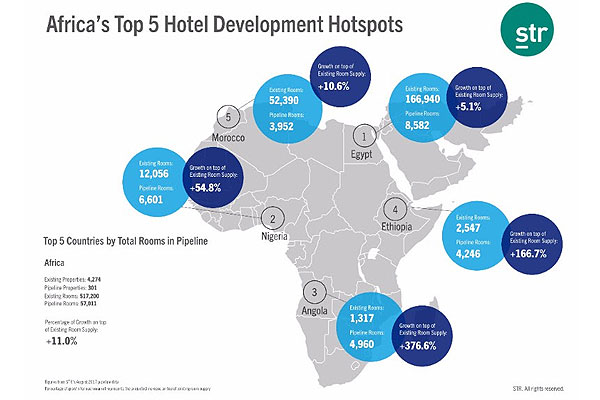

Based on August 2017 data from STR, Africa currently shows 301 hotel projects in the pipeline, accounting for 57,011 rooms, or 11.0% of the continent’s existing room supply.

LONDON – Ahead of the Africa Hotel Investment Forum (AHIF), STR highlights Africa’s key hotel development and performance trends.

Ahead of his AHIF presentation today, Wednesday, 11 October, Thomas Emanuel, STR’s director of business development, commented on recent performance trends in the market. “Across Africa, we’ve seen mixed performance results to date,” Emanuel said. “In local currencies, rates are up in several countries, including Egypt, Morocco and South Africa, but in many instances, you need to consider exchange rates to see the full picture. Meanwhile, some other markets are already experiencing performance declines as a result of supply growth, such as Nigeria, Ethiopia and Algeria, so it will be very interesting to see how these markets respond as more rooms continue to come online.”

Overview of select hotel markets:

Egypt

As of August, Egypt hotels posted a 70.1% increase in average daily rate (ADR) to EGP1,185.53. While the country’s ADR has remained above EGP1,000 each month since November 2016, the devaluation of the Egyptian pound has significantly inflated figures. When reported in U.S. dollars, Egypt’s ADR declined 17.2% for the January to August 2017 time period, dropping to an actual level of US$66.54. Occupancy, on the other hand, rose 17.2% to 52.7%.

At the market level, Cairo posted an 8.5% increase in occupancy and a 72.5% increase in ADR (-16.2% in U.S. dollars), resulting in 87.2% growth in revenue per available room (RevPAR) to EGP997.58. Although Sharm El Sheikh recorded a 13.9% increase in occupancy for the first eight months of the year, the market’s actual occupancy level was only 40.4%. STR analysts note that security concerns continue to hinder Sharm El Sheik’s hotel demand.

Nigeria

With the current pipeline representing more than half of the market’s existing hotel rooms, STR analysts expect that supply growth will continue pressuring Nigeria’s occupancy levels in the near future. August year-to-date data shows a 1.2% decline in occupancy to 44.3% but a 6.8% increase in ADR to NGN47,819.53. When measured in U.S. dollars, however, ADR declined 23.3% to US$149.58. The market currently faces several challenges, with security concerns as well as struggles in Lagos due to the low oil prices.

Ethiopia

Hotels in Ethiopia have experienced mixed performance levels thus far in 2017, with occupancy down 6.7% to 51.6% and ADR up 8.0% to ETB4,914.13. STR analysts note that the country’s number of roomnights available increased 4.2% compared with the first eight months of 2016, which has affected occupancy levels. For the month of August, RevPAR was down 5.4% to ETB1,834.81, mainly the result of a 4.2% drop in occupancy. Rate performance has been stronger on weekdays than weekends this year, indicating growth in corporate business, but occupancy levels are down for both weekdays and weekends.

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.