According to m1nd-set, there are currently more than 750 million Seniors in the world and by 2030, there will be more than one billion. The consumer class among Middle-aged consumers will grow by 40% between 2020 and 2030, just below the average across all age groups.

The second part of m1nd-set’s age demographic specific research underscores the importance of the older generation consumer markets and reveals details of their travel retail shopper behaviour.

The second research in a two-part series on age segments of shoppers in travel retail has revealed some interesting and actionable insights for marketers across the global travel retail industry across both Middle-aged and Senior travellers, m1nd-set reports. According to the Swiss travel research agency, which boasts a database of several hundred thousand travellers from all world regions, the research on the older generations provides a range of thought-provoking findings and reveals areas which the industry needs to place greater emphasis on, to seduce and convert older generation shoppers.

The research, conducted from shopper interviews from the first half of this year, identifies the significant potential of both age segments given the growth rates of the consumer class among Middle-aged and Senior shoppers in the years ahead. According to m1nd-set, there are currently more than 750 million Seniors in the world and by 2030, there will be more than one billion. The consumer class among Middle-aged consumers will grow by 40% between 2020 and 2030, just below the average across all age groups. Seniors will see 66% growth over the same period however – 25 points higher than the average across all age groups. The top two consumer markets for Senior consumers in 2030 are forecast to be the US and China, but the most significant growth in consumer spending among Seniors this decade, will be China, where spend is forecast to triple, and India, where Senior consumers spending will increase tenfold this decade.

As far as the size of the shopper segments in travel retail is concerned, Middle-aged consumers represent the largest age segment with 59% of the shopper population, with Millennials in second place at 25%. Seniors represent only 9% of shoppers in travel retail, 3% more than GenZ consumers. Seniors present a significant opportunity however and are not to be ignored, m1nd-set reports. The net worth of Seniors and Middle-aged consumers is considerably higher than younger consumers, especially for Seniors in developed markets, thanks to pension schemes.

Staff interaction is an area which m1nd-set’s research reveals there to be significant areas for improvement when it comes to marketing to Seniors. Seniors’ tendency to interact with the sales staff is significantly less than all other age groups. Only 22% of Seniors say they interact with the sales staff compared to 76% among Middle-aged shoppers and 65% across all age groups. The impact of the interaction is also significantly lower than average. Only just over one third of Senior shoppers report a positive impact following the interaction compared to 84% among Middle-aged shoppers, which is just above the average for all age groups at 81%. This finding is in direct correlation with how Seniors say they believe brands consider their age group when marketing their products.

Peter Mohn, Owner & Chief Executive Officer at m1nd-set, explained: “While Seniors currently represent a smaller percentage of shoppers in travel retail, it must not be forgotten that the population of Seniors is growing and, as the research highlights, growth within the consumer class among Seniors will be significantly higher than all other age segments.”

“The focus on Millennials and GenZ consumers must not overshadow the attention given to older generations," Mohn continued. “This means that attention to them and their needs should be integrated into marketing and communications campaigns and staff training in particular.”

Another area which reveals concern is the level of consideration Seniors feel they receive from marketers and sales teams. “Seniors say they often feel neglected in the stores. The sentiment of being perceived as invisible means that they are less incentivised to shop in the store. They also feel they are regularly forgotten by brands in their marketing campaigns” Mohn added.

The research reveals as much in terms of the behaviour and interaction by Seniors with communications touch points. Only 13% of Seniors said they noticed communications touch points about the duty free offer prior to shopping in the duty free shops. This contrasts with the

tendency for Middle-aged shoppers to notice touch points. 57% of Middle-aged shoppers said they noticed touch points, which is significantly higher than the average for all age groups.

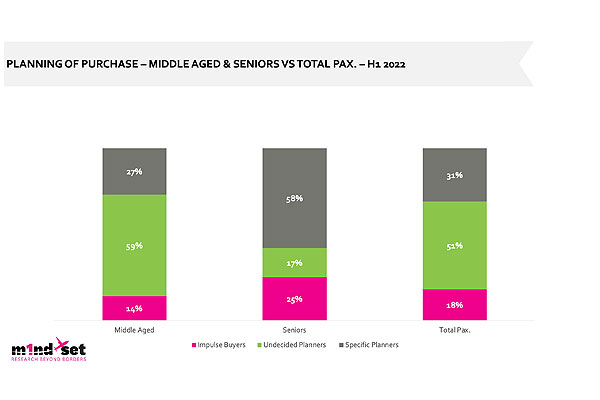

The research also details other aspects of the shopper behaviour among Middle-aged and Seniors such as how they travel, with whom, how often and how often they visit and purchase from the duty free shops. It also unveils detailed insights on what they purchase, who they

purchase for and how much they spend per category as well as the planning and impulse purchasing trends across both age groups. According to m1nd-set, just less than 30% of Middle-aged travellers plan their shopping with specific products or brands in mind. Seniors on the other hand tend to have a much greater tendency to plan their shopping more diligently; 58% of Seniors plan with a specific product or brand in mind. Seniors have a greater tendency to purchase on impulse than Middle-aged travellers however with one quarter indulging on impulse while at the airport, compared to 14% among Middle-aged shoppers.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.