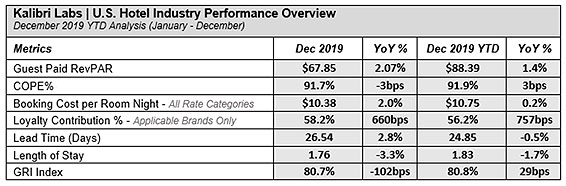

Each month, Kalibri Labs analyzes booking data for more than 34,500 U.S. hotels and delivers key insights for hoteliers to make smarter business decisions.

ROCKVILLE, MD – The hotel brand loyalty programs continue to play a major factor in where and how guests are booking their stays, and today loyalty-related bookings account for more than 50% of the total hotel bookings in the U.S., according to new, full-year 2019 booking data from Kalibri Labs.

Throughout 2019, total US Loyalty Contribution increased 7.6% to 56.2%, a jump of 8.3 percentage points or 17.3% since the top hotel brands launched aggressive book-direct campaigns in 2016.

However, top-line growth rates slowed in 2019, meaning it's more important than ever for hotels to control their entire P&L, not just their expenses.

"Our goal at Kalibri Labs is to provide the hotel industry with tools and actionable insights to maximize profit contribution and flow through on a daily basis; our December 2019 HIPO report highlights a number of opportunities for hotels to drive additional revenue with a heightened focus on profitability in 2020," said Kalibri Labs CEO and Co-Founder Cindy Estis Green.

"The first step in that process is the realization that there are opportunities to drive revenue beyond simply raising room rates. Meaningful top-line and margin gains can be made by shifting to a business mix with higher rates and/or lower booking costs, taking advantage of the brand’s Loyalty Contribution, considering a broader range of competitors by segment, being more aware of longer length of stay business in the market, and making the best mix decisions related to booking curves," continued Estis Green.

Noteworthy in December and Full-Year (FY) 2019:

- Growth in hotel demand exceeded supply growth, both in December and FY 2019, as evidenced by increases in both Guest Paid RevPAR and Occupancy.

- Total U.S. Loyalty Contribution increased 7.6% in 2019 to 56.2%, an increase of 8.3 percentage points or 17.3% growth since the book direct campaigns were launched in 2016.

- December FY booking window and Average Length of Stay (ALOS) continue to compress, making optimal business mix more important than ever.

- Group demand for FY 2019 increased at a slower pace than growth in overall room nights, 1.4% versus 1.85%. When combined with contractions in both the ALOS and booking window, this suggests that hotels could benefit from targeting group business earlier in the booking window.

- Growth in Brand.com outpaced OTA room night growth by 80bps in 2019, increasing nearly 7.5% year-over-year (YoY). Given significant customer acquisition costs differences between these two channels, independent hotels in markets with weak and declining COPE % (1) may consider a soft brand affiliation.

- The Upscale, Upper Upscale, and Luxury segments experienced improved acquisition efficiencies with declines in booking costs in 2019, while the Midscale and Economy segments experienced increases.

- Properties with lower consumer review scores, as measured by the Global Review Index (2), experienced declines in Guest Paid ADR in 2019. Those with the highest ratings (90% – 100%) exhibited the greatest increases, outpacing overall industry Guest Paid ADR growth nearly 2.75:1 demonstrating a link between consumer review scores and ADR performance.

Market-Specific Highlights:

- New York City remained under pressure in 2019, experiencing declines in Guest Paid ADR, Occupancy, ALOS, and Lead Time. In addition, the market's 48.8% Loyalty Contribution is well below the 56.2% national average, driven by heavy third-party dependence, all of which suggest that even a modest increase in direct business through transient or group segments in select time periods would bolster performance.

- Phoenix, Los Angeles, and Chicago experienced above average occupancy gains of 2.2%, 2.1%, and 1.3% respectively in 2019, but failed to translate higher occupancies into impactful Guest Paid ADR growth. This suggests opportunity to actively shift business mix to higher rated and/or lower cost channels.

- Miami experienced a 3.2% Guest Paid RevPAR decline in 2019 as a result of both Occupancy and ADR. Coincidentally, Miami also had the lowest loyalty percentage contribution and YoY loyalty growth of the top ten markets, at just 48.0% and +5.0%, compared to the 56.2% national average and +7.6%. This suggests there may be an opportunity for some operators in Miami to better leverage.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.