Island of Mykonos. In 2015, the government cancelled VAT privileges for the islands of Mykonos, Naxos, Paros, Santorini, Skiathos and Rhodes (Photo by Alex Korolkoff on Unsplash)

The low VAT regime on 27 Greek islands ceased on January 1, 2018. How will this affect the country’s economy, tourists and foreign investors in real estate?

Since January 1, 2018, Greece ceased VAT privileges on 27 of its islands. Previously, they enjoyed VAT rates that were 3% lower than on the mainland. Now VAT there will rise from 5%, 9% and 17% to 6%, 13% and 24% respectively for different types of goods and services.

According to news portal Greek Travel Pages, the VAT hike will cause prices for medicines, books and magazines to increase by 1.5% on average. Prices for essential foods (fish, milk, fruits, vegetables and olive oil) will grow by about 4% while prices for petrol, cigarettes, alcohol and clothing will grow by 6%. At the same time, the Greek Finance Ministry promised to partially compensate islanders’ for their losses by revising transportation charges.

Five Greek islands – Lesbos, Chios, Samos, Kos and Leros – are temporarily exempted from the VAT rate hike because of economic problems caused by the flow of refugees from the Middle East and Africa who are arriving to the islands via Turkey (the distance between Lesbos and Turkey is less than 20 kilometres). These islands will see VAT rates rise only from July 1, 2018. The delay is to allow the islands time to recover from economic problems caused by the large number of refugees from the Middle East and Africa via Turkey (the distance between Lesbos and Turkey is less than 20 kilometres).

Why? Over the years, the low VAT regime on the islands was to offset the increased costs of transporting goods to the Islands. The government hopes that the VAT rise will help it fill its coffers so it can pay back international creditors. According to The National Herald, a 30% reduction in VAT rates for 32 of its Islands in the Aegean Sea has cost Greece about €311 million per year.

This is only one of 12 measures that the government plans to take in 2018. Others include investments in social security, the introduction of a new tourist tax, reducing heating benefits and increasing a number of other taxes. According to the government’s estimates, these measures will bolster its budget by about €1 billion.

The combination of initiatives to reduce public debt and the country’s budget deficit is already bearing fruit – IMF experts forecast a 1.8% increase in Greece’s GDP in 2017 and 2.6% in 2018. According to the Ministry of Finance, these measures are helping international investors regain confidence in the country and provide the foundation for Greece’s comeback to the international capital market. According to preliminary estimates by the Greek Ministry of Economy, foreign direct investments in 2017 are expected to reach €4 billion – 42% more than the year before.

How will the VAT rise affect real estate investors?

The first conclusion is that any increase in VAT means higher costs for property buyers. In Greece, buyers have to pay VAT of 24% on properties with construction permits issued after January 1, 2006. At the same time, properties built before 2006 are only subject to an ownership transfer tax, which is 3.09% of the property value. Thus, the VAT hike will only affect some real estate investors.

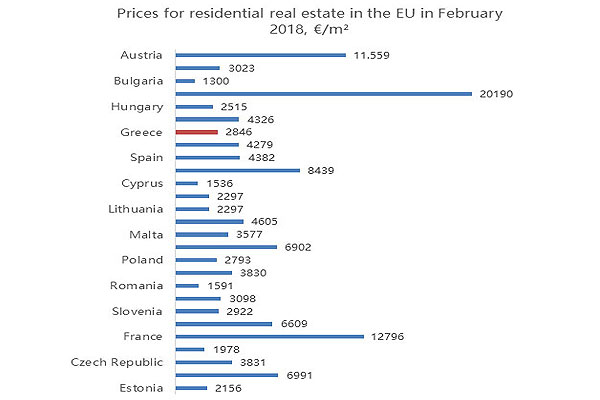

Prices for residential real estate in the EU in February 2018

Source: Statista

Source: Statista

On the other hand, the economic recovery Greece is moving towards means an increase in real estate prices in the future. According to web portal Statista, property in Greece is almost 50% cheaper than in Germany and Spain, three times cheaper than in Italy and four times cheaper than in France. Therefore, investors who want capital gains in the long term should consider buying real estate in Greece.

Price growth is also bolstered by the country’s growing tourism sector. In 2017 Greece saw a record number of international tourist arrivals. A representative from the Greek National Tourism Organization was quoted as saying at the WTM international fair in London that this number was about 30 million, which is 7% higher than in 2016. Opponents of the VAT increase cite the negative impacts this might have on the attractiveness the Islands might have among tourists. However, given that prices in Greece are still much lower than other popular tourist destinations and because the projected increase in the cost of goods and services is not so significant, these concerns seem unreasonable. A constant flow of tourists ensures high demand for rental properties in popular locations, which include the Greek Islands.

Olga Anisimova is a real estate writer and content strategist at Tranio.com. Tranio.com is an international real estate platform with a network of 700 partners worldwide and a catalogue of more than 80,000 listings in 54 countries. The company publishes daily news, high quality analysis on foreign realty, expert advice, and notes on laws and procedures related to buying and leasing properties abroad so that readers can make their property decisions with confidence.