business travel expenses

You can deduct business travel expenses on your tax return for the year the travel occurred.

For example, if you incurred business travel expenses in 2020, you would deduct those expenses on your 2020 tax return.

You cannot deduct business travel expenses in advance or retroactively.

For example, you cannot deduct business travel expenses on your 2019 tax return if the travel occurred in 2020.

What if you do not have receipts

If you do not have receipts for your business travel expenses, you may still be able to deduct them if you can prove that the expenses were incurred.

For example, you may be able to use bank and credit card statements or canceled checks as documentation of your expenses.

If you cannot provide documentation of your expenses, you will not be able to deduct them from your taxes.

Expenses you can't claim

Not everything can be deducted as a business expense. The IRS specifically excludes the following:

- Commuting costs (driving to and from work)

- Clothing expenses (unless required for safety or as part of a uniform)

- Education expenses (unless your employer requires it or it maintains or improves job skills)

- Expenses incurred before starting your business

- Home office expenses (unless you have a dedicated home office space)

- Meals while not traveling on business

- Personal entertainment expenses

- Political contributions or lobbying expenses

- Repairs and maintenance to your personal vehicle.

If you're unsure whether or not an expense qualifies, the IRS has a comprehensive list of what does and does not qualify as a business deduction. When in doubt, it's always best to consult with a tax professional to ensure you're taking advantage of all the deductions you're entitled to.

Conclusion

As you can see, the business tax deduction can help reduce your taxable income, saving you money in the long run. Keep in mind that you can only deduct expenses connected to your business, and be sure to keep detailed records of all your expenses.

Be sure to stick to the rules as the IRS is very strict about what expenses can and cannot be deducted. And as always, if you have any questions, be sure to consult with a tax professional. They can help you maximize your deductions and ensure you stay in compliance with the IRS.

Happy travels!

Main photo by bruce mars on Unsplash

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.