Luxury prices around the world increased by an average of 3.1% in 2023, with Manila (26%) leading the rankings and Dubai (15.9%*) in the second spot.

DUBAI – According to The Wealth Report, Knight Frank’s flagship research report – prime residential prices showed significant strength in 2023. Of the 100 markets tracked in Knight Frank’s Prime International Residential Index (PIRI), 80 recorded flat or positive annual price growth. Luxury prices increased by an average of 3.1% in 2023, with Manila (26%) leading the rankings and Dubai (15.9%*) in the second spot. The Bahamas (15%) comes in third place with the Algarve and Cape Town (both 12.3%) completing the top five.

Prime residential values in Dubai, which encompass the neighbourhoods of the Palm Jumeirah, Emirates Hills and Jumeirah Bay Island, have experienced record growth during 2023, albeit this has been from a low base, Knight Frank says. Furthermore, Knight Frank’s 2024 global prime residential markets forecast positions Dubai in third place at 5%. This comes hot on the heels of an estimated 16% rise in prime residential prices in 2023 and building on the 44.4% rise registered in 2022.

Faisal Durrani, Partner and Head of Research, MENA says: “The total number of prime homes available for sale declined by 38.5% in Dubai during 2023, echoing the 52% decrease in sales inventory in Dubai’s Burj Khalifa over the same period. Owners are clearly deciding to hold on to their homes for longer, with inventory levels falling sharply, signalling the longer-term residency mindset now bedding in amongst the increasingly dominant buy-to-hold purchasers. Unsurprisingly, this behaviour has helped to sustain price growth in the emirate’s prime market, which registered the second fastest rate of growth globally in 2023 at 15.9%*”

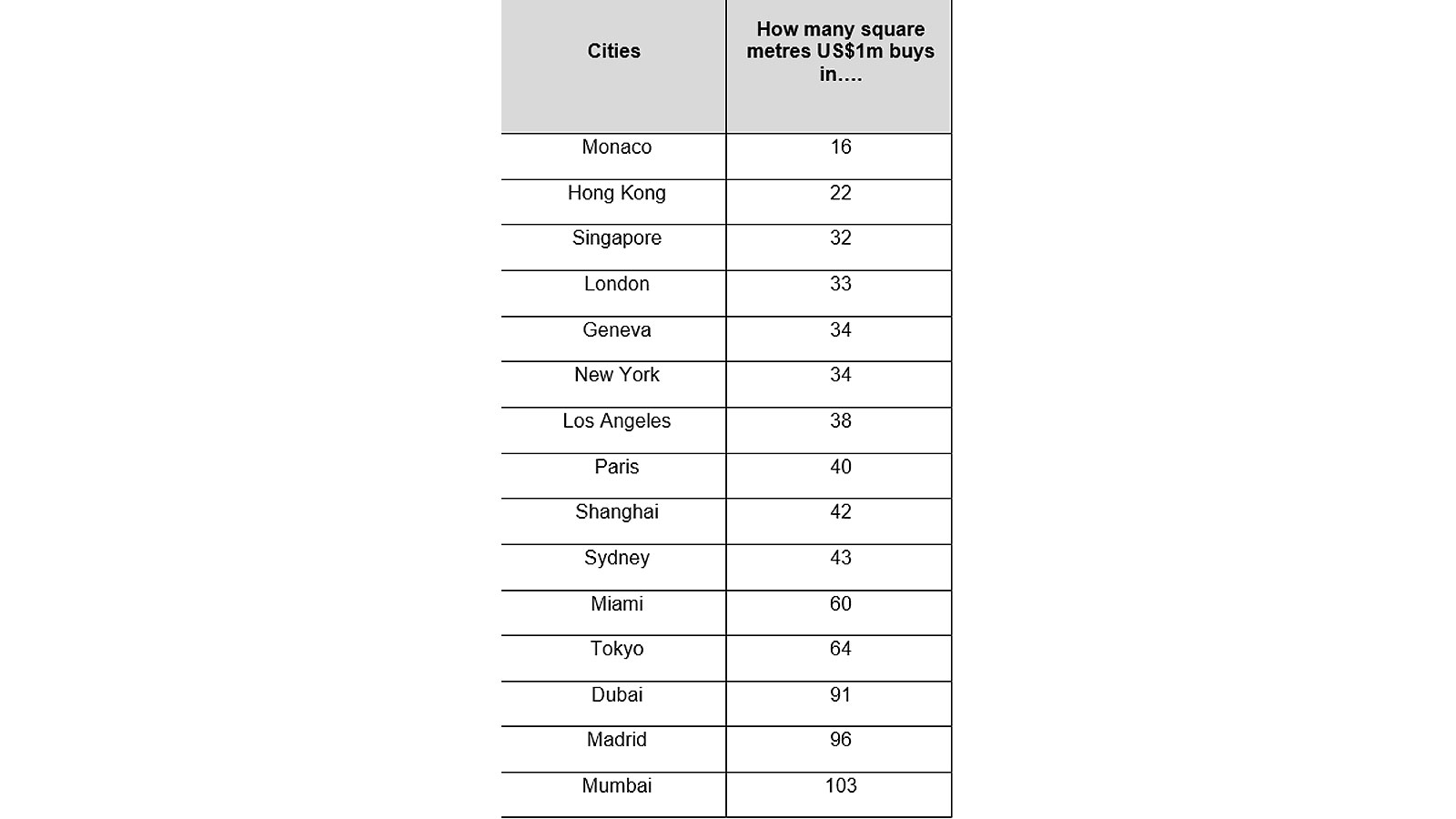

“The accolades for Dubai’s prime market are piled high following the city’s record breaking 431 US$ 10 million+ home sales, including an all-time high of 56 properties trading for over US$ 25 million last year. Despite the record-breaking sales of luxury homes, Dubai ranks towards the bottom end of the most expensive prime markets globally. Indeed, in our global tracker of 15 prime residential markets around the world, US$ 1 million secures 979 square feet of residential space, three-times more than London, New York, or Singapore and about 806 square feet more than first-placed Monaco, where US$ 1 million buys around 172 square feet of space. Dubai remains one of the most affordable luxury markets in the world, which only adds to its appeal among the international elite who dominate the upper echelons of the market”.

Will McKintosh, Regional Partner and Head of Prime Residential, MENA says: “Dubai’s residential market is no longer emerging. It has emerged. The nature of buyers in the market is testament to this shift, as is the type of real estate being developed in the city, much of which would not look out of place in other global cities. The city’s relative affordability, combined with an unparalleled lifestyle offering in one of, if not the safest cities in the world, means not only are international second home buyers zeroing in on the emirate, but residents in the city are staying for longer and putting down roots, which is fostering the emergence of highly sought after communities away from the luxury beach-front mansions. For instance, we found a balance in Jumeirah Islands, which offered both in terms of tranquil lake views, newly renovated contemporary style homes & convenient access to local amenities.”

Knight Frank’s Prime International Residential Index (PIRI 100)- Annual change in luxury residential prices in 2023: Global top 10

On an annual basis, Knight Frank provides a guide to how much space you can buy for US$1 million. There is a significant variation in prime prices across luxury residential markets. Prime prices in Dubai may sit 134% higher than at the start of the pandemic but are still noticeably lower than in more established markets. Here, US$1 million buys 91 sq m, four times the equivalent in Hong Kong.

How many sq m of prime property US$1m buys in selected city and second home markets

Source: Knight Frank Research, Douglas Elliman, Ken Corporation. Currency calculation as at 29 December 2023

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.