Investors are putting more money in hotels, one of the most promising property segments in the near future, while tourist numbers globally have set a new record.

Yulia Kozhevnikova, real estate expert at Tranio.com finished a new report, that is a review of the European hotel market, explaining investment volumes and structure, occupancy rates in European cities, the best places to invest in hotel real estate, as well as a market forecast.

According to the United Nations World Tourism Organization (UNWTO), the number of international tourists reached a new high in 2016 – 1.235 billion. Almost a half of them (615 million) visited Europe, making the continent the most popular tourist destination in the world.

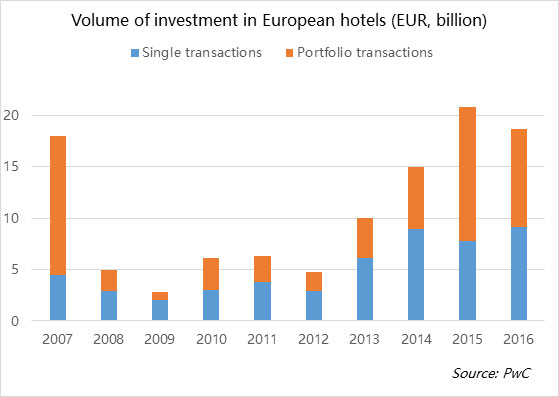

The hotel industry is growing alongside the tourist numbers. According to PwC, the total volume of investment in this segment in Europe amounted to 18.7 billion euros in 2016. Though this is 9.7% below the record of 20.8 billion euros set in the last decade, in general, analysts denote a stable growth in investment since the 2008–2009 global financial crisis.

Taking only single transactions into account, over 9 billion euros was invested in European hotels.

Why the market will continue growing

According to a survey conducted by PwC in 2017 among investors on different types of property in Europe, 70% of the respondents deemed the prospects of hotel investments "good" or "very good" (51% and 19% respectively). A number of reasons are behind this optimism:

1) Tourist numbers are expected to continue increasing

In addition to the fact that Europe is the most popular tourist destination in the world, four of the five countries at the top of the 2017 Travel and Tourism Competitiveness Index are in Europe: Spain, France, Germany and the United Kingdom (UK). According to industry forecasts, the number of tourists will grow by another 2–3 % this year.

The tourist flow estimates are directly related to disposable incomes. According to UNWTO, in 2016, Chinese tourists spent the most (€235.9 billion), followed by tourists from the United States (US), Germany, UK and France. The economic conditions of these countries will largely define the future development of international tourism.

|

Total tourist spending in 2016 (EUR, billion) |

Projected growth between 2017 and 2020 (%) |

||

|

Personal income |

GDP (per annum) |

||

|

China |

235.9 |

+24 |

+1.5 |

|

United States |

109.8 |

+11 |

+2 |

|

Germany |

73.3 |

+7 |

+0.5 |

|

United Kingdom |

57.5 |

+29 |

+0.3 |

|

France |

36.6 |

+4 |

+0.6 |

Sources: UNWTO, tradingeconomics.com

According to Trading Economics, personal income and GDP in these countries will grow. In the UK and China, income levels will rise by 29% and 24% respectively, while the US will demonstrate the most significant economic growth, at 2% per annum.

2) Stable business tourism demand

While holidays are the main reason for most international trips (around 75% according to ITB Berlin), business trips still constitute an important segment of this market.

According to a survey by American Express Global Business Travel, in 2017, Europe will host the largest number of international meetings, conferences and exhibitions in the world. In the opinion of most respondents, travel costs in large organisations will increase by approximately 1% in 2017. Therefore, a stable demand for hotels can be expected in the near future.

George Kachmazov, managing partner at Tranio.com, says: "Hotels fit the collaborative consumption economic model perfectly. In my opinion, the segment of apartment hotels (where rooms represent separate apartments) will continue to grow. They are becoming more popular among business travellers, who use them as a “home base” for several weeks or months, before moving to another city for work."

3) Favourable economic climate

Investment sustainability largely depends on the country’s economy and the region in general: stable growth partially guarantees the reliability of investments.

According to Trading Economics, the annual growth of the EU’s GDP up to 2020 will run at around 2%, while the unemployment rate in the region will decline by 1.6% and the income of euro-area residents will grow by almost 9%.

In Spain, one of the most popular tourist destinations in the world, experts anticipate the dynamics to be positive up to 2020 at least, with annual GDP growth amounting to 0.6% on average, the unemployment rate declining by almost 4%, and personal income growing by 13%.

4) High yields and long-term rent

Hotels remain to be an attractive asset type for two reasons:

1) They have relatively high yields, typically between 4–6%, compared to street retail, which yields 3–4%, and long-term flat rentals at only 2–3% per annum;

2) In the case of large hotels, contracts with operators can be signed for 10–20 years.

Where should you invest to get the best returns?

According to experts, terror attacks have affected travel destinations, not the number of trips. According to preliminary UNWTO data, in 2016, tourist numbers increased significantly (by 10% and more) in Cyprus, Bulgaria, Portugal and Spain but shrank in Turkey (29%), Belgium (13%) and France (5%).

In our opinion, France will retain its position as the largest tourist market despite fears over terrorism. Spain and Italy will continue to draw crowds to their resorts, while Germany will benefit from its reputation for stability. On the other hand, Turkey will temporarily take a back seat as tourists seek affordable alternatives in more secure countries: primarily Cyprus and Greece.

George Kachmazov said: "Greece currently offers excellent opportunities for hotel investments. The main reason is that its property market will soon hit rock bottom before bouncing back. "

According to the Bank of Greece, property prices in the country fell by 40% between 2008 (when the latest price peak was recorded) and 2016. According to Numbeo, a square metre in Greek city centres is about 1.5 times cheaper than in Portugal, twice as cheap as in Spain and almost thrice as cheap as in Italy. Therefore, the potential for price growth is high. According to Trading Economics, prices of the property in Greece will increase by 22% by 2020. This will be supported by GDP growth (by 0.4% per annum) and a decline in unemployment (from 21.7% currently to 18.8% in 2020).

Demand from foreign investors is also being fuelled by cheap “golden visas”: a Greek residence permit can be obtained through the purchase of a property of at least 250,000 euros. In contrast, the threshold in Spain and Portugal is 500,000 euros."

Tranio.com analysts looked at the availability of hotels, occupancy, average daily rates and the owners/ income in European cities popular with tourists. The results show that the demand for hotels in Dublin, Amsterdam and Barcelona is higher than other European cities. There are far fewer hotels than tourists there, and occupancy rates are higher. At the same time, the occupancy rate in London, which leads Europe in tourist arrivals, is second in the continent.

Hotel markets of large European cities (2016)

|

City |

No. of international tourists* (million) |

No. of rooms per thousand tourists |

Occupancy |

Average daily rate (EUR) |

Revenue per room (EUR) |

Yield (%) |

|

London |

19.9 |

7.3 |

81 |

164 |

132 |

4.0–5.0 |

|

Paris |

18.0 |

4.4 |

69 |

233 |

162 |

4.0–5.3 |

|

Barcelona |

8.2 |

4.4 |

76 |

135 |

103 |

5.0–5.5 |

|

Amsterdam |

8.0 |

4.3 |

78 |

137 |

107 |

5.0–5.5 |

|

Milan |

7.7 |

3.2 |

65 |

138 |

90 |

5.5–6.5 |

|

Rome |

7.0 |

6.9 |

68 |

153 |

103 |

5.5 |

|

Vienna |

6.7 |

5.0 |

74 |

101 |

75 |

5.0–5.5 |

|

Prague |

5.8 |

5.7 |

77 |

88 |

68 |

6.0 |

|

Madrid |

5.3 |

7.1 |

71 |

99 |

70 |

5.0–6.0 |

|

Munich |

5.3 |

6.3 |

75 |

198 |

155 |

4.5–5.0 |

|

Dublin |

5.0 |

4.0 |

83 |

129 |

107 |

5.5–6.5 |

|

Berlin |

4.9 |

11.2 |

77 |

97 |

75 |

4.5–5.0 |

|

Lisbon |

3.6 |

5.5 |

76 |

99 |

75 |

n/a |

|

Frankfurt |

3.6 |

12.8 |

70 |

131 |

92 |

4.5–5.0 |

|

Budapest |

3.4 |

5.7 |

76 |

79 |

60 |

6.0 |

|

Athens |

2.7 |

7.2 |

67 |

105 |

73 |

7.5–8.0 |

*The tourists who have spent at least one night in the city

Another important factor when assessing the hotel market’s investment attractiveness is the influence of online short-term rental platforms such as Airbnb.

This market is strictly regulated in Germany. According to Hessenschau.de, in Frankfurt, the local authorities have declared the remote lease of 1,293 flats illegal between 2013 and 2016. The number of hotel rooms there exceeds Airbnb offers more than 26 times. In Berlin, where the number of hotel rooms exceeds the number of Airbnb listings by four times, the owner must occupy at least a half of the property being leased or risk a €100,000 fine. In Munich, Vienna, Brussels, Dublin and Athens, the ratios are approximately the same.

Number of hotel and Airbnb offers in large European cities (2017)

|

City |

No. of hotel rooms (thousand) |

No. of Airbnb listings (thousand) |

Rooms-to-listings ratio |

|

|

Frankfurt |

46.4 |

1.8 |

25.8 |

|

|

Munich |

33.5 |

5.5 |

6.1 |

|

|

Vienna |

33.3 |

6.4 |

5.2 |

|

|

Brussels |

19.3 |

4.7 |

4.1 |

|

|

Berlin |

55.0 |

14.0 |

3.9 |

|

|

Dublin |

20.0 |

5.1 |

3.9 |

|

|

Athens |

19.6 |

5.4 |

3.6 |

|

|

Prague |

33.0 |

10.4 |

3.2 |

|

|

Geneva |

6.4 |

2.1 |

3.1 |

|

|

London |

145.0 |

50.4 |

2.9 |

|

|

Madrid |

37.4 |

13.1 |

2.9 |

|

|

Zurich |

8.0 |

2.9 |

2.8 |

|

|

Amsterdam |

32.0 |

12.6 |

2.5 |

|

|

Budapest |

19.3 |

8.2 |

2.4 |

|

|

Rome |

49.2 |

24.4 |

2.0 |

|

|

Barcelona |

35.9 |

18.0 |

2.0 |

|

|

Milan |

24.8 |

12.6 |

2.0 |

|

|

Paris |

80.2 |

46.5 |

1.7 |

|

|

Lisbon |

20.0 |

11.7 |

1.7 |

|

|

Porto |

6.0 |

4.9 |

1.2 |

|

In Porto, Lisbon and Paris, the competition between hotels and Airbnb is greater: the number of hotel rooms there exceeds rental offers only marginally. In these three cities, investing in short-term residential rentals is more profitable.

Choosing the right property

- Budget: At least 10 million euros, otherwise, there is a high risk the location is not very good.

- Location: A large city, independent of seasonal demand (taking the average tourist flow and the competition from the short-term rental market into account).

- Hotel room capacity: Starting from 70 rooms. Small hotels are likely to have small (and, subsequently, risky) operators that will "eat up" the yields.

- Rating: Three-star or four-star (such hotels are the most popular).

- Operator: A large international or a local company with a good reputation and a vast management experience.

- Contract with the operator: A 10 to 20-year management contract gives investors the right balance between a franchise and a fixed rental rate, as yields rates may increase depending on the operator's results.

- Yield: Average yield: 4%–6%; maximum: 8%, but a high yield implies greater risks.

Tranio.com is an international overseas property broker with a network of 700 partners worldwide and a catalogue of more than 110,000 listings in 65 countries. We publish daily news, high quality analysis on foreign realty, expert advice, and notes on laws and procedures related to buying and leasing properties abroad so that our readers can make their property decisions with confidence.

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.