Embraer delivered 47 jets in the second quarter, of which 17 commercial aircraft and 30 executive jets (19 light and 11 mid-size). A strong increase of 47% in total deliveries compared to 2Q22.

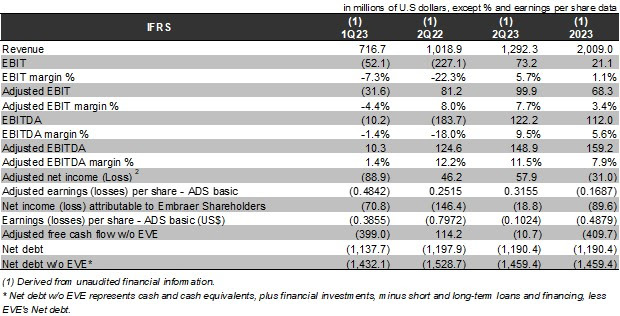

SAO PAULO, BRAZIL – The company’s operating and financial information is presented, except where otherwise stated, on a consolidated basis in United States dollars (US$) in accordance with IFRS. The financial data presented in this document as of and for the quarters ended June 30, 2023 (2Q23), June 30, 2022 (2Q22), and March 31, 2023 (1Q23), are derived from the unaudited financial statements, except annual financial data and where otherwise stated.

Revenue and gross margin

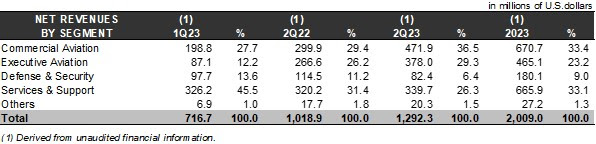

Consolidated revenue of US$ 1,292 million in 2Q23 represented an increase of 27% YoY due to higher volumes in Commercial and Executive aviation with strong growth of 57.4% and 41.8% respectively.

Commercial Aviation reported revenue growth of 57% YoY to US$ 471.9 million due to higher number of deliveries. Reported gross margin of 12.9% versus 13.2% in 2Q22 shows a small decrease due to one-time effects.

Executive Aviation revenues were US$ 378.0 million, 42% higher than 2Q22 with an increase in volumes and deliveries mix. Gross Margin in 2Q23 was 19.8% compared to 22.1% YoY due to one-time effects last year.

Defense & Security revenue of US$ 82.4 million, 28% lower YoY due to delay in revenue recognition in the 1H23. Reported gross margin of -1.5% versus 28.0% in 2Q22 due to lower revenue and different mix, partially offset by other expenses.

Services & Support reported revenues of US$ 339.7 million, representing a YoY growth of 6%. Reported gross margin of 24.4% lower than 31.8% reported in 2Q22 due to one-time effects and different mix of services in the quarter.

Adjusted EBIT

Excluding the above special items, 2Q23 Adjusted EBIT was US$ 99.9 million and Adjusted EBIT margin was 7.7%. Strong recovery of Adjusted EBIT in 2Q23 compared to 1Q23 was mainly driven by higher volumes from Commercial and Executive Aviation. On a YoY basis, Adjusted EBIT decrease is mainly due to difference in revenue mix and Defense margins compared to 2Q22.

net income (Loss)

Net income (loss) attributable to Embraer shareholders and income (loss) per ADS for 2Q23 were US$ (18.8) million and US$ (0.1024) per share, respectively, compared to US$ (146.4) million in net loss attributable to Embraer shareholders and US$ (0.7972) in income per ADS in 2Q22. Excluding extraordinary effects, adjusted net income was US$ 58 million compared to US$ 46 million in 2Q22 representing an increase of 25% YoY.

Debt & Liability Management

Embraer ended the quarter with a net debt position of US$ 1,459.4 million (without EVE), compared to US$ 1,528.7 million YoY and US$ 1,432.1 million QoQ.

The average loan maturity of 2Q23 was extended to 3 years. The cost of Dollar-denominated loans was 5.74% p.a., while the cost of Brazilian Real denominated loans was 10.04% p.a. in 2Q23.

In the last week of July, we reprofiled our debt and extended maturities until 2030 with a New Bond Issuance of US$ 750 million for 7 years and 7.0% coupon.

Free Cash Flow

Adjusted free cash flow for the second quarter 2023 was US$ (10.7) million, with no substantial increase in working capital usage compared to 1Q23. Although we still carrying higher inventories due to larger deliveries in the second half, cash consumption was stable QoQ.

CAPEX

Net additions to total PP&E for 2Q23 were US$ 35.5 million, versus US$ 31.6 million in net additions reported in 2Q22. Of the total 2Q23 additions to PP&E, CAPEX amounted to US$ 24.7 million, and additions of pool program spare parts represented US$ 23.9 million of the additions, partially offset by US$ (13.1) million of proceeds from the sale of PP&E. The increase in PP&E in 2Q23 versus 2Q22 is related to expansion in services training and maintenance.

Working Capital

To meet greater production and delivery guidance for 2023, inventories of mainly work-in-progress impacted the quarter’s reported Free Cash Flow.

Total Backlog

Firm order backlog ended 2Q23 at US$ 17.3 billion stable quarter over quarter, with a slight variance compared to the previous quarter. The highlight continues to be the increase in backlog from Executive Jets.

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.