CarTrawler sponsored research reveals better ancillary revenue results continue with 2021 3rd quarter per passenger receipts up 6.8% over the pre-pandemic year of 2019.

DUBLIN, IRELAND & SHOREWOOD, WISCONSIN – The US and Canada have reinforced their position as global “centers of gravity” for ancillary revenue during the pandemic. Earlier research from CarTrawler and IdeaWorksCompany showed US and Canada airlines led all regions with 33.5% of the world’s 2020 ancillary revenue dollars. Robust co-branded credit card activity, along with 2021 passenger traffic gains, brought even more ancillary revenue to US and Canada airlines, yielding a higher 37.1% global share. The Europe/Russia region was the global top performer prior to the pandemic; the region fell to the #3 position for 2021, with Asia/South Pacific moving up into the #2 position.

Last year CarTrawler and IdeaWorksCompany reported the ancillary revenue disclosed by 75 airlines for 2020. These statistics were applied to a larger list of 109 airlines to provide a global projection of ancillary revenue activity by the world’s airlines for 2021. The image below shows how this revenue is distributed within five regions of the world.

“The continued growth of ancillary revenue per passenger through 2021 shows the growing importance of this revenue stream to airlines across all markets. The difficult year of 2020 will, in CarTrawler’s view, prove to be a turning point for the way ancillary revenue is perceived by all of us across the travel industry. It is an area with significant growth potential, fueled by differing consumer behavior as we emerge into a post-pandemic world. Travelers’ behaviors have evolved, and as long as ancillary services are providing the reassurances and services that consumers are seeking there is no reason why the expansion of this revenue stream can’t continue,” commented Aileen McCormack, Chief Commercial Officer at CarTrawler.

Ancillary revenue is generated by activities and services that yield cashflow for airlines beyond the simple transportation of customers from A to B. This wide range of activities includes commissions gained from hotel bookings, the sale of frequent flyer miles to partners, and a la carte services − providing more options for consumers and more revenue for airlines.

The distribution of ancillary revenue around the world is influenced by factors such as the market penetration of a la carte pricing methods, the success of co-branded credit card programs, and market influence of low-cost carriers (LCCs). The below narrative compares 2021 to 2019 because that is the last pre-pandemic year and provides the most legitimate reference point. The following summarizes results for four regions:

- Canada/US continues to dominate total ancillary revenue for a 2nd year with its borderfree giant domestic US market. Strong consumer use of co-branded credit cards, such as those issued by mega-carriers American, Delta, Southwest, and United, boosted ancillary revenue in the US. Airlines get paid by card-issuing banks for every mile accrued by cardholders. But even with strong traffic gains, the region remains 30.7% below the $35.2 billion ancillary revenue total of 2019.

- Asia/South Pacific started 2021 with much improved results, especially for airlines with large domestic markets such as China and India. However, the delta variant stalled this recovery in mid-2021. Airline results vary wildly through the region. For example, Indigo (India) posted 38% higher per passenger ancillary revenue for the 3rd quarter of 2021 compared to the 3rd quarter of 2019. But AirAsia (SE Asia) flew so few passengers as to invalidate any statistical comparison. The airline carried 97% fewer passengers in the 3rd quarter of 2021 than it did in the 3rd quarter of 2019.

- Europe/Russia led the world for total ancillary revenue in 2019. However, this ended in 2020 with a further slide for 2021 as the region’s ancillary revenue decreased by $755 million from 2020. Cross border travel troubles stalled the recovery for Europe/Russia; it was the only region with lower year-over-year total ancillary revenue results for 2021.

- Latin America for 2021 produced an impressive 86% of its total 2019 ancillary revenue. Total ancillary revenue for two airlines (Viva Aerobus and Volaris) was more than 77% higher for the 3rd quarter of 2021 compared to the 3rd quarter of 2019. LCCs, such as GOL, JetSmart, Sky Airline, Viva Aerobus, Viva Air and Volaris, have raised the profile of ancillary revenue in the region.

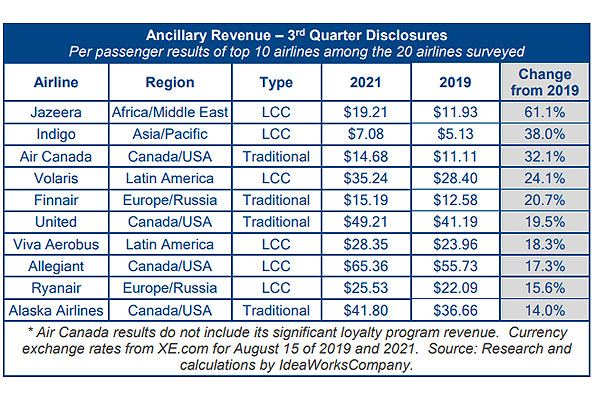

Ancillary revenue, on a per passenger basis, has proven to be a very durable revenue generator during the pandemic. The 3rd quarter results of 20 airlines were reviewed to determine how the pandemic has affected ancillary revenue. The following table displays results for the top 10 carriers among the 20 based upon the highest per passenger ancillary revenue increase since 2019:

PINAKAS

Research reveals per passenger results during the pandemic have generally been higher. Among the 20 airlines reviewed, the average per passenger increase for the 3rd quarter of 2021 was 6.8% over 2019 (after conversion to US dollars). However, the 3rd quarter increase for 2020 compared to the 2019 result, was even higher at 13.1%. A similar trend can be found when ancillary revenue is expressed as a percentage of total airline revenue. The average result among the 20 airlines for the 3rd quarter of 2021 was 24.1%. The corresponding results for 2020 and 2019 respectively were 25.9% and 20.6%.

The most difficult period for airlines during the pandemic was 2020. However, it produced strong ancillary revenue results when measured on a per passenger and a percent of revenue basis. For many airlines, passenger fares were lower in 2020 and this boosted the share represented by ancillary revenue. Consumers also aggressively sought a la carte seat assignments and were more primed to pay for baggage. Average fares have increased for 2021, which reduced the share represented by ancillary revenue. Consumers also backed off their peak purchase behavior for checked bags and assigned seating. Perhaps this subtle change signals a greater acceptance of risk associated with Covid – and a return to earlier consumer behavior – as the industry enters the third calendar year of the pandemic.

The pandemic changed many factors for the airline industry. Leisure travel has become a larger focus for all airlines. Business travel has definitely receded and its full return remains a concern for global network carriers. Consumers have become wary and weary of border closures and expect airlines to help with this issue. Throughout all of these travails, ancillary revenue remains a reliable workhorse to generate revenue in good times and in bad. As the industry works to find how the airline business is redefined, the role of ancillary revenue will become greater still.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.