Transaction will result in changes to management and Board of Directors.

WHISTLER, BC – Whistler Blackcomb Holdings Inc. (the “Corporation”) and KSL Capital Partners, LLC (“KSL”) are pleased to announce that an affiliate of KSL has entered into a purchase agreement with Intrawest ULC (“Intrawest”) to acquire Intrawest’s 9,092,500 common shares of the Corporation, representing approximately 24% of the Corporation’s issued and outstanding common shares, for $12.75 per common share. The Corporation understands that the Intrawest disposition is being made in conjunction with an Intrawest refinancing. The transaction is expected to be completed tomorrow. KSL is a U.S. private equity firm dedicated to investments in travel and leisure businesses.

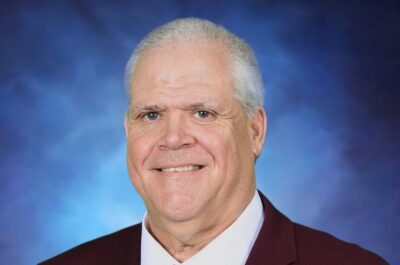

As a result of the sale by Intrawest, Bill Jensen has tendered his resignation as a director and Chief Executive Officer and each of Wes Edens and Jonathan Ashley has tendered his resignation as a director of the Corporation, effective as of the time of closing. Also effective as of the time of closing, the Corporation’s board of directors has appointed Dave Brownlie, the Corporation’s current President and Chief Operating Officer, as the Corporation’s President and Chief Executive Officer and a director, and appointed Eric Resnick and Peter McDermott, both of KSL, as directors to fill the vacancies created by these resignations. Mr. Resnick is co-founder and Managing Director of KSL and has deep, long-standing ties to the ski industry. Mr. McDermott is a partner at KSL.

Concurrently with these appointments, the Corporation’s board of directors has appointed Flora Ferraro, the Corporation’s current Vice President of Finance, as Interim Chief Financial Officer. The Corporation intends to announce the appointment of a permanent chief financial officer shortly.

“KSL is delighted to be acquiring a 24% interest in a world-class ski area. Whistler Blackcomb is the largest and most visited ski resort in North America and we feel that it complements our portfolio of premier travel and leisure properties. Peter and I are looking forward to working with the board to grow the business. Whistler Blackcomb has a very experienced and successful management team and we are enthusiastic to work with them as they continue to deliver a fantastic mountain experience for Whistler Blackcomb’s guests” commented Mr. Resnick.

“On behalf of the board of directors, I am very pleased to welcome Eric Resnick and Peter McDermott to the board. We would also like to express our appreciation to Wes Edens and Jonathan Ashley for their contributions to Whistler Blackcomb during their tenure on the board, and especially to Bill Jensen, for his valued service as Chief Executive Officer and as a director” commented Graham Savage, Chairman of the Corporation’s board of directors. “We are also pleased to appoint Dave Brownlie as Chief Executive Officer and as a member of the board of directors. With over 24 years in ski resort management, Dave brings insight and experience to the position and I am looking forward to continuing to work with him to grow the business.”

About the transaction

KSL expects to hold the purchased shares for investment purposes. However, KSL and its affiliates expect to evaluate on an ongoing basis the Corporation’s financial condition and prospects and its interest in, and intentions with respect to, the Corporation and KSL’s investment. KSL and its affiliates may from time to time acquire additional common shares of the Corporation or may dispose of all or a part of their shares.

In connection with KSL’s acquisition of Intrawest’s common shares, KSL will assume Intrawest’s rights and obligations under a registration rights agreement which will provide KSL the right to require the Corporation to qualify by prospectus all or a portion of its shares for distribution to the public in Canada, subject to certain conditions. The registration rights agreement is more fully described in the Corporation’s final prospectus dated November 2, 2010 and a copy is available on SEDAR online under the Corporation’s profile.

KSL’s acquisition of common shares of the Corporation from Intrawest will be made in reliance on the take-over bid exemption contained in subsection 100.1(1) of the Securities Act (Ontario), its corollary provision in Multilateral Instrument 62-104 Take-Over Bids and Issuer Bids and section 2.3 of National Instrument 45-106 Prospectus and Registration Exemptions.

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.