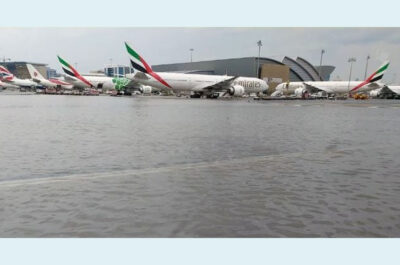

Homewood Suites Hotel.

Both group and transient travel segments experience boost during first quarter.

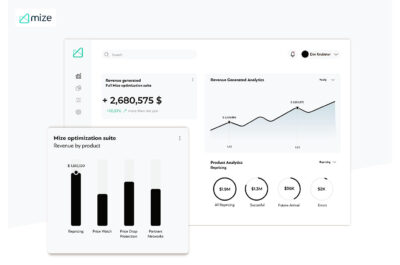

NEW YORK – TravelClick, a leading global provider of data and revenue-generating solutions for hoteliers, released new data from the company’s February 2018 North American Hospitality Review (NAHR). According to this data, North American hoteliers are continuing to experience healthy gains across both average daily rates (ADR) and bookings for all travel segments, up 0.6 percent and 1.3 percent, respectively, in the first quarter of the year.

Transient bookings are particularly strong in Q1, up 1.9 percent across the segment for both business and leisure travel. Revenue per available room (RevPAR) is also up 2.7 percent for this sector.

“Following months of instability in 2017, the start of 2018 is a breath of fresh air for hoteliers, as rates and bookings remain solid during the first two months,” said John Hach, senior industry analyst, TravelClick. “The data also indicates that hoteliers are poised for transient growth in the second quarter and that this trend has the potential of continuing well into the year.”

Twelve-Month Outlook (February 2018 – January 2019)

For the next 12 months (February 2018 – January 2019), transient bookings are up 3.3 percent year-over-year, and ADR for this segment is up 1.5 percent. When broken down further, the transient leisure (discount, qualified and wholesale) segment is up 4.1 percent in bookings, and ADR is up 1.6 percent. Additionally, the transient business (negotiated and retail) segment is up 1.9 percent in bookings, and ADR is up 1.6 percent. Lastly, group bookings are slightly up 0.6 percent in committed room nights* over the same time last year, and ADR is up 1.5 percent.

“Transitioning into the second quarter of 2018, hoteliers will need to stay focused on group pace within their local markets and continue to tap into data and business intelligence so that they can use every available tool to their advantage during this growth period,” added Hach. “It’s important to take the lessons learned from 2017 to stay one step ahead of the competition, as group pace could experience another few months of uncertainty similar to last year in the industry at any given time.”

|

NAHR First Quarter 2018 Outlook |

|||

|

ADR |

Reserved Occupancy |

RevPAR |

|

|

All Travel Segments |

0.6% |

1.3% |

2.0% |

|

Group Only |

0.4% |

-0.1% |

0.3% |

|

Transient Only (Business + Leisure) |

0.8% |

1.9% |

2.7% |

|

Transient Business |

0.9% |

1.7% |

2.6% |

|

Transient Leisure |

0.9% |

1.7% |

2.6% |

Source: TravelClick

|

NAHR Second Quarter 2018 Outlook |

||

|

ADR |

Committed Occupancy |

|

|

All Travel Segments |

2.3% |

1.8% |

|

Group Only |

4.2% |

1.8% |

|

Transient Only (Business + Leisure) |

1.6% |

1.7% |

|

Transient Business |

3.2% |

2.0% |

|

Transient Leisure |

1.1% |

1.7% |

Source: TravelClick

The February NAHR looks at group sales commitments and individual reservations in the 25 major North American markets for hotel stays that are booked by February 1, 2018, from the period of February 2018 – January 2019.

*Committed Occupancy – (Transient rooms reserved + group rooms committed) / capacity

The first quarter combines historical data (January) and forward-looking data (February – March).

Angelos is the news editor for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). His role includes to monitor the hundrends of news sources of TravelDailyNews Media Network and skim the most important according to our strategy.

He currently studies Communication, Media & Culture in Panteion University of Political & Social Studies of Athens.