3.5 million guests travelled with TUI in the period under review – an increase of 6 percent year-on-year (Q1 2023: 3.3 million)

The TUI Group has started the new financial year with a strong operating performance. 3.5 million guests travelled on vacation with TUI in Q1 2024 (October to December 2023), driving a 15 percent increase in Group revenue to 4.3 billion euros (Q1 2023: 3.8 billion euros). For the first time1 in the company’s history, underlying EBIT was positive at six million euros in this quarter, which is normally negative due to seasonal factors. In a persistently challenging market environment, TUI benefited from the sustained demand for travel with higher prices and rates.

TUI CEO Sebastian Ebel said: “We remain on course, transforming the Group and growing. The measures we have introduced are taking effect. We are accelerating our transformation quarter by quarter. Operational excellence, agile and flexible actioning and the consistent implementation of our programs are important. In addition, people’s willingness to travel is still high, despite a market environment that remains challenging. We are thus creating the basis for TUI’s future profitable growth. And it confirms our expectations for the year as a whole: We want to increase revenue by at least 10 percent and operating earnings by at least 25 percent.”

Developement of the First Financial Quarter 2024

3.5 million guests travelled with TUI in the first quarter of the financial year 2024 – that is six percent or 200,000 more than in the previous year (3.3 million). At 87 per cent, the load factor was one percentage point higher than in the previous year. Due to people’s high willingness to travel as well as higher prices and rates, the underlying operating result improved by 159 million euros and was positive for the first time at six million euros (previous year: -153 million euros). The first two quarters of the financial year (October to March) are usually negative for the industry due to seasonal factors. Revenue also improved significantly, increasing by 15 per cent to 4.3 billion euros (previous year: 3.8 billion euros).

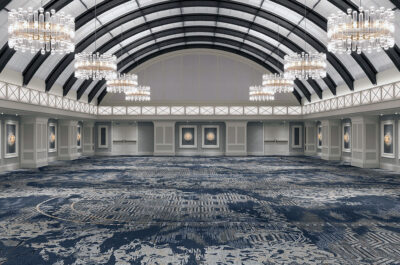

In the Holiday Experiences segment, Hotels & Resorts recorded an increase in underlying EBIT of 26.6 per cent to 90.7 million euros in the months from October to December 2023 (previous year: 71.6 million euros) and continued its series of successful quarters with earnings above pre-crisis levels. Hotel occupancy climbed by 3 percentage points to 78 per cent, while the average bed rate rose by 4.9 per cent year-on-year to 90 euros.

The strong development of Cruises continued in the first quarter of the financial year 2024, resulting in another positive result. Underlying EBIT improved significantly from 0.2 million euros in the previous year to 34.5 million euros. The earnings performance is attributable to higher capacities and significantly higher average rates. The latter rose by 17.0 per cent to 204 euros after 175 euros in the previous year. At 2.336 million, passenger days were slightly down to the previous year (2.379 million).

TUI Musement increased the number of experiences sold by 16 per cent to 2.0 million (previous year: 1.7 million). The number of transfers also rose by 9 per cent to 5.4 million in the period under review (previous year: 5.0 million). The underlying result for the segment improved to -10.7 million euros (previous year: -13.5 million euros).

Underlying earnings also improved in the Markets & Airlines segment. At -95.7 million euros, the seasonal loss was halved compared to the previous year (-194.6 million euros). This development was driven by higher average prices, an improved operating performance and a return to normal hedging lines. Northern Region(UK, Ireland and Nordic countries) also improved its underlying earnings significantly, from -122.0 million euros to -50.4 million euros in Q1 2024. Central Region, with tour operators in Germany, Austria, Switzerland and Poland, generated positive underlying earnings of 1.3 million euros for the reporting period after a loss of -29.0 million euros in the previous year. Although the underlying EBIT for Western Region (France, Belgium, Netherlands) was 6.6 per cent lower than in the previous year (-43.7 million euros) at – 46.6 million euros, this was due to one-off effects. In operational terms, the result improved compared to the previous year.

Positive booking momentum continues with higher average prices – Expectations for full-year targets confirmed

With a current year-on-year increase in bookings of 8 per cent for the 2023/24 Winter season and an increase of 8 per cent for summer 2024, the positive booking momentum2 continues. TUI has currently recorded a total of 9.4 million bookings for Winter 2023/24 and Summer 2024 combined (previous year: 8.7 million).

Average prices for winter 2023/24 are currently 4 per cent above the previous year’s level. Short and medium-haul destinations continue to drive bookings, with the Canary Islands, Egypt and Cape Verde once again proving to be popular destinations. Average prices for the upcoming Summer 2024 are 4 per cent higher than in the previous year. Demand for all key medium and short-haul destinations is currently up on the previous year, with Spain, Greece and Turkey once again the most popular destinations for TUI guests for Summer 2024.

The current positive trend in bookings is also reflected in the Holiday Experiences segment. In Hotels & Resorts, the current occupancy rate2 for the first half of 2024 (October 2023 to March 2024) is one percentage point higher than in the previous year, while average daily rates for this period are 12 per cent higher. The current occupancy rate for Cruises is a significant 13 per cent higher than the previous year, but this increase is expected to normalize somewhat over the course of the season. For the Group’s three fleets, available passenger cruise days in the first half of 2024 are 9 per cent higher than in the previous year, while average rates are slightly below the previous year at -2 per cent. The number of experiences sold at TUI Musement is up by a low double-digit percentage year-on-year, while the number of transfers is in line with operational developments in Markets & Airlines.

Outlook for the Full Year 2024

Strong operational growth and the successful implementation of our strategic measures, form the basis for future profitable growth. The outlook for the financial year 2024 is based on the current macroeconomic challenges and geopolitical uncertainties, particularly in the Middle East. Nevertheless, the operating performance in Q1 2024, the current positive booking momentum and the return to normal hedging lines underline the expectations for the full year. TUI therefore confirms its forecast for financial year 2024:

- Year-on-year revenue growth of at least 10 per cent expected

- Underlying EBIT expected to increase by at least 25 per cent year-on-year

Medium-Term targets

TUI has a clear strategy and has created the basis for future profitable growth. With more products and a broader offering, the aim is to increase the so-called “customer lifetime value” of customers and also to acquire new customers. In the medium term, TUI aims to:

- achieve average EBIT growth of around 7-10 per cent CAGR,

- reduce the net gearing ratio to well below 1.0x,

- return to a credit rating equivalent to BB/Ba (S&P/Moody’s) before the pandemic.

Annual General Meeting decides future listing structure of TUI AG

As part of today’s Annual General Meeting of TUI AG in Hanover, shareholders will decide on whether the Group’s listing on the London Stock Exchange should be discontinued. Previously, TUI investors had suggested that the company should give up its current dual listing and seek a simplified listing and inclusion in the MDAX in Frankfurt. In recent years, most of the liquidity of the TUI share has shifted to Germany. Around 77 per cent of share transactions are settled directly via the German share register and less than a quarter of trading in TUI shares is in the form of UK depositary interests. The termination of the listing in London would offer understandable advantages for investors and the company: Simplification of structures, improvement in liquidity and indexation, and support for EU airline ownership. TUI’s Executive Board and Supervisory Board have followed the investors’ suggestions and, after extensive discussions and intensive analysis, recommend that shareholders approve the proposed resolution at today’s Annual General Meeting. A majority of 75 per cent is required for approval.

1 since the merger of TUI AG and TUI Travel plc

2 As at 4 February 2024

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.