Alexandre de Juniac, IATA’s Director General and CEO.

The International Air Transport Association reported that the global airline industry’s performance on safety, sustainability and profitability is solid, but the industry faces the threat of protectionist measures being implemented by governments.

CANCUN – IATA called for governments to enhance their collaboration with the industry to meet rising security challenges, avert a looming infrastructure crisis and to build smarter regulation.

The Director General’s Report on the Global Air Transport Industry was delivered to the 73rd IATA Annual General Meeting and World Air Transport Summit. The event has gathered 1,000 industry leaders and stakeholders in Cancun, Mexico.

Highlights from de Juniac’s address include:

- Industry Financial Performance: Although regional differences remain stark, overall the air transport industry is generating profits above its cost of capital. In 2017 the global airline industry is expected to generate a $31.4 billion profit on $743 billion in revenues. That’s a $7.69 average profit per passenger.

- Defending Against Protectionist Measures: "Nothing should stand in the way of aviation – the business of freedom. Aviation is globalization at its very best. But to deliver aviation’s many benefits we need borders that are open to people and trade. Today we face headwinds from those who would deny the benefits of globalization and point us in the direction of protectionism. This is a threat to our industry. We must bear witness to the achievements of our connected world. And we must ensure the benefits of aviation for future generations," said Alexandre de Juniac, IATA’s Director General and CEO.

- Safety Performance: Flying remains the safest form of long distance travel by a wide margin. In 2016 the industry performed 40.4 million flight sectors and there were 10 fatal accidents. A major achievement on safety performance in 2016 was in Sub-Saharan Africa. The region had no jet hull losses last year.

IATA signaled its concern for states’ not living up to their obligations to fully investigate air accidents. "Accidents are rare, but each represents an opportunity to learn more about making aviation safer. That’s why their investigations are mandated in Annex 13 of the Chicago Convention. But, of the 1,000 accidents investigated over the last decade, reports are available for only 300, and many of these are not exhaustive. There can be no excuse for a statistic like that. Governments must do better," said de Juniac.

- Sustainability: A major achievement of 2016 was the landmark Carbon Offset and Reduction Scheme for International Aviation (CORSIA) agreed at the International Civil Aviation Organization’s (ICAO) 39th Assembly. Already 70 states representing at least 80% of anticipated future growth have indicated their voluntary participation in the scheme. This will be a major enabler of the industry’s commitment to carbon-neutral growth from 2020 and to cut net emissions to half of what they were in 2005.

The success of CORSIA is unaffected by the US decision to withdraw from the Paris Agreement. "The disappointing decision of the US to back out of the Paris Agreement is not a setback for CORSIA. They are completely separate from one another. The alternative to CORSIA is a patchwork of measures that would be ineffective, costly and unmanageable. Our membership remains united behind CORSIA and our climate change goals," said de Juniac.

The AGM passed a resolution calling on governments to finalize the details of CORSIA with enough time for implementation by airlines, support the commercialization of sustainable alternative aviation fuels and modernize air traffic management.

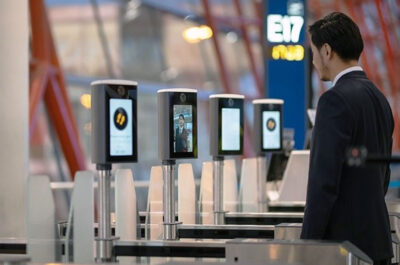

- Collaboration to Address Security Challenges: IATA warned that while air travel faces security threats, alternatives must be found to the ban on large portable electronic devices (PEDs) in the cabin by the US and the UK on some flights from the Middle East and North Africa.

"We must trust that valid intelligence underpinned the UK and US decisions to ban large PEDs on flights from some African and Middle Eastern airports. But, the measures themselves test the confidence of the industry and the public. We need to get security right. There is a clear duty for governments to make sure that the measures are logical, effective and efficient. That is not the case with the current PED ban. And it must change," said de Juniac.

IATA called for governments to adopt alternatives to the current ban. "In the short-term, these include more intense screening at the gate and skills training. In the medium-term, faster and more advanced explosive detection technology is the solution to evolving bomb threats. But painfully slow certification processes must be accelerated so that we can actually use it," said de Juniac.

De Juniac emphasized the importance of working with governments on security challenges. "Security is ultimately a government responsibility. But airlines also have a big stake in the matter. The safety and security of our passengers and crew is our top priority. We have vital operational expertise that can help governments and it’s difficult to understand their resistance to greater collaboration. We could achieve better solutions by working together," said de Juniac.

The AGM passed a resolution calling for governments to work more closely with the industry and among themselves to keep flying secure. It also strongly endorsed the efforts of ICAO to establish a Global Aviation Security Plan (GASeP) which will lay the foundation for more effective collaboration on security.

- Infrastructure: "An infrastructure crisis is looming. Infrastructure in many parts of the world can barely cope with demand today. And development plans are not ambitious enough to accommodate the 7.2 billion passengers we expect in 20 years’ time," said de Juniac. Bottlenecks and deficiencies in airport and air navigation services exist in all corners of the earth.

IATA called for governments to fully implement the IATA Worldwide Slot Guidelines to fairly and efficiently manage scarce capacity. It also warned that the guidelines are not a substitute for building capacity where demand exists. "Governments have a responsibility to provide sufficient capacity, with service quality aligned to user expectations and at an affordable cost, capacity, quality and affordability. It is a commonsense mantra that we must insist on in our dialogue with governments," said de Juniac.

IATA also urged governments to be cautious when privatizing aviation infrastructure assets. "Privatization has failed to deliver promised benefits in many countries – India, Brazil, France, and Australia to name just a few. The concessionaire makes money. The

government gets its cut. The airlines pay the bill – usually a big one. And passengers and the local economy suffer the results of higher costs. When governments privatize critical infrastructure, economic regulation is essential. To date I cannot name a single long-term success story. Finding the solution is an important piece of work that needs government and industry collaboration. It’s the only way to balance the investor’s need for profit with the community’s need for cost efficient connectivity," said de Juniac.

- Building Smarter Regulation: Building Smarter Regulation in an age focused on mmediate gratification is a challenge.

The majority of the 100,000 flights that operate each day, do so without incident. However, when things go wrong the potency of social media to hold individual companies and entire industries instantly accountable is formidable.

"Regulators and politicians can feel confident that the discipline of competitive market forces has been given a boost. And regulators themselves face pressure to respond to social media frenzies with immediate solutions. Hastily-built regulation almost always brings unintended consequences. That’s why Smarter Regulation principles are absolutely critical," said de Juniac.

Strong Profits Continue Labor, Fuel and Supplier Costs on the Rise

IATA)revised its 2017 industry profitability outlook upwards. Airlines are expected to report a $31.4 billion profit (up from the previously forecast $29.8 billion) on revenues of $743 billion (up from the previously forecast $736 billion).

"This will be another solid year of performance for the airline industry. Demand for both the cargo and passenger business is stronger than expected. While revenues are increasing, earnings are being squeezed by rising fuel, labor and maintenance expenses. Airlines are still well in the black and delivering earnings above their cost of capital. But, compared to last year, there is a dip in profitability," said Alexandre de Juniac.

In 2017 airlines are expected to retain a net profit of $7.69 per passenger. That is down from $9.13 in 2016 and $10.08 in 2015. The average net profit margin stands at 4.2% (down from 4.9% in 2016).

"Airlines are defining a new epoch in industry profitability. For a third year in a row we expect returns that are above the cost of capital. But, with earnings of $7.69 per passenger, there is not much buffer. That’s why airlines must remain vigilant against any cost increases, including from taxes, labor and infrastructure," said de Juniac.

While overall industry performance is strong, major regional variations remain. About half the industry profits are being generated in North America ($15.4 billion). Carriers in Europe and Asia-Pacific will each add a $7.4 billion profit to the industry total. Latin America and Middle East carriers are expected to earn $800 million and $400 million respectively. Airlines in Africa are expected to post a $100 million loss.

Forecast Drivers

Strong Demand Environment: The demand environment has been much stronger than anticipated. Expectations for GDP growth in 2017 stand at 2.9%. If realized this will be the strongest global economic performance since 2011.

Passenger demand is expected to grow by 7.4% over the course of 2017. That is the same growth rate as 2016 and 2.3 percentage points higher than previously forecast. Stronger demand translates into an additional 275 million passengers (over 2016), which will bring the total number of passengers expected to fly this year to 4.1 billion. If achieved, this would be the largest year-on-year growth in absolute passenger numbers ever recorded.

What is most important for the industry financial performance is that this surge in expected demand takes traffic growth ahead of planned capacity growth. As a result, the average passenger load factor is expected to reach 80.6% (slightly ahead of the 80.3% achieved in 2016), helping to boost unit revenues.

Cargo demand is expected to grow by 7.5% in 2017. That is more than double the 3.6% growth realized in 2016 and 4.0 percentage points above the previous forecast for this year. Total cargo carried is expected to reach 58.2 million tonnes. This is higher than previously forecast (by 2.5 million tonnes) and 3.9 million tonnes over 2016 levels.

Costs

Cost increases for fuel, labor and maintenance accelerated in the first quarter. Overall industry expenses are expected to rise to $687 billion, a $44 billion increase on 2016. Industry revenues are expected to increase to $743 billion, $38 billion more than 2016.

Cheaper fuel was responsible for most of the 8% fall in airlines’ unit costs in 2016, but that impact is coming to an end due to the influence of fuel hedges and rising spot prices. Some regions will still see some modest benefits from hedges but this will be insufficient to offset the rise of other operating costs. The total industry fuel bill is predicted to be $129 billion, slightly below the 2016 level of $133 billion, and accounting for 18.8% of the industry’s total costs. The forecast anticipates an average oil price of $54.0/barrel for Brent Crude (up from $44.6/barrel in 2016 but close to current levels) reflecting a broad balance between OPEC supply cuts and new supply from US shale oil producers. That will lead to jet kerosene prices averaging $64.0/barrel this year.

Aside from the effect of fuel prices and hedging, the main driver of increased costs this year is coming from labor and industry suppliers which are exerting pressure for an increased share of the airline industry’s improved financial performance. Last year productivity gains offset wage increases, but this year we expect unit labor costs to rise by almost 3%, continuing what has already been evident in the first quarter.

Yields

Yields are still expected to be down on 2016 levels, but there are signs of stabilization in the first half of the year with a slight improvement anticipated towards year-end, driven by better capacity utilization and the imperative to respond to the rise of unit costs.

Passenger yields are expected to fall by 2.0% over the course of the year. This is the smallest decrease in recent years (-8.8% in 2016, -11.9% in 2015, -5.5% in 2014, -3.9% in 2013).

Cargo yields are expected to fall by 1.0% over the course of the year. This is also the smallest decrease in recent years (-12.5% in 2016, -17.4% in 2015, -2.0% in 2014, -4.9% in 2013).

Regional Round-up

- North America: Carriers in this region are expected to post a $15.4 billion net profit (down slightly from the $16.5 billion in 2016), which is equal to $16.32/passenger. Passenger demand is expected to grow by 4.0%, slightly behind expected capacity growth of 4.4%.

- North American airlines are the powerhouse of industry profitability, generating about half of the collective global profit. This is owing to the restructuring of the industry, a relatively strong economy and a resilient US dollar. The region’s carriers also face challenges. Very limited fuel hedging delivered quick benefits when fuel prices fell. Conversely, there is less of a buffer as fuel prices rise. A tight labor market is adding more pressure to profits by pushing up wages. Nonetheless, profitability remains at historically high levels, even if slightly down on 2016.

- Asia-Pacific: Airlines in this region are expected to post a $7.4 billion net profit (down from $8.1 billion in 2016) which is equal to $4.96/passenger. Passenger demand is expected to grow by 10.4%, slightly ahead of expected capacity growth of 8.8%.

- Europe: European airlines are expected to post a $7.4 billion profit (down from $8.6 billion in 2016) which is equal to $6.94/passenger. Passenger demand is expected to grow by 7.0%, slightly ahead of expected capacity growth of 6.9%. Terror incidents in 2016 have dented European demand. Performance over the first months of the year pointed towards the recovery of lost ground. However, recent terrorist attacks demonstrate that the threat continues to hang over the continent with potential negative impacts on demand.

- Latin America : Latin American airlines are expected to post a $0.8 billion profit (up from $0.6 billion in 2016) which is equal to $2.87/passenger. Passenger demand is expected to grow by 7.5%, well-ahead of expected capacity growth of 6.7%. The continent is seeing slightly improved trading conditions with its largest economy (Brazil) emerging from recession. Political instability persists in many markets and rising costs in dollars (for fuel) presents challenges. Additionally the region suffers from an onerous regulatory burden on passenger rights. Brazil has been joined by Mexico with punitive passenger rights regimes that differ significantly from international norms. And the political chaos in Venezuela makes it unlikely there soon will be a recovery of $3.8 billion of airline revenues blocked from repatriation. Nonetheless, the region’s airlines are responding to these challenges and Latin America is expected to be the only region to see an improvement in its business fortunes compared to 2016.

- Middle East: Middle East airlines are expected to post a $0.4 billion profit (down from $1.1 billion in 2016) which is equal to $1.78/passenger. Passenger demand is expected to grow by 7.0%, slightly ahead expected capacity growth of 6.9%. Trading conditions for the Middle Eastern carriers have sharply declined over the last six months. Profitability and load factors are down significantly, as traffic and some business models have come under pressure. There is growing evidence that the ban on large electronic devices in the cabin and the uncertainty created around possible US travel bans is taking a toll on some key routes. Meanwhile the region is struggling with increased infrastructure taxes/charges and air traffic congestion.

- Africa : African airlines are expected to post a $0.1 billion loss (in line with the $0.1 billion loss in 2016) which is equal to a loss of $1.50/passenger. Passenger demand is expected to grow by 7.5%, slightly behind expected capacity growth of 7.9%. African carriers remain in the red; but without a deterioration on 2016 performance. On safety, the region’s carriers achieved a major milestone with zero jet hull-losses in 2016. And a general improvement in commodity prices is helping invigorate the continent’s economies (and offset fuel price increases). This trend, however, is unlikely to accelerate substantially. The burdens of high taxes, higher-than-global-average fuel prices, competition from the Gulf and limited intra-continental liberalization remain. The balance of these factors is expected to result in continued small losses.

2016

IATA revised downwards its estimation for 2016 profits to $34.8 billion (from previously forecast $35.6 billion). Industry level profitability peaked at a historically high level in the first half of 2016 and has since been slowly declining. This is the result of margins being squeezed by unit costs which are rising faster than unit revenues. Additionally, net post-tax profits took a hit from fuel hedging losses.

The Business of Freedom

"Air transport is the business of freedom. The safe and efficient global movement of goods and people is a positive force in our world. Aviation’s success betters peoples’ lives by creating economic opportunity and supporting global understanding. We must stand firm in the face of any rhetoric that would put limits on aviation’s future success," said de Juniac.

Some key indicators of the strength of global connectivity include:

- The 2017 average return airfare is expected to be $353 (2016 dollars), which is 64% below 1996 levels after adjusting for inflation.

- Average air freight rates in 2017 are expected to be $1.51/kg (2016 dollars) which is a 69% fall on 1996 levels.

- Air cargo accounts for around 35% of the total value of goods traded globally.

- The number of unique city pairs served by aviation is forecast to grow to 19,699 in 2017, a 99% increase on 1996.

- The global spend on tourism enabled by air transport is expected to grow by 5.2% in 2017 to $685 billion.

- Airlines are expected to take delivery of some 1,850 new aircraft in 2017, around half of which will replace older and less fuel-efficient aircraft. This will expand the global commercial fleet by 3.8% to 28,645.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.