St. Petersburg.

Steady occupancy growth supports profitability of resort hotels. Also the average occupancy of hotels in the Moscow Region in December-February reached 52%.

JLL presents the 2017-2018 winter season results of the Russia resorts hotel markets (Sochi and Moscow Region). According to Tatiana Veller, Head of JLL Hotels & Hospitality Group, JLL, Russia & CIS, "from December 2017 to February 2018, the hotel markets of Moscow region and Sochi displayed stable growth of the main operational indices, continuing to build on the successes of the past several years. Seems like Russian travelers learnt to value the comforts of domestic travel, and started to receive the same value for the money at home as in comparable by the budget locations abroad.”

Sochi

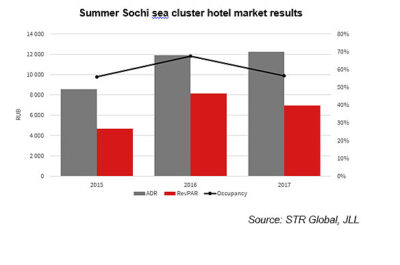

"The past winter has become another outstanding low season for sea hotels in Sochi,” says Tatiana Veller. “With a minimum change in ADR of the cluster (was at about RUB6,700), hotels on the seashore managed to fill 44% of rooms on average in December – February vs. 37% in the same months last year. At the same time, in the mountain cluster almost 70% of available rooms were sold, with a slight increase in ADR (by 2%, to RUB8,600).”

In sea cluster, the best dynamics of the operational indices this winter was shown by the hotels of the upper segments: on the back of rather stable ADRs (about RUB9,000), occupancy increased by 9 ppt in comparison with the previous season and reached 48%. In the middle segments, the occupancy increased by 5 ppt, to 40%, while the ADR remained at RUB4,100.

“The higher-level hotels offer well-developed infrastructure, and in the low season give their guests, who prefer mild climate on the shores of the Black Sea to mountain skiing, more opportunities for entertainment. Probably, this fact can explain the seemingly illogical difference in the occupancy of assets on the seashore” says Tatiana Veller. “As a result, the RevPAR in the sea cluster increased by 21%, to RUB4,400 in the upper segments and by 14%, to RUB1,600, in the middle ones".

"The summit of post-Olympic years has been reached by the Krasnaya Polyana quality hotels this winter; the occupancy in the upper segments reached 67% (an increase of 0.5 ppt compared to the previous year), and 75% in the middle segments (growth by 3 ppt). This demonstrates the specifics of ski demand: these tourists mainly prefer budget-friendly accommodation and choose a hotel simply as a place to sleep,” notes Tatiana Veller. “ADRs were also quite stable here: in hotels of upper segments – RUB9,700 vs. RUB9,400 a year earlier, in the middle segments – RUB6,900 vs. RUB7,000. The result was RevPAR growth of 3-4% in all segments of the southern ski resort of Russia.”

Moscow Region

The average occupancy of hotels in the Moscow Region in December-February reached 52%, an increase of 4 ppt compared with the 2016-2017 winter season. The average rate remained stable, at RUB5,500, which supported a further increase in RevPAR by 8%, to RUB2,900.

“The busiest month of this winter was January (with 54% of rooms sold), whereas in the last winter season, due to the effect of early spring, February was the leader in occupancy (56%)" comments Tatiana Veller. “The highest rates were observed in January 2018, helped by the New Year holidays, while the ADR in 2018 fell to RUB6,000 vs. RUB6,500 in January 2017.”

“In the current economic and political environment, highly likely that current trends in the domestic resort hotel markets are here to stay, because Russians continue to vacation ‘at home’. In turn, the domestic hospitality industry is striving to match the growth in demand, by offering more diverse, modern, and unusual hotel and travel product at reasonable for the Russian customer prices” adds Tatiana Veller.

Start of 2018 on Moscow and St. Petersburg quality hotel markets: occupancy growth at the expense of slight ADR drop

“The first few months of the year are always a relatively quiet time for hoteliers. First part of January suffers from impact of New Year & Christmas holidays, Moscow business activity begins to pick up in February, however, it is still too cold for leisure tourism in St. Petersburg, and only March is a full-fledged business month in the hotel industry when events resume and the business tourists flow increases,” -says Tatiana Veller.

The demand for quality hotels grew in Q1 2018 both in Moscow and in St. Petersburg compared to the same period in 2017 against the background of a small drop in prices. “Occupancy in the Moscow market grew by 3.5 ppt to 65%, with a very slight decrease in ADR – by 4%, to RUB 7,100. St. Petersburg hotels were busier by 1.5 ppt (46% occupancy) vs. last year; nevertheless, the ADR fell more significantly, by 5% to RUB 4,600.” – comments Tatiana Veller. RevPAR in both cities remained at the level of last year – RUB4,400 in Moscow and RUB2,100 in St. Petersburg.

The most in demand segments of the Moscow hotel market in early 2018 were Upscale, where the occupancy reached 74%, and Economy (new segment for JLL analysis). The most inexpensive quality hotels (the average price per room in Q1 was RUB2,400) were 69% sold. Amusingly, ADR in the first quarter of the year in the Moscow Luxury segment was almost the same as for a full successful year 2017 – about RUB18,000.

In St. Petersburg, the Upscale segment was also a market leader in terms of occupancy – 58%, in the 2nd place – Upper Upscale with 53% of sold rooms. “It seems that management of these hotels began to practice the reverse policy to last year, when it was driving rates at the expense of occupancy,” – notes Tatiana Veller. – “Only the Midscale segment managed to grow rates (ADR increased by 11% compared to last year, to RUB 2400). At the same time, this segment also became the leader in occupancy loss in January-March (lost 2 ppt., to below 36%).”

Since the beginning of the year, two branded hotels with 340 rooms have opened in the Russian capital – ibis Moscow Domodedovo Airport (150 rooms) and Holiday Inn Express Sheremetyevo (190 rooms), both in the airport areas. This year Moscow expects more than 2,000 new rooms; there is a reason to believe that most of them will be introduced in Q2. Although, no new hotels entered the market in the first quarter in St. Petersburg, the market expects 244 rooms in the economy segment – Holiday Inn Express Sadovaya.

"Two Russian capitals are preparing to receive teams, fans, staff, sponsors and journalists of the FIFA 2018, in the months ahead, until the peak in July, the number of the guests in championship cities promises to grow enormously. At the same time, a large increase in room stock is expected, even in quite mature markets such as Moscow, Yekaterinburg, Rostov-on-Don, and whether the major sporting event will bring explosive growth in the occupancy of quality hotels, is still in question” says Tatiana Veller.

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.