Kiev quality hotel market shows stable growth in occupancy fourth year in a row. First months of the year are traditionally quiet for St. Petersburg’s hotel market, and this year was no exception. For the fourth consecutive year, the occupancy of quality hotels in this period fluctuated between 38-39%.

“The market in the Russian capital is still riding strong, gaining volume of rooms sold in most segments and rates in some. Overall, the weighted market average occupancy of the quality hotels in the Russian capital had risen 2.6 ppt, and reached 62.1%, the highest Q1 YTD number in at least 5 years. Average marketwide ADR has dropped by mere RUB 44, representing a 0.6% loss, to RUB 7,450. RevPAR still managed to climb a healthy 2,2% – to RUB 4,480” Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia & CIS, says.

Surprisingly, the segment in this quarter that lost a little bit on all fronts first time in at least 4 years was Luxury. Occupancy here dropped by 3 ppt (to 55%), rate by 1% (to RUB 17,250), and as a result the revenue per available room was 6% less, RUB 9,450. “This is probably because the segment has been riding high and making large gains in many previous periods or maybe because the ruble had been appreciating further against hard currencies, and splurging on unreasonably high-end accommodation became less affordable for foreign traveler” Tatiana Veller comments.

The segment that recorded the largest RevPAR gain was, of course, Midscale. “We say ‘of course’ because the market has been fueled by domestic business and leisure travel and group tourist business for a while, and that’s high-volume, relatively inexpensive demand” Tatiana Veller notes. “The occupancy growth was very large here, by 7 ppt, to 66% – this is higher than any other segment this quarter, and higher than this segment has been in at least 5 years! So, even with a few rubles’ loss in ADR, the RevPAR managed to bring additional 11% to the bottom line for the owners.”

The suburban resorts in the Moscow Region also had a good start to the year. Here RevPAR grew by 6% – to RUB 2,500 – due to an increase in the average rate by 11%, to almost RUB 5,500. At the same time, the occupancy dropped by 2 ppt, to 46% amidst growing prices.

“According to our estimates, April will support the positive dynamics of the market, due to business travel and MICE demand and will become another successful month for most segments of the Moscow hotel market. In June, Moscow will welcome guests of the Confederations Cup as a small rehearsal for future sporting events of 2018. This event will likely bring an upsurge in rates, as hotels will expect more demand, but with a high probability restrain the occupancy: regular tourists and business travelers will plan trips and events so as not to mix with a crowd of football fans” Tatiana Veller predicts.

JLL presents also the Q1 2017 Kiev quality hotel market results. “Compared to what we forecasted for 2017 when reporting on 2016 results, quality hotels in the Ukrainian capital are meeting the expectations. The occupancy grew healthily in the first 3 months of the year, actually surpassing the YTD results of the last stable year, 2013 (39%). 40% of quality room stock was occupied in Jan-March this year, vs. 34 last year, and 31 in 2015” Tatiana Veller, Head of JLL Hotels & Hospitality Group, Russia & CIS, says.

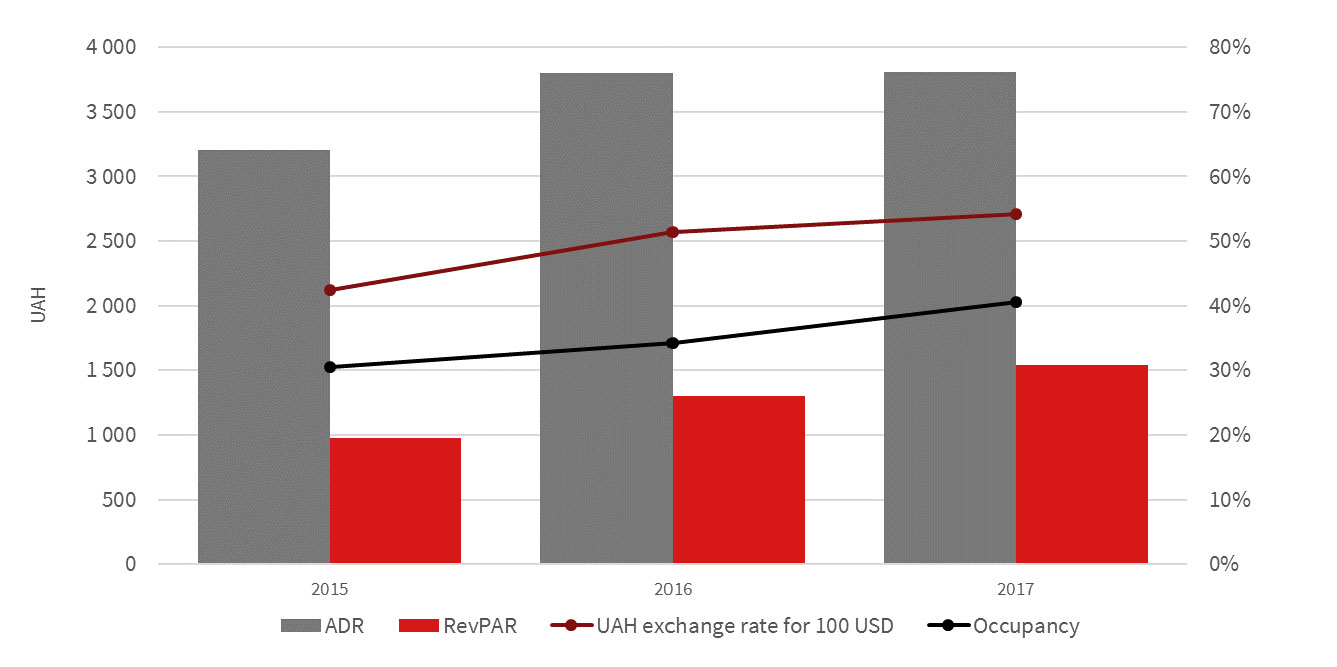

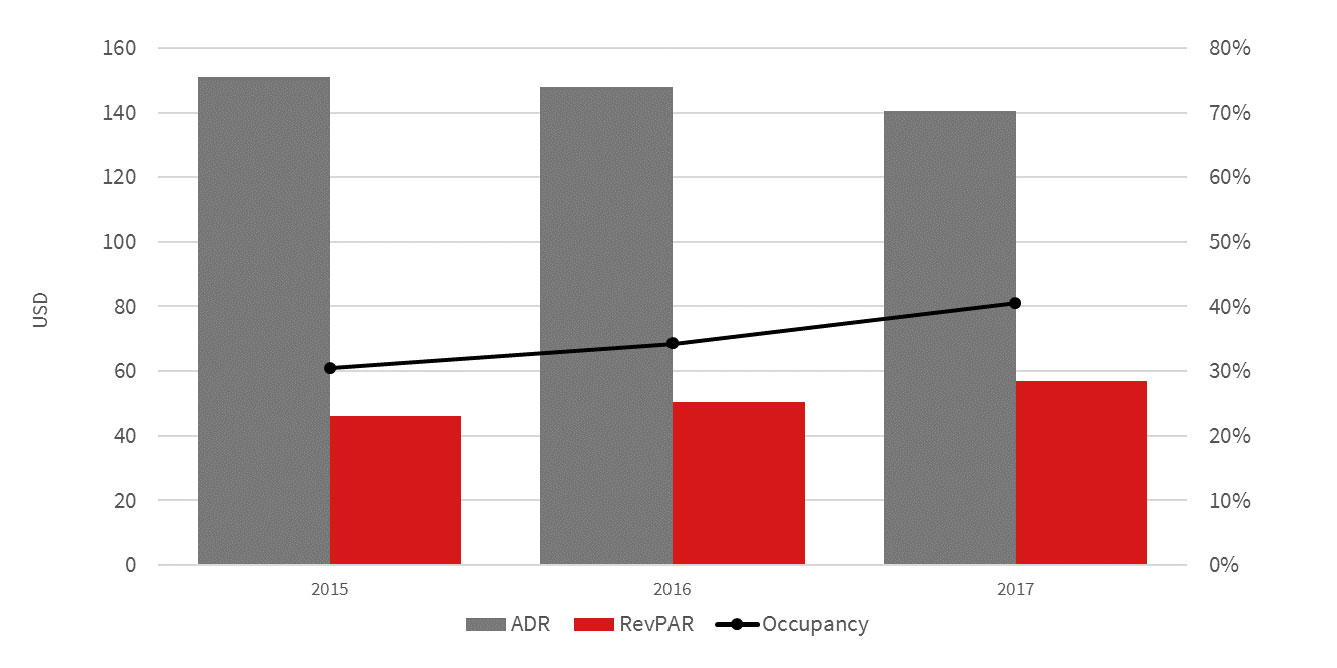

In terms of rates, average quarterly ADR results continue to give mixed feelings – still growing in UAH terms (probably a result of continued weakness of the national currency, rather than a real market condition change), and still falling in USD terms (to an absolute figure of USD141 vs. USD148 last year and USD151 in 2015). In local currency, quarterly average ADR remained relatively stable compared to a year before (grew by a meagre 7,5 hryvnia) but increased by over UAH 600 compared to 2015, reaching UAH 3,203.

Q1 Kiev quality hotel market results in local currency (YTD year-on-year) vs. UAH-USD exchange rate

RevPAR though, even USD-denominated, makes one see a recovery in underway. On the back of a stronger occupancy, the average index reached USD57 in the Q1 2017, the highest in the past 4 years (growth by 12.5% YoY). In local currency, obviously, the figure is even more impressive, UAH1,542 which is about 240 hryvnia (19%) higher than last year.

“We connect this growth with such factors like: 1) political situation has been stable for a while, and 2) business is slowly coming back having realized that this is new reality and there’s nothing else to gain by waiting. We now await the second quarter, historically the most active time of the year for the touristic and hotel market of the largest city in Ukraine, with higher occupancies and rates of the year, to see if this is a true trend for recovery”, Tatiana Veller notes.

Q1 Kiev quality hotel market results (YTD year-on-year), USD

St. Petersburg

“First months of the year are traditionally quiet for St. Petersburg’s hotel market, and this year was no exception. For the fourth consecutive year, the occupancy of quality hotels in this period fluctuated between 38-39%; past quarter it was almost equal to previous year's level – 38.7%. hotels continued to increase the weighted market average rate– by 6% compared to the same period in 2016, up to RUB 3 600. As a result, the revenue per available room (RevPAR) grew by 4%, to RUB,1 600” Tatiana Veller comments.

The occupancy of hotels in both Luxury and Midscale segments fell to 38% in Q1; the first case, the drop was 3.4 ppt in comparison with the same period of previous year, in the second – only by 0.5 ppt. The most expensive segment of St. Petersburg hotel market strengthened its price position, gaining 7% in ADR (to RUB 11,500), and was thus able to slow down the RevPAR decrease – it fell by only 1.5%. The Midscale segment, due to a very marginal loss in occupancy and growth in rates for a second consecutive year (an increase of 3.5%, up to RUB 2,200), also managed to raise rooms revenues by 2%.

“The reason for this dynamic in the most expensive and most affordable segments of quality market most likely lies in the nature of demand: both luxury and midscale segments are fueled by tourists. But while in the luxury it is mostly frequent individual travelers (FIT) with high disposable incomes, in the midscale it is Russian or Asian touristic groups; both are subject to fluctuations due to the ruble exchange rate dynamics and weather conditions” Tatiana Veller comments. “The remaining segments are primarily filled by business demand, thus are less volatile and have a different seasonality; as a result, these hotels continue to show growth in the three main operating indices – occupancy, ADR and RevPAR.”

According to Tatiana Veller, the May holidays, followed by the traditionally high season of ‘White nights’ and major events – the St. Petersburg International Economic Forum and the Confederations Cup – are likely to help St. Petersburg hotel market to show excellent results in Q2 and recoup its small losses of the beginning of the year.

Tatiana is the news coordinator for TravelDailyNews Media Network (traveldailynews.gr, traveldailynews.com and traveldailynews.asia). Her role includes monitoring the hundreds of news sources of TravelDailyNews Media Network and skimming the most important according to our strategy.

She holds a Bachelor's degree in Communication & Mass Media from Panteion University of Political & Social Studies of Athens and she has been editor and editor-in-chief in various economic magazines and newspapers.