The month of November 2014 hotels in Dubai have reported weakening performance trends, as RevPAR declined by 6.6% to US$ 340.06 for the month of November compared to the same period last year. Hotels in Sharm El Sheikh reported encouraging performance levels, led by a 46.3% increase in ARR to US$ 47.72 and a 2.0 percentage point increase in occupancies to 61.8%.

Dubai hotels start to feel the pressure

The month of November 2014 Hotels in Dubai have reported weakening performance trends, as revenues per available room (RevPAR) declined by 6.6% to US$ 340.06 for the month of November compared to the same period last year, according to the latest HotStats data. The contraction in room revenues was due to a softening of occupancies which retracted by 1.1 percentage points to 86.7%, but led largely by a decline in average room rates (ARR) of 5.5% to US$ 392.37. The drop in room revenues also caused a decline in total revenues per available room (TRevPAR) by 2.3% to US$ 602.70, but was compensated in some part by an increase in food and beverage revenues that rose by 4.8% for the period. Profitability levels were under pressure as some key cost items such as payroll and sales and marketing inched higher for the period, causing gross operating profit per available room (GOPPAR) to contract by 4.3% to US$ 316.36.

“Hotels in Dubai have begun experiencing several demand and supply based issues that have weighed down on performance levels for the period. The largest impact was seen through the deterioration of political and economic conditions in Russia and some eastern European countries that drive significant demand to the city. The declining Rouble and higher rates in Dubai appears to have made many of them reconsider their trip to Dubai, but also diverted some traffic to Sharm El Sheikh and Istanbul which offer a better value proposition. Additionally, new supply entering the market has also made the sector more competitive” commented Peter Goddard, Managing Director of TRI Consulting.

Performance levels keep growing in Sharm El Sheikh

Hotels in Sharm El Sheikh reported encouraging performance levels, led by a 46.3% increase in ARR to US$ 47.72 and a 2.0 percentage point increase in occupancies to 61.8%. As a consequence, RevPAR grew by 51.3% to US$ 29.51 pushing up TRevPAR by 28.0% to US$ 53.90. Despite an increase in payroll and other overhead costs, GOPPAR levels managed to increase by 67.0% to US$ 15.31, benefitting largely from the strong increase witnessed in average room rates for the period.

“Egyptian hotel markets have made a comeback this year with both Sharm El Sheikh and Cairo reporting strong growth in RevPAR levels for the calendar year up to November of this year. The confidence in the market is led by the efforts of the government to prioritize tourism and provide necessary security arrangements to protect its tourism assets, specifically for Sharm El Sheikh. Despite a strong growth in ARR reported for the period, Sharm El Sheikh still holds a strong value proposition compared to similar beach destinations in the region, and will be particularly attractive for key European source markets which are expected to drive performance going forward” commented Goddard.

Doha hotels relish a growth in demand dynamics

Four and five star hotels benefitted from some of the strongest occupancy levels experienced in the past 24 months, as occupancies grew by 10.3 percentage points to 82.9% for the period. The rise in demand allowed hotels to utilise progressive rate strategies as ARR increased by 6.4% to US$ 230.59 resulting in RevPAR growing by 21.5% to US$ 191.05.

The improvement in demand also translated to an increase in other revenue streams, as food and beverage and conferencing revenues increased by 17.5% and 20.4% respectively. As a result TRevPAR increased by 18.8% to US$ 431.88, helping GOPPAR levels nudge higher by 21.8% to US$ 196.86.

“Hotels in Doha performed extremely well in November, reaching the highest occupancy level in the past two years. The growth in demand is primarily led by the corporate sector, which has witnessed increasing activity from the construction sector and government related businesses. The leisure segment still remains a challenge for Doha, but the expected opening of new attractions in the near future and the efforts of The Qatar Tourism Authority (QTA) that recently opened its fifth overseas market are expected to help raise more awareness about Doha as a leisure destination” commented Goddard.

Jeddah hotels witness mixed results

Hotels in Jeddah progressed towards record performance levels as RevPAR grew by 5.2% to US$ 190.25, reporting a two-year high for the Red Sea city. The surge in RevPAR was led by a strong growth in ARR that increased by 11.3% to US$ 254.77, which outplayed a 4.4 percentage point drop in occupancy to 74.7% for the period. On the contrary, TRevPAR only managed to increase by 0.4% to US$ 295.41, dampened by stagnant growth in food and beverage and conferencing revenues. The lack of growth in total revenues and an increase in A&G and maintenance costs put downward pressures on profitability as GOPPAR marginally contracted by 0.8% to US$ 137.62.

“Performance growth in Jeddah for November was led by aggressive rate strategies targeting leisure travellers, who have a strong preference for Jeddah for its gentle weather in winter and summer compared to the rest of the country. However, profitability declined in the process as the drop in occupancies resulted in a decline in other revenue streams, and an increase in some undistributed expenses further compounded the effect” commented Goddard.

Beirut hotels continue on the path of recovery Hotels in Beirut continued to post strong recovery in performance levels, as occupancies increased by 9.6 percentage points to 57.4% and ARR grew by 3.3% to US$ 131.84 for the month of November compared to the same period last year. The increase in occupancy levels led the 24.1% growth in RevPAR to US$ 75.71 which, along with other revenue streams such as conferencing, helped drive top line revenues as TRevPAR moved up 11.9% to US$ 139.86 for the period. The improvement in some overhead costs helped profitability levels surge by 165.0% to US$ 23.08.

“The improvement in performance levels for hotels was led by a growth seen in corporate travel to Beirut, which is a key driver of the hotel demand to the city. Average room rates for leisure segments also increased along with the corporate segment. However, leisure travel is yet to see substantial growth due to the on-going crisis in Syria which has diverted some leisure travel from Lebanon to other low risk destinations within the region” commented Goddard.

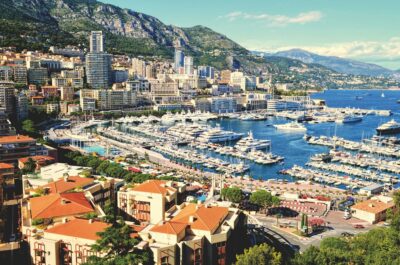

Photo caption: Sharm el Sheikh, Egypt.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.