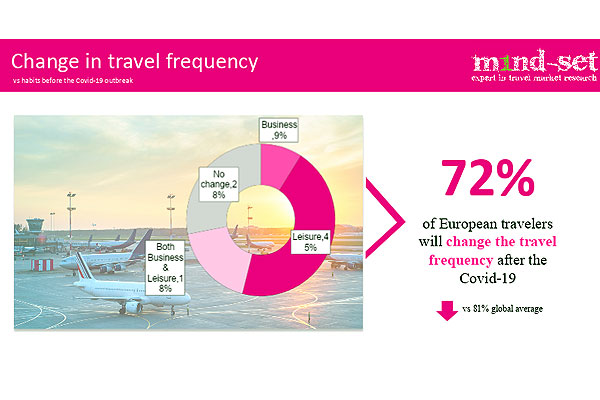

Although 72% of Europeans say Covid has had an impact on their intended travel frequency, according to m1nd-set, this is still lower than the global average (81%) and the lowest among all other world regions.

The latest shopper behaviour report from leading industry consumer insights research agency, m1nd-set, reveals quite mixed prospects for the travel retail sector across Europe as the region continues to battle the Coronavirus pandemic. The report was finalized this week, only days after quarantine rules are enforced in the UK and as Manchester Airport, the country’s third largest airport, announces the imminent closure of T2 yet again. However, despite the unprecedented traffic declines across Europe over the second quarter and uncertain times ahead, the news is not all ‘doom and gloom’ according to m1nd-set.

The research, undertaken among European travellers who have travelled internationally in the past 12 months, reveals a number of encouraging findings on the intent of Europeans to travel internationally again and equally positive insights on how European travellers will behave in the duty free and travel retail stores once international travel resumes.

The report commences with an overview of the devastating impact the Coronavirus pandemic has had on departing passenger numbers across the continent, citing declines between Q2 2019 and the same period in 2020 across the major European hubs. m1nd-set’s Business 1ntelligence Service (B1S) traffic tool, based on exclusive and comprehensive traffic data from IATA, reveals that London Heathrow, Amsterdam Schiphol and Paris Charles de Gaulle, the top 3 airports for departing passengers in Q2 2019, all lost between 94% and 96% of passengers compared in Q2 2020. Similar shifts in rankings for departure traffic can be seen among the leading airport countries, with the UK falling from first to second position between Q2 2019 and the same period this year.

Although 72% of Europeans say Covid has had an impact on their intended travel frequency, according to m1nd-set, this is still lower than the global average (81%) and the lowest among all other world regions. Less than one fifth of European travellers say their travel (business and leisure combined) will be reduced as a result of the global pandemic. Business travel will be the least affected for Europeans with less than one in ten travellers planning to reduce their work-related international travel. Covid-19 will have a greater impact on leisure travel as 45% of Europeans say their leisure travel plans will be affected, compared to a global average of 30%, 21% among Asia Pacific travellers and 25% among travellers from the Americas.

A significant percentage of Europeans say they will not change their behaviour across certain key categories. 70% of European travellers say they do not plan on changing their purchasing behaviour for spirits, which is significantly higher than the global average – 56%. The delta is even greater for Gifts and Souvenirs, where 74% of Europeans say they will not change, compared to only just over half of all travellers globally (53%).

However, despite the positive news on intentions to purchase, spend levels are likely to be impacted among European travellers when shopping in duty free and travel retail on future international flights. Among those European travellers who will shop or spend less in the duty free shops, physical stores at home, online and downtown duty free shops are cited as the top three retail channels to which they will divert their spend.

Peter Mohn, CEO & Owner at m1nd-set stressed the need for retailers to rethink their digital marketing and e-commerce activities: “As we have underlined several times in the past, the current trends and shift to online spending are a major call to action for the travel retail sector to upgrade its online strategy. This is essential for both the e-commerce offer and digital marketing activities to prospective customers – passengers and consumers while they are in the process of booking or searching for travel.”

According to m1nd-set, it will be vital to ensure the airport shopping experience is front of mind and part of their planned shopping during their next international trip. The research agency argues however that in order to achieve this effectively and successfully, there will need to be significant changes to the way stakeholders market to consumers.

“While data-sharing has been taboo among travel retail stakeholders until now," Mohn continued, “the Coronavirus has forced all companies across the industry into a corner. The current pandemic may be the catalyst to a more collaborative approach and real partnership model where airlines and airports – and more importantly, their commercial partners – finally start working together to drive travel retail revenues, where all parties benefit.”

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.