The Russian capital’s market appeared resilient to the post-World Cup blues in terms of hotel occupancy in 2018 and displayed a very healthy growth vs. 2017.

JLL presents the 2018 results of the branded hotel market1 in Moscow and St. Petersburg as well as forecast for 2019.

“Last year was a trial and a test for the Russian hotel market. Will the accommodation industry be able to sustain the crowds of football fans and caprices of crews and sponsors, will the service hold and the appearance be to the liking of the demanding masses of foreigners – these questions were heard before the event. The World Cup came and passed, no accidents happened besides the carefully planned PR-targeted ones, and the hoteliers are left to count the profits” Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia & CIS, says.

Occupancy

The Russian capital’s market appeared resilient to the post-World Cup blues in terms of hotel occupancy in 2018 and displayed a very healthy growth vs. 2017. In fact, Moscow showed the highest weighted market average number of occupied rooms in the observable history – 76% of all modern room stock here was sold every night of this year (vs. 72% a year before).

Quite a different effect on number of tourists this year had in St. Petersburg. The 2nd Russian capital was, in fact, less popular with tourists amidst the rate hikes for the Football Championship. Crowds that are usually there during the White Nights didn’t appear, and there were much less fans then everyone expected – average occupancy dropped by 1 ppt here – to 61.3%.

In Moscow, the Upscale segment (or equivalent of 4 star hotels) was a leader in Occupancy, at 81% this year, while the close counterparties of these hotels, Upper Upscale properties (or 5 star business hotels), were below 70% of sold rooms. In St. Petersburg, the leader is the same, but with different result – 73% of sold rooms in Upscale hotels. Lowest occupancy this year here was recorded in the most expensive hotels – Luxury properties were only 55% occupied.

RUB ADR dynamics

Rate-wise, 2018 was quite a success in both cities. In Moscow the yearly average price per room reached almost RUB10,700 (growing by 41% over the previous year), and at the same time in St. Petersburg hoteliers raised prices to almost RUB 7,800, which represents a 17% growth compared to 2017.

Luxury segment was a leader in both places, reaching RUB 22,500 per room in the Northern capital, and bringing in almost RUB 30,000 in Moscow (growth of 20% and 62%, respectively).

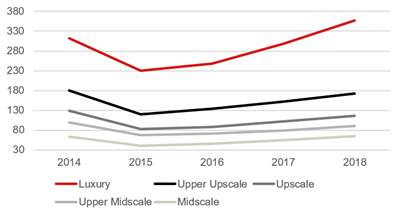

USD ADR dynamics

“The overall market was favorable this year to allow the hard currency-denominated hotel ADR to continue to return to its pre-crisis level. If at the end of 2017 only the St. Petersburg Luxury hotels were able to take over their own USD-denominated performance of 2014, this year Moscow’s Luxury segment far surpassed its own 2014 rates – USD467 vs. 351 before the ruble crush. Another segment that almost caught up here was Upper Upscale – these hotels brought in USD238 per room on average throughout the year (while in 2014 they were at USD249).” Tatiana Veller comments. “In St. Petersburg the most expensive accommodation options offered rooms at USD357 on average (vs. USD312 in 2014), accompanied by the least expensive hotels – Midscale surpasses the 2014 by a mere dollar, having been at USD65 vs. 64 in 2014.”

New market entrants

In 2018 in Russia branded room supply increased by 1.5 times the growth rate of 2017: on the background of FIFA-2018 preparations, hotel market gained 5,700 keys compared to 3,700 the year before. Well over half of the new branded supply volume belongs to hotels opened in World Cup cities (3,400 rooms). Moscow received 1,700, and St. Petersburg about 540 hotel rooms (with the rebranding of W into So Sofitel). For the upcoming 2019, branded openings pace should slow down: in Moscow, international brands are planning ‘only’ 1,100 rooms. In St. Petersburg, new branded hotels have not been announced yet.

2019 Outlook

“2018 turned out to be very close in operational performance to our forecasts, and now is the time to assess the prospects for the 2019 as the first year of the hotel markets after major international event. For 2019, in our opinion, Moscow will endeavor to keep the high occupancy levels of 2018, while also trying not to lose much in rates, while St. Petersburg will be rebuilding back to the 2017 in terms of occupancy, while trying to maintain the ADRs reached in 2018” Tatiana Veller concludes.

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.