35% of small businesses in retail, leisure & hospitality sectors think it will be a whole year before they fully recover from the devastating impact of Covid-19.

LONDON – The harsh reality of the brutal economic damage of the UK lockdown is starting to bite and hit most small businesses owners hard. Nearly one in two no longer feel optimistic about the future of their companies and may need to shed jobs in 2020.

Almost one quarter don’t think the government support schemes are enough to help them ultimately survive and 35% of small businesses in retail, leisure & hospitality sectors think it will be a whole year before they fully recover from the devastating impact of Covid-19, a new study finds.

Buckworths, the UK’s only law firm working exclusively with start-ups and high growth businesses, surveyed over 500 UK SME owners and decision-makers to gauge attitudes towards the Government’s response to the coronavirus crisis and the economic impact of the ongoing lockdown.

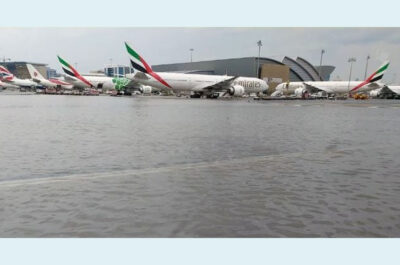

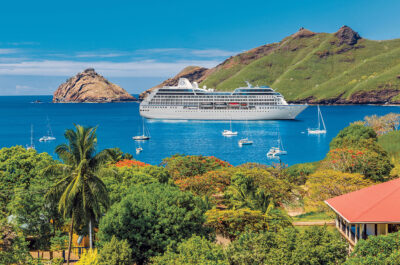

Those who work in the travel or transport industries will be the hardest hit with nearly half (47%) thinking it will take twelve months to return to pre-pandemic operations.

The travel and tourism industries are most pessimistic about the loss of income and their ability to rebound in the next twelve months; 45% of SMEs in Wales, 34% in Scotland and 62% in Northern Ireland all predicting a grim year ahead. however there’s clearly a regional disparity with over half of travel SMEs in South-West England believing they will fully recover from the economic impact of the virus.

The Coronavirus job retention scheme launched by the Treasury has seen the government pay 80 per cent of wages, up to £2,500 a month, to furloughed workers between April and June this year. It has encouraged employers to retain staff by putting them on furlough instead of making them redundant.

The Office of Budget Responsibility (OBR) estimates it will cost more than £40bn over its original three-month time period.

Of the 500 small business owners surveyed, 50% say further investment is crucial to saving jobs. Overall, only 28% of companies think they will be able to bring back all their staff once the furlough scheme has ended and that number decreases in London (23%), the Midlands (22%) and the North-East (22%).

Michael Buckworth, Managing Director at Buckworths, says: ”The government has failed to set out a coherent plan to exit the lockdown, and this has left businesses feeling a severe lack of optimism for the future. The Prime Minister's speech may have contained an outline timetable, but it was subject to numerous caveats, ifs and maybes.

“According to some sources, government ministers, MPs and anonymous officials said the government was surprised that so many businesses had complied with the lockdown and implied that they had not expected (or wanted) them to. One could be forgiven for thinking that the government is trying to state officially that the lockdown should continue whilst metaphorically winking at businesses to tell them to go back to work.

“Businesses cannot plan based on nods, winks and possible maybes. The government must get a grip on this crisis and clarify several points. Now that the furlough scheme will run to September, will it change it to reduce the government contribution, or allow part-time work? Secondly, what will be the obligations of employers when work people return to work? Will staff have to wear PPE? Will employers have to maintain social distancing in the workplace? Will employers have to allow flexible working? Employers cannot impose new working conditions without warning and preparation.

“Finally, the government must be clear when businesses can return to work. The government cannot continue a policy of lockdown indefinitely. The British Bank Bank loan schemes have provided vital cash injections during the period of strict lockdown, but they are only short-term solutions. The Future Fund will help a small number of highly innovative startups but will be inaccessible to most SMEs. An alternative approach which shifts the onus from the government to private investors should be pursued, such as a temporary tax relief scheme that is similar to the existing Seed Enterprise Investment Scheme (SEIS) and Enterprise Investment Scheme (EIS).

“At some point, the economy must be allowed to return to normal and the NHS must be in a position to cope with outbreaks of illness as they occur. The Prime Minister's speech at the weekend suggests that the government does not yet have a policy to allow that to happen. If that is the case, it is a failure of policy that is unparalleled in modern times.”

The research carried out by Buckworths forms part of the firm’s nationwide campaign: Rebooting British Businesses post COVID 19. The results of the survey will be analysed and dissected in Buckworths’ upcoming whitepaper.

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.