The biggest winner was the Luxury segment, capturing mainly international travelers who upgraded from lower level hotels, taking advantage of the weak ruble and thus dropping rates in hard currency denomination.

MOSCOW – Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia & CIS, comments on operational performance of branded hotels in Moscow:

“Domestic tourism reached an all-time high this summer. Moscow, as a key destination in Russia, recorded unparalleled increases in operational performance of most hotel segments. Quality hotel market as a whole showed an almost 10% jump in occupancy (to 74%) compared to 2014, resulting in a 9% growth in RevPAR.

The biggest winner was the Luxury segment, capturing mainly international travelers who upgraded from lower level hotels, taking advantage of the weak ruble and thus dropping rates in hard currency denomination. ADR grew by almost 11% YoY (to approx. RUB 14,000), which, combined with the nearly 13% Occupancy growth, allowed hoteliers to bring a whopping 25% (reaching RUB 9,800) more to the bottom line (RevPAR). Even by comparison to the previous 5-year average (2010-2014), the segment has shown a solid 5% gain in occupancy and a very strong 17% ADR gain.

All other segments managed to sustain the profitability levels as well, by compensating ADR losses with higher occupancy – a factor of demand shifting heavily towards domestic and more price-sensitive tour group business.

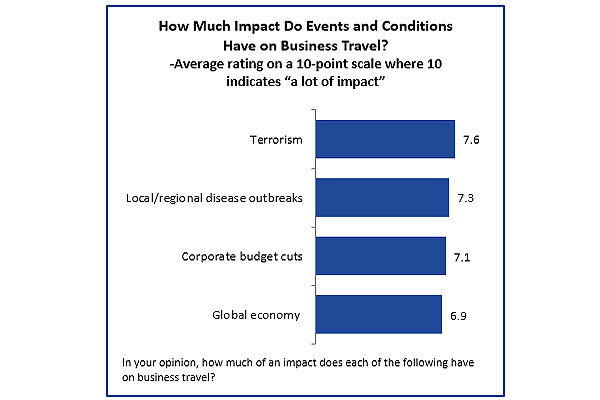

However, keeping in mind that Moscow has always been a destination heavily weighted towards business travel, we decided to compare its results to how other key business hubs in Europe did this summer.

Moscow vs. European Business Destinations, operating metrics (June-August, 2015)

Moscow outperformed Frankfurt in terms of Occupancy levels (73.9% vs. 70.3%), and almost reached Brussels (75,1%). The latter was also the closest comparison in RevPAR (USD 85.4 and USD 99.4), as well as Frankfurt at USD 100.8. In terms of ADR Moscow almost caught up with Dublin (USD 118.6 vs. 127.5). We have to remember, though, that Russian hotels, which trade in rubles, automatically lose out against any European destination when compared in USD terms – and even notwithstanding that, Moscow performed moderately well.

However, looking at this summer in historical perspective shows how heavily the devaluing ruble weighs down on Moscow’s operational results in hard currency.

Moscow Summer in retrospective

Russian capital lost almost a half of its’ ADR in USD terms since the last “calm” summer of 2013 (from USD 218 to 118), and RevPAR followed, although not directly proportionally – slight gains in occupancy levels helped mend some of the loss.

We will most likely see continued strengthening of the Moscow’s hotel performance in ruble terms, as the year progresses. The 2015-16 business season in the coming 2-3 months should traditionally help the rates and occupancy. Refocusing of the economy on domestic market is bound to bring additional volumes of travelers to the city.”

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.