HIP’s six-month growth rate, which has historically confirmed the turning points in US hotel business activity, posted a positive rate of 0.6% in April, following a positive rate of 0.8% in March. This compares to a long-term annual growth rate of 2%, the same as the 40-year average annual growth rate of the industry’s gross domestic product.

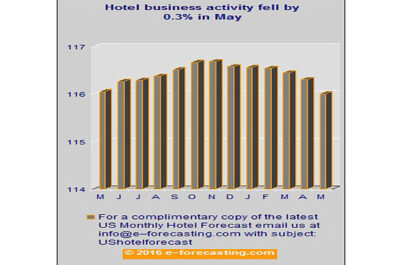

DURHAM, NEW HAMPSHIRE USA – Business activity for US hoteliers held flat at the previous month reading of 116.8 in April according to the release of the Hotel Industry's Pulse (HIP) indicator. e-forecasting.com's HIP – a predictive analytic which gauges monthly overall business conditions for hotels earlier than any industry indicator – stalled, posting a nil growth rate in April after an increase of 0.1% in March. The index is set to equal 100 in 2010.

HIP's six-month growth rate, which has historically confirmed the turning points in US hotel business activity, posted a positive rate of 0.6% in April, following a positive rate of 0.8% in March. This compares to a long-term annual growth rate of 2%, the same as the 40-year average annual growth rate of the industry's gross domestic product.

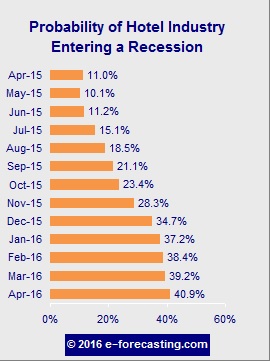

The probability of the hotel industry being in recession, which is detected in real-time from HIP with the help of sophisticated statistical techniques, registered 40.9 % in April, up from 39.2% reported in March. When this recession-warning gauge is near or passes the threshold probability of 50%, the US hotel industry has entered a recession.

"The slowdown in the growth rate of HIP continued in April. In the last 10 months, monthly growth rates varied between (+0.1) to (-0.1) with three months posting nil growth," said Maria Sogard, CEO of eforecasting.com. "We have not seen any solid gains in predictive analytics for a long time," Maria added.

Only one of the three demand and supply indicators of current business activity that make up Hotel Industry's Pulse (HIP) Index had a positive contribution to its change in April: Total Spending on Hotels (includes non-room revenues). The two of the three indicators of current business activity which had a negative or zero contribution to HIP's change in April were Hotel Jobs and Hotel Capacity.

“Two turning-point predictive analytics, recession probabilities and the long-term growth rate, show underlying trends leading to a recession for US hoteliers. The readings of analytics over the next three months are critical to confirm the industry's position in the business cycle,” said Evangelos Simos, research advisor for predictive analytics at e-forecasting.com.

The latest HIP reading will be used to update e-forecasting.com’s total US Monthly Hotel Forecast as well as market level forecasts for the top 25 US markets. The firm also covers EMEA markets via a partnership with HotStats with hotel market profitability forecasts.

e-forecasting.com, an international economic research and consulting firm, offers forecasts of the economic environment using proprietary, real-time economic indicators to produce customized solutions for what’s next. e?forecasting.com collaborates with domestic and international clients and publications to provide timely economic content for use as predictive intelligence to strengthen its clients’ competitive advantage.

The Hotel Industry Pulse, or U.S.-HIP for short, is a hotel industry indicator that was created to fill the void of a real-time monthly indicator for the hotel industry that captures current conditions. The indicator provides useful information about the timing and degree of the industry’s link with the US business cycle for the last four decades. Simply put, it tracks monthly overall business conditions in the industry, like an industry GDP, and points in a timely way to the changes in direction from growth to recession or vice versa. The composite indicator is made with the following components: revenues from consumers staying at hotels and motels adjusted for inflation, room occupancy rate and hotel employment, along with other key economic factors which influence hotel business activity. HIP indicators are also available for the United Kingdom and Germany.

The US hotel industry leading indicator, or U.S.-HIL for short, is a monthly leading indicator for the industry. Building off the tracking success of HIP, the real-time indicator for the U.S. hotel industry, U.S.-HIL was built as a composite indicator that uses nine different components that, on average, when put together have led the industry four to five months in advance of a change in direction in the industry business cycle. U.S.-HIL provides useful information about the future direction of the U.S. hotel industry. HIL indicators are also available for the United Kingdom and Germany.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.