CarTrawler sponsored research identifies bright ancillary revenue results in a difficult year with per passenger receipts up more than 13% in the 3rd quarter.

DUBLIN, IRELAND & SHOREWOOD, WISCONSIN – New research from CarTrawler and IdeaWorksCompany has shown that US and Canada airlines dominate global ancillary revenue, accounting for more than a third of the market’s total value of $58.2 billion. This assessment comes against the backdrop of rare good news for the airline industry. Ancillary revenue actually increased during the depths of the pandemic when measured on a per passenger basis. In a 3rd quarter 2020 survey of 20 airlines, the per passenger average was $26.91, which is a 13.1% increase above the $23.36 result for 3rd quarter 2019.

Last year CarTrawler and IdeaWorksCompany reported the ancillary revenue disclosed by 81 airlines for 2019. These statistics were applied to a larger list of 134 airlines to provide a global projection of ancillary revenue activity by the world’s airlines for 2020. The image below shows how this revenue is distributed within five regions of the world.

Ancillary revenue is generated by activities and services that yield cashflow for airlines beyond the simple transportation of customers from A to B. This wide range of activities includes commissions gained from hotel bookings, the sale of frequent flyer miles to partners, and the provision of a la carte services ? providing more options for consumers and more revenue for airlines.

“This detailed assessment of ancillary revenue points to a promising silver lining for airlines after a challenging year,” said Aileen McCormack, Chief Commercial Officer with CarTrawler. “Airlines can be heartened by the fact that, of those passengers that did travel last year, their spend on ancillaries actually increased – proving that an outstanding customer experience is not only recession-proof, but also pandemic-proof. At CarTrawler, we are helping to drive recovery by facilitating the kind of transformative ancillary revenue programs that airlines need to thrive in our new reality.”

The distribution of ancillary revenue around the world is influenced by factors such as the market penetration of a la carte pricing methods, the success of co-branded credit card programs, and market influence of low-cost carriers (LCCs). The following summarizes results from three regions:

- Canada/US now dominates total ancillary revenue as it’s home to the world’s largest three carriers (American, Delta, and United) and because consumers continued to embrace airline cobranded credit cards during the pandemic. Even with these advantages, there was a 44.6% estimated decrease of ancillary revenue for 2020.

- Europe/Russia actually led the world for total ancillary revenue in 2019. Even though Europe boasts a high concentration of powerful LCCs with easyJet, Ryanair, and Wizz Air, the region had the largest year-over-year drop of 55.5%.

- Latin America experienced the smallest drop of just 14.5% for 2020, while producing the smallest share of ancillary revenue. The region is undergoing an LCC revolution through the growing importance of GOL, JetSmart, Sky Airline, VivaAerobus, Viva Air, and Volaris.

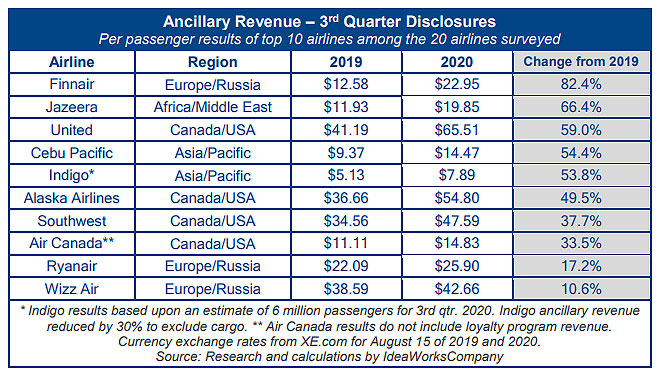

Fortunately for airlines all over the world, ancillary revenue has been a strong performer during the pandemic. A survey of financial disclosures from the limited activity of the 2nd quarter hinted ancillary revenue on a per passenger basis was on the upswing. This trend was confirmed among the 20 airlines surveyed for the 3rd quarter, with 13 posting improvement. The following table displays results for the top 10 carriers based upon the year-over-year increase. The average increase among these 10 is 46.5%.

Airline managers attribute the increases to changed consumer behavior during the pandemic. For example, seat assignment has become the most important feature. Passengers will pay a premium for seats in the front of the cabin (to ensure a faster exit upon arrival) and for the assurance of being seated adjacent to members of their travel party. However, empty flights can work against the perception that seat assignments are needed. Airlines offering the ability to carry on larger bags for a fee have found this feature to be more popular during the pandemic. More travelers also seem to be relocating, perhaps due to personal disruption, and this has increased checked baggage activity.

Some airlines allow consumers to pay in advance for the ability to change reservations for any reason. The feature has proved to be a more frequent choice for consumers flying airlines that have not waived change fees during the pandemic. Overall, the purchase window has decreased for a la carte services; many passengers defer these purchases until a few days before departure. When offered, the pre-order of meals has become more popular due to the uncertainty of finding open take-out services on airport concourses.

Similar to wearing a mask, ancillary revenue has provided a solid level of protection from the threats of the pandemic. While passenger fares fell during 2020, a la carte fees remained steady. Managers have determined fee discounting does not generate significantly more a la carte purchases. Across the world, the pandemic has proven ancillary revenue an able, accepted, and attractive source of cash to boost battered bottom lines.

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.