Kea is the closest to Athens of the Cyclades.

Major international investors have started coming to Greece. According to Enterprise Greece, the net volume of direct foreign investment has grown more than tenfold from 249 million euros in 2010, when it was at its lowest, to 2.8 billion euros in 2016.

In the summer of 2017, Standard & Poor's, Moody's and Fitch upgraded Greece's credit rating to positive. Analysts acknowledge the country's economy is in recovery, and they are not alone in their optimism:

1) According to the IMF, it will grow by 1.8% in 2017, while the EU expects it to grow by 1.6% and by 2.5% over the next two years.

2) According to the Hellenic Statistical Authority (ELSTAT), the unemployment rate hit a peak of 27.8% in 2013 but dropped to 20.6% in 2017. According to the EU, the unemployment rate will continue falling. And will reach 18.7% in 2019.

3) According to the EU, Greece’s national debt will decline from 180.8% of GDP in 2016 to 170.1% in 2019.

4) In July 2017, Greece sold 3 billion euros f new five-year bonds at a yield of 4.625% per annum for the first time in three years. This means that the country is learning to do without external financial aid, replacing it with market capital.

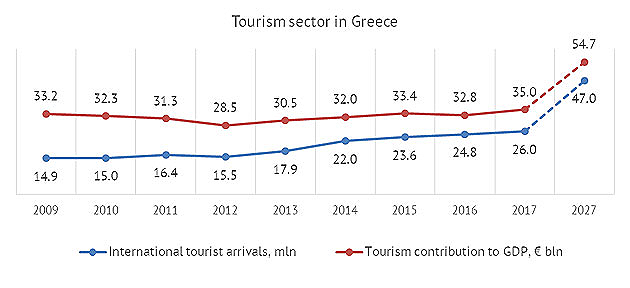

Services account for about 80% of Greece's GDP, and the country is now experiencing a tourist boom. The number of international tourist arrivals increased from 14.9 million in 2009 to 24.8 million in 2016. According to the World Travel & Tourism Council (WTTC), it will grow further to 26 million in 2017 and to 47 million by 2027.

According to WTTC, the contribution of tourism to Greece's GDP, adjusted for inflation, increased by 23% from 28.5 billion euros in 2012 to 35 billion euros in 2017. According to analysts, this figure will grow by another 56% to reach 54.7 billion euros in a decade. Analysts are unanimous: tourism is the main driver for the Greek economy.

Major international investors have started coming to Greece. According to Enterprise Greece, the net volume of direct foreign investment has grown more than tenfold from 249 million euros in 2010, when it was at its lowest, to 2.8 billion euros in 2016. All this bodes well for real estate in Greece.

According to the Hellenic Chamber of Hotels, there are 9,700 hotels in Greece, which can accommodate almost 900,000 people. The hospitality market has been growing actively in recent years. The world’s largest hotel chain, Starwood Hotels & Resorts, which merged with Marriott International in 2016, has been expanding its operations in Greece. Today, Starwood manages 21 hotels in Athens, Thessaloniki, the Sithonia and Peloponnese peninsulas and the islands of Crete, Rhodes, Santorini, Serifos, Mykonos and Folegandros.

Four Seasons Hotels and Resorts

In September 2017, international hospitality leader Four Seasons Hotels and Resorts and Greek operator Astir Palace Vouliagmeni SA announced plans to open the first Four Seasons resort in the country, which would replace the Astir Palace Hotel located in the southern Athens suburb of Vouliagmeni. The building will be completely renovated by spring 2018.

Over 100 million euros has been invested in the 300-room Four Seasons Astir Palace Hotel Athens project, which includes an overhaul of the Astir Marina yacht club and Astir Beach, the construction of 13 villas and the Peninsula Park. “The Hotel’s location offers a unique combination of seaside tranquillity and easy access to the Athens city centre, making it an ideal destination for leisure and business travellers year round”, Four Seasons Hotels and Resorts president and CEO J. Allen Smith said in a press release.

In October 2016, Jermyn Street Real Estate Fund IV LP, an investment fund with investors including Abu Dhabi and Kuwait sovereign wealth funds, other Arab investors and the Turkish Dogus Group acquired Greek company Astir Palace Vouliagmeni SA, a Four Seasons partner, in a deal worth 444 million euros.

Kerzner, Dolphin Capital Partners and Dolphin Capital Investors

In November 2017, international hotel operator Kerzner International Holdings Limited entered into a partnership agreement with Dolphin Capital Partners and Dolphin Capital Investors for the development and long-term management of One&Only Kea Island resort in Greece, with Dolphin Capital Partners taking charge of project management and sales. According to Greekreporter, the total investment will reach 150 million euros, and with Kerzner owning 40%. The project includes the construction of 75 villas along the coast of Kea island.

This is the second One&Only Resort in Europe. “Our goal is to create another world-class asset, which together with Amanzoe [the company's other project in Greece], will rank as two of the top resorts in the Mediterranean and elevate further the image of the Greek hospitality market”, Dolphin Capital Partners founder and managing partner Miltos Kambourides said.

On November 20, 2017, Eurobank officially accepted the local hotel operator Lampsa SA's pre-emptive right for the purchase of the five-star King George Hotel for 43 million euros. The 9,450 m² property is located in the very heart of Athens, opposite the famous Grande Bretagne Hotel, owned by Lampsa SA before its sale to Starwood in 2006. The hotel was leased to Lampsa SA in 2012 for 20 years with an annual rent of 700,000 euros. According to the media, Lampsa is also planning to purchase property on the corner of Panepistimiou Street and Vasilissis Sofias Avenue, currently owned by the Hellenic Ministry of Foreign Affairs.

Elena Izyumova, is a writer and content strategyst at Tranio.com. Tranio.com is an international real estate platform with a network of 700 partners worldwide and a catalogue of more than 110,000 listings in 65 countries. The company publishes daily news, high quality analysis on foreign realty, expert advice, and notes on laws and procedures related to buying and leasing properties abroad so that readers can make their property decisions with confidence.