Successful A$1.1 million Placement to accelerate current growth opportunities for expanding product suite. Strongly supported private placement to new and existing institutional and sophisticated investors, demonstrating strong endorsement for Way2VAT’s growth plans.

Automated VAT claim and return solutions company Way2VAT Ltd has secured commitments from new and existing institutional and sophisticated investors to raise up to A$1.1 million (before costs) following support in the private placement (Placement) at an issue price of A$0.026 per share (Placement Price).

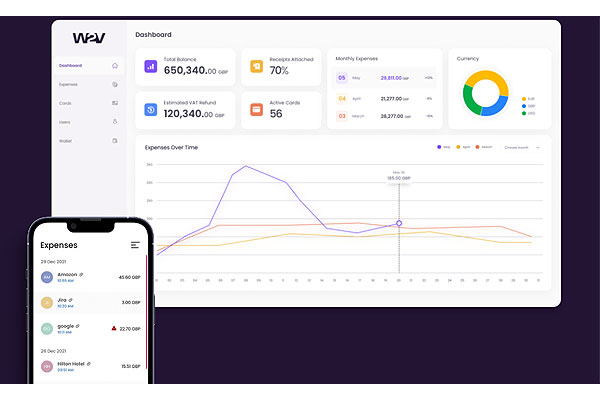

Proceeds from the placement will be used to scale the marketing capability of W2V’s expanding product suite and patented technology platform and continue the rollout of the Smart Spend Debit Mastercard in targeted sectors.

Way2VAT CEO and Founder, Amos Simantov, said, “We are delighted this Placement has enabled new and existing shareholders to show their support for Way2VAT which will provide the Company with additional investment in sales and marketing to further accelerate growth opportunities as market conditions improve, as evidenced by escalating gross transaction volumes.

“With the global easing of COVID-related travel restrictions and business travel beginning to normalise, Way2VAT is keen to harness the opportunity that exists for our broadening product suite that covers local and international VAT and expense reclaims as well as our Smart Spend Debt Mastercard.”

Accelerating W2V expansion strategy

Proceeds will be mainly used to invest in projects and initiatives to:

- Accelerate sales and marketing campaigns;

- Continue rollout of Smart Spend Debt Mastercard; and

- Provide working capital and balance sheet strength

Placement details

Way2VAT has successfully secured firm commitments to raise A$1.1 million. It received strong support from new and existing institutional and sophisticated investors.

The Placement Price of A$0.026 represents a 13.9% discount to the 10-day volume weighted average price of the shares of A$0.0302 recorded on ASX prior to 5 December 2022 (being the date of the trading halt).

The company will issue 42,307,693 shares under the Placement in two tranches which will utilise the Company's ASX Listing Rule 7.1 and 7.1a capacity. The Placement is not underwritten. Settlement of 38,461,539 shares under the Placement is expected to occur on Tuesday, 13 December 2022. Settlement of the remaining 3,846,154 Shares is expected to occur on Monday, 16 January 2023.

All shares issued under the Placement will rank equally with existing fully paid ordinary shares in the company. An Appendix 3B for the proposed issue of shares in respect to the Placement will be lodged with ASX following this announcement. Market standard rates were paid to brokers who assisted with the raise for the portion they raised.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.