2022 was a year of recovery for the short-term rental industry in Europe, which saw 355 million nights booked, 39% more than in 2021, and even 3% higher than in 2019. This brought in over $55 billion in revenue.

AirDNA‘s latest monthly review shows that short-term rentals in Europe ended 2022 on a high with strong demand, with 10.2% more nights booked than in December 2019 and 47.4% more than in 2021, and revenue up 38.5% year over year. The supply of available listings only rose 13.8% year-over-year, pushing occupancy up to historic highs for December.

Despite the challenges posed by the macroeconomic conditions in 2022, the European short-term rental market closed the year on a strong note. In December of 2022, there was a significant increase in demand for short-term rentals in Europe, with an increase of 26.4% compared to the previous year and 10.2% compared to 2019. Additionally, average daily rates also saw a significant increase, with rates 16.6% higher than in 2021.

This increase in demand and average daily rates led to an overall increase in revenue for the European short-term rental market. In the final month of the year, the continent generated more than $4.1 billion, which was 38.5% higher than in 2021 and 47.4% higher than in 2019.

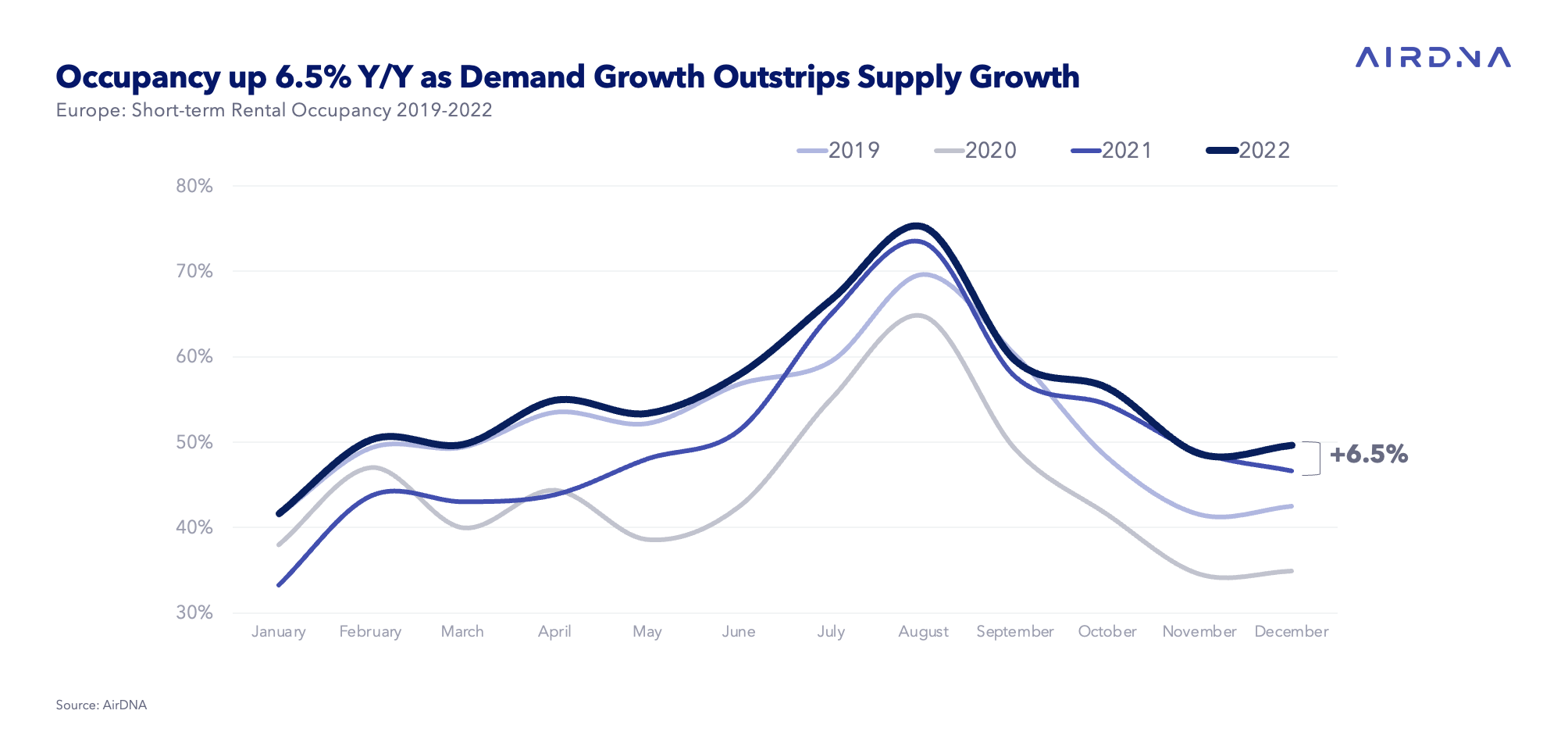

In December, the supply of available listings increased year-over-year, with a 13.8% increase compared to 2021. However, it remained 5.6% below December 2019 levels. This discrepancy between supply and demand led to higher occupancy rates, with occupancy sitting 6.5% higher than in 2021 and 16.8% higher than in 2019. The increase in demand, ADR, revenue, and occupancy, despite the challenges posed by a war, high inflation, and worries of future economic declines, show the resilience of the European short-term rental market.

At a Glance: Key European Short-Term Rental Performance Metrics for December 2022

- Revenue hit more than $4.1 billion, up 38.5% from last year and 47.4% vs. 2019

- Available listings were up 13.8% YoY but 5.6% below 2019

- Total demand (nights) rose 26.4% YoY, 10.2% higher vs. 2019

- Occupancy rose 6.5% higher than in 2021 and 16.8% higher than in 2019

- Average daily rates rose 16.6% YoY

A Year in Review: New Records Set, Though Growth Rates Varied

In 2022, Europe experienced a record number of demand nights booked, with 355 million demand nights booked, representing an increase of 39% from the previous year and 2.9% compared to 2019. The continent also set a new record in terms of revenue generation, with over $55 billion earned in 2022, which was 42% more than in 2021. Average available listings per month in 2022 increased by 11.2% from the previous year to over 2.5 million, although this figure remained 7.4% below 2019. Despite substantial growth in available listings over last year, demand growth exceeded supply growth, resulting in a change in occupancy in 2022 of +6.9% over 2021 and +5.9% over 2019.

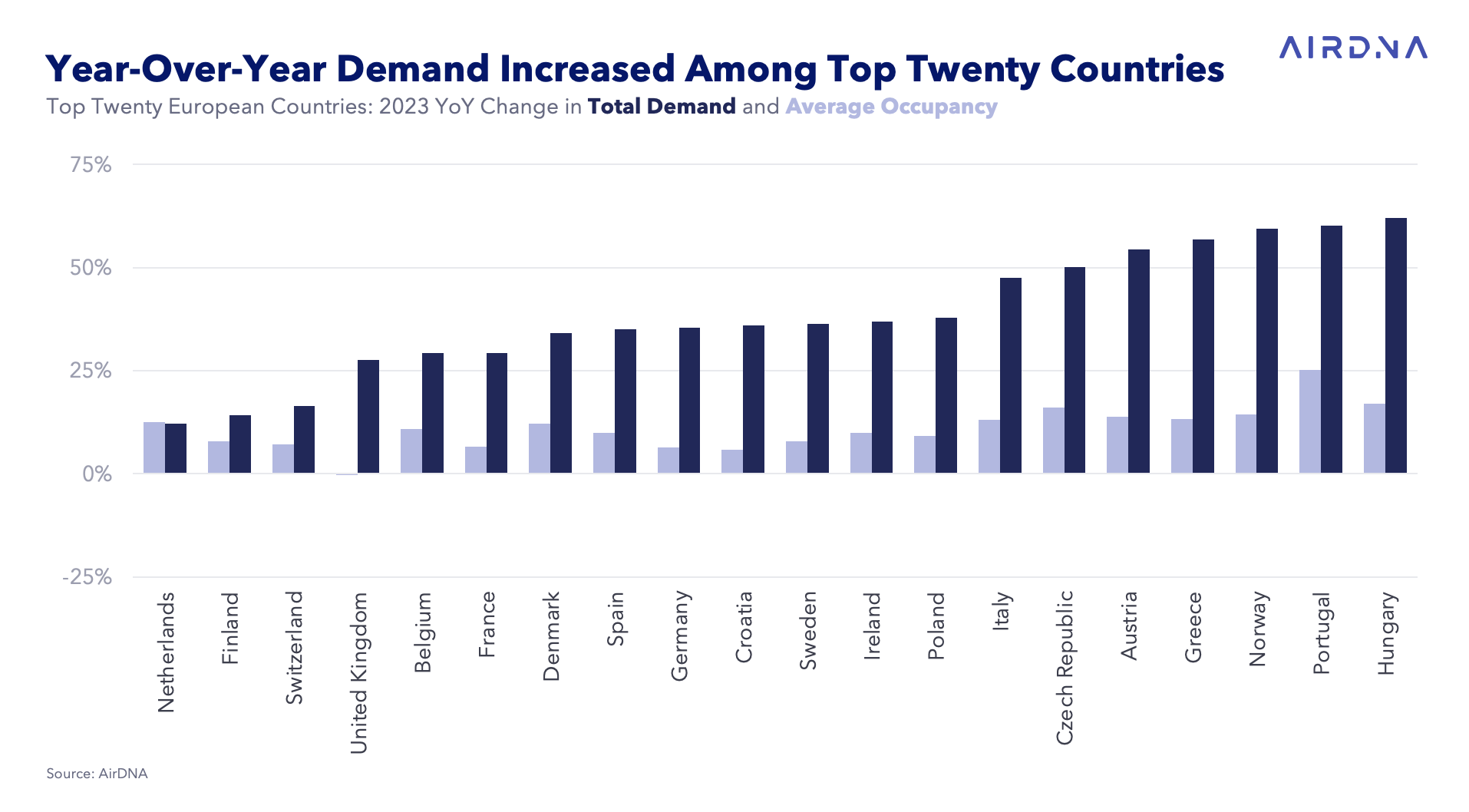

Each of the top 20 countries demonstrated year-over-year demand growth, although some countries recovered stronger than others. Hungary had the strongest recovery, with 62.1% more nights booked than the previous year, followed by Portugal (60.2%) and Norway (59.4%). The countries that saw the smallest increases in demand between the two years were the Netherlands (12.3%), Finland (14.1%), and Switzerland (16.5%).

All but one country experienced growth in occupancy relative to 2021. The United Kingdom was the exception, experiencing a decline in occupancy by 0.3% in 2022. Portugal was able to grow occupancy the strongest (25.2%), followed by Hungary (17.0%) and the Czech Republic (16.0%).

Factors that Contributed to Occupancy Growth in 2022: A Study of Unit Characteristics

The short-term rental market in Europe saw significant growth in 2022 compared to the previous year. With many people looking to travel again after a year of lockdowns and restrictions, the demand for short-term rentals increased beyond the rate of supply growth, which resulted in strong gains in occupancy.

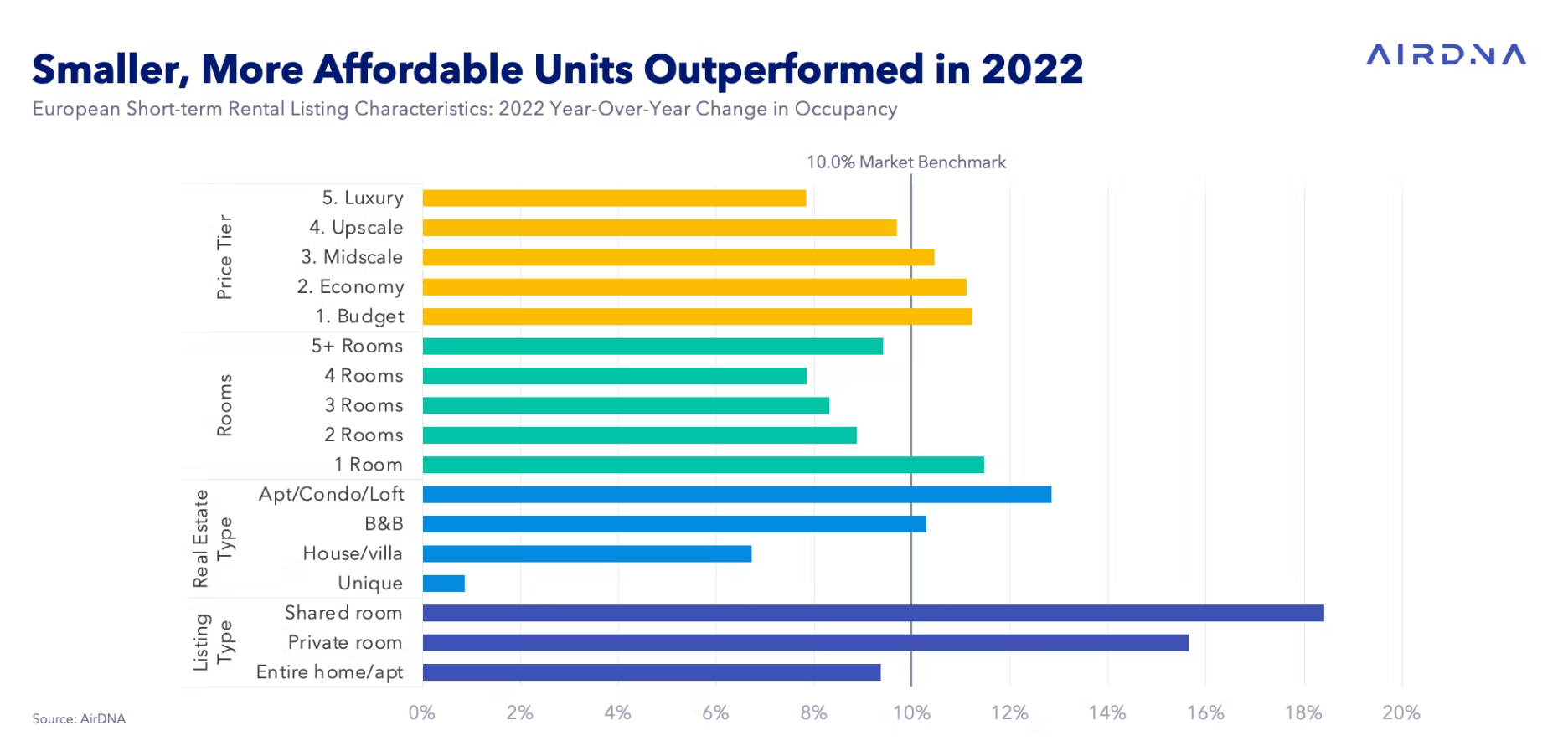

In order to compare the occupancy rates of short-term rentals in 2022 to that of 2021 without introducing bias from new rentals added during both periods, we isolated this analysis to only include rentals that were listed prior to 2021 and were active during both 2021 and 2022. For this group of listings in Europe, the year-over-year change in occupancy was 10% in 2022. Using this figure as a benchmark, we can then break out various property characteristics to differentiate the attributes, which provided stronger increases in occupancy in the period.

Before diving into the specific property characteristics that provided outperformance, it should be noted that short-term rental demand among Europe’s top 50 markets grew by 27.8% compared with the year prior. On the other hand, demand remained flat (-0.04%) year over year in destinations outside of Europe’s 50 largest markets. And while occupancy grew by 7.2% relative to 2021 outside of the top 50 markets, occupancy within Europe’s top 50 markets grew at a much greater pace of 27.2%.

Smaller and More Affordable Units Drove Occupancy Rate Growth

In the short-term rental market, certain types of features have driven the growth in occupancy at a greater rate than others. As we compare the performance of short-term rentals in Europe from 2021 to 2022, we can see that consumers have taken preference for units with specific features, resulting in certain feature types driving the growth in occupancy.

One of the most notable trends in the short-term rental market is the growth in shared rooms. Of the three listing types (entire home/apartment, private room, shared room), shared rooms saw the greatest growth in occupancy in 2022, increasing by 18.4% on a year-over-year basis. This is in contrast to private rooms, which increased by 15.6%, and entire home/apts, which increased by 9.4%. The growth in shared rooms may be attributed to the increasing desire for more affordable options for travelers.

Another trend that emerged in the European short-term rental market in 2022 is the growth in occupancy among apartment-type listings. Of the four real estate types (apartment/condo/loft, bed and breakfast, house/villa, and unique stays), the apartment, condo or loft type increased occupancy the greatest, with 12.8% higher occupancy levels year over year. This may be due to the convenience and amenities that these types of properties offer, as well as a concentration of this real estate type within urban areas.

In addition to listing type and real estate type, price tier also played a role in determining the growth in occupancy. Occupancy grew among all price tiers, though the growth levels were highest among the lower price tiers. The budget price tier grew occupancy by 11.2%, followed closely by economy (11.1%) and midscale (10.5%). The growth levels descended with each climb in tier; upscale grew occupancy by 9.7%, while luxury grew by 7.8%. This suggests that travelers are increasingly looking for more affordable options in the European short-term rental market, and those who would book luxury rentals are perhaps travelling further afield.

Lastly, the number of bedrooms in a unit also had an impact on the growth in occupancy. Of the five bedroom types (1-bedroom, 2-bedroom, 3-bedroom, 4-bedroom, and 5+ bedrooms), 1-bedroom units had the greatest increase in occupancy, with 11.5% more in the period. This was most likely driven by the return of demand to urban areas where the concentration of 1-bedroom units is much higher than in other location types. 5+ bedrooms saw the second-highest increase in occupancy (9.4%). This may be due to sustained demand for larger properties, as friends and family who travel in groups have increasingly tended to stay in the same unit.

The growth in occupancy in 2022 in terms of listing characteristics can be attributed to a variety of factors, including the convenience and amenities offered by apartments, condos, and lofts, the desire for more affordable options, and demand recovering in urban areas.

Unlocking the Impact of Amenities on Short-term Rental Occupancy

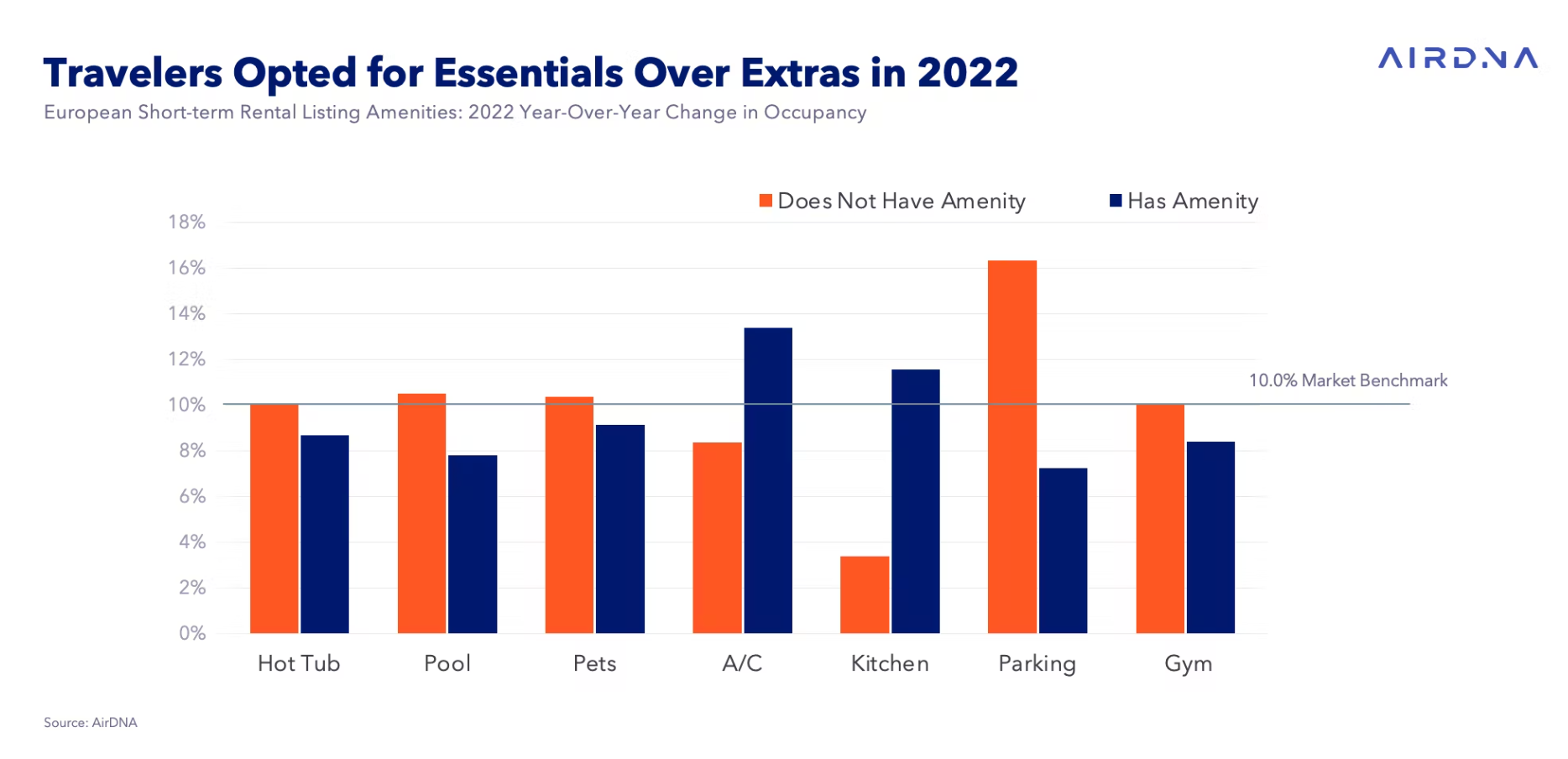

Consumer preferences in terms of short-term rental amenities were one of the greatest drivers of year-over-year occupancy growth in 2022. However, not all properties benefitted from this change in preferences. The data suggests that consumers may have been opting for more budget-friendly options that did not include properties with higher-tier amenities.

One of the most significant findings is that properties with hot tubs and pools saw a lower increase in occupancy compared to properties without these amenities. Properties with hot tubs saw an increase of 8.7% year over year, while properties without hot tubs saw an increase of 10.1%. Similarly, properties with pools saw an increase of 7.8%, while properties without pools saw an increase of 10.5%. This suggests that consumers are looking for more cost-effective options and not necessarily prioritizing luxury amenities.

Air conditioning, on the other hand, seems to be a crucial factor for renters. Properties with air conditioning saw an increase in occupancy of 13.4%, while properties without air conditioning grew occupancy by 8.4%. This is likely due to the summer heatwave that Europe experienced in 2022, making air conditioning a necessity for many travelers.

The presence of a kitchen also tended to be an important factor for renters. Properties with a kitchen saw an increase in occupancy of 11.5%, while properties without a kitchen only increased occupancy by 3.4%. This suggests that renters value the flexibility and cost-saving opportunities that having a kitchen provides, allowing them to prepare their own meals and have more control over their travel plans.

The data shows that consumers appeared rather indifferent in 2022 to pet-friendly units and the presence of a gym. Both configurations of these two amenities (having it and not) saw occupancy rises similar to those of the market as a whole. Properties that allowed pets saw an increase in occupancy of 9.2%, while properties that did not allow pets grew occupancy by 10.4%. Similarly, properties without a gym had a greater increase in occupancy than those with a gym. Properties without a gym increased occupancy by 10%, while properties with a gym increased occupancy by 8.4%.

Lastly, parking did not seem to be a highly considered necessity for short-term rental goers. Properties that did not have parking as a listed amenity grew occupancy by 16.3%, which was much stronger than properties that did have parking, which only increased by 7.2%.

Overall, the short-term rental market in Europe in 2022 has seen significant growth compared to the previous year, bolstered by consumers increasingly opting for more budget-friendly options. Air conditioning and the presence of a kitchen seemed to be crucial factors for renters, while luxury amenities that are typically associated with higher dollar accommodation, such as hot tubs, pools, gyms, and parking, did not seem to have a substantial impact on occupancy growth. As the short-term rental market continues to evolve, it will be important for hosts and managers to take these amenity trends into consideration in order to attract and retain guests.

H1 2023 Outlook Remains Strong: Consumer Preferences Shift Toward Value-Conscious Travel

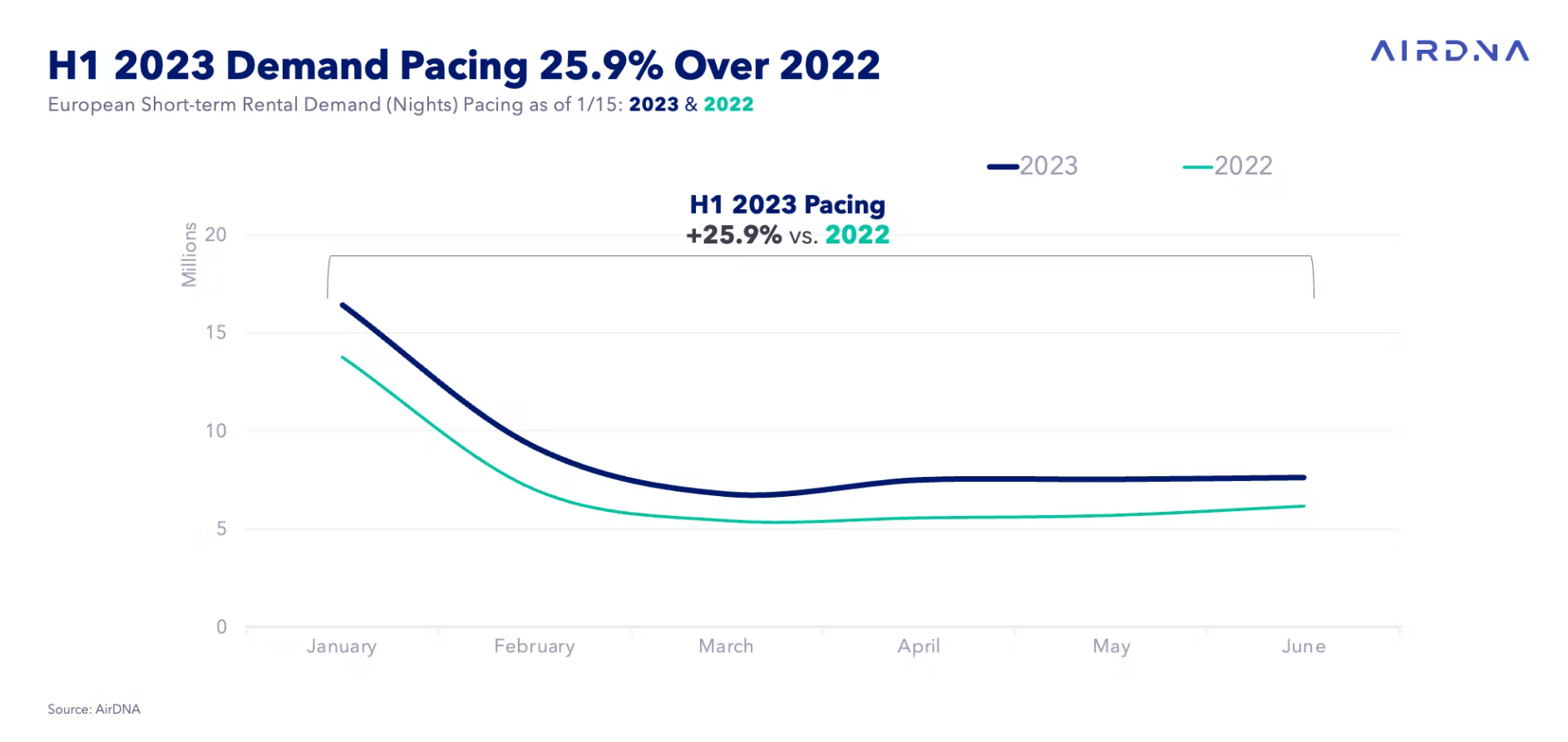

The short-term rental market in Europe is expected to remain strong in the next six months, with demand for nights booked pacing 25.9% above 2022 figures. As people begin to plan their summer holidays, macroeconomic conditions, as a result of inflation, may lead consumers to continue to become more value-focused in their travel choices.

In 2022, we saw a shift in consumer preferences, with travelers returning to larger cities in greater volumes than in 2021 and becoming more selective in terms of the value they receive for their money. This year, amenities that are considered more essential, such as having a kitchen and air conditioning, may continue to be more highly valued than paying extra for non-essential amenities, such as a hot tub or pool. Additionally, travelers may continue to favor smaller and more budget-friendly units, indicating that while people will still go on vacations, they may do so in a more value-conscious manner with fewer frills than in previous years.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.