Kempinski - Moscow Hotel Baltschug

Moscow Region’s quality hotels are increasing ADR and RevPAR for the third year in a row. Suburban resorts in the Moscow region this year will likely to be perceived as less attractive than available outbound destinations, that’s why hoteliers focused their attention on generating demand from higher-paying guests.

MOSCOW – JLL presents the H1 2017 results of the quality hotel market in Moscow and the Moscow Region.

According to Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia & CIS, Moscow’s quality hotels have set a new 5-year record – nearly 70% of the room stock was occupied in the Russian capital in the first 6 months of this year. Notwithstanding the branded supply growth in the period by 1,200 rooms, market average occupancy increased by 2 ppt. At the same time, ADR dropped by 0,5%.

“This price dynamic can be explained by several main reasons: increasing competition, very specific demand type (sports fans, tourist groups) and supply growth which is concentrated in the cheaper market segments, thus putting pressure on the ADR. As a result, RevPAR showed only slight growth (1.4%), but still exceeds the number for the last 5 years – RUB 5,100.”, Tatiana Veller comments.

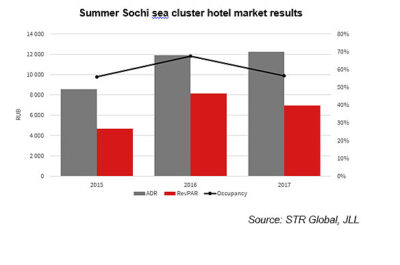

H1 Moscow quality hotel market results

Source: STR Global, JLL

In June, all segments of quality hotel market in Moscow experienced ADR growth, while the majority of them also displayed record-breaking occupancy. This fact is not surprising: FIFA Confederations Cup coincided with the hot tourist season. Combination of these events helped hotels not only to keep ADR on the relatively high level, but also to gain required demand volume. Most of the foreign demand obviously gravitated to the more expensive hotels, thus supporting their operational performance, while domestic and more price-sensitive inbound demand redirected to more budget-friendly accommodation options. For example, in June the upper midscale segment occupancy skyrocketed to 90%.

“In general, H1 2017 results can be divided into two groups: in the first one RevPAR increased through occupancy growth in the context of stable ADR, while in the second minor losses in RevPAR occurred due to the lack of positive demand dynamics, which encouraged hoteliers’ attempts to at least protect the ADR.”, Tatiana Veller says. “The first tendency can be observed in the Upscale and Midscale segments: 6% and 7,5% RevPAR growth, to RUB 4,700 and RUB 2,800 respectively, on the back of occupancy rising by 5.4 and 3.4 ppt. At the same time, Upper Upscale and Upper Midscale segments declined in RevPAR by 0.4% and 0.2% in the context of minimal fluctuation in occupancy and ADR compared to 2016.”

“Luxury segment is worth mentioning as an exception from rule above. It is the only one to show negative operational performance dynamics compared to last year: occupancy for H1 dropped by 1,6 ppt, ADR – by 1.2%, bringing RevPAR down by 3.7% – to RUB 11,000. At the same time, luxury hotels still exhibit the highest level of operational indices in last 10 years.”, Tatiana Veller adds.

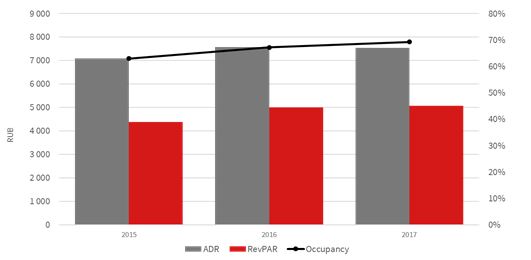

Moscow Region’s quality hotels are increasing ADR and RevPAR for the third year in a row. Suburban resorts in the Moscow region this year will likely to be perceived as less attractive than available outbound destinations, that’s why hoteliers focused their attention on generating demand from higher-paying guests. On the back of slight occupancy decline compared to the last year (by 0.4 ppt, to 46.7%) and ADR growth by 5,6% (to RUB 5,100), RevPAR in this segment rose by 4.7% and amounted to RUB 2,400.

H1 Moscow Region quality hotel market results

Source: STR Global, JLL

“We expect that 2017 for the Moscow quality hotel market will finish at approximately the previous year’s operational performance level. Short boost brought by FIFA Confederations Cup will help eliminate the negative impact of the price sensitive tourists fleeing the market because of the gradual price increases that Moscow hoteliers are using in their efforts to optimize revenue.”, Tatiana Veller concludes.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.