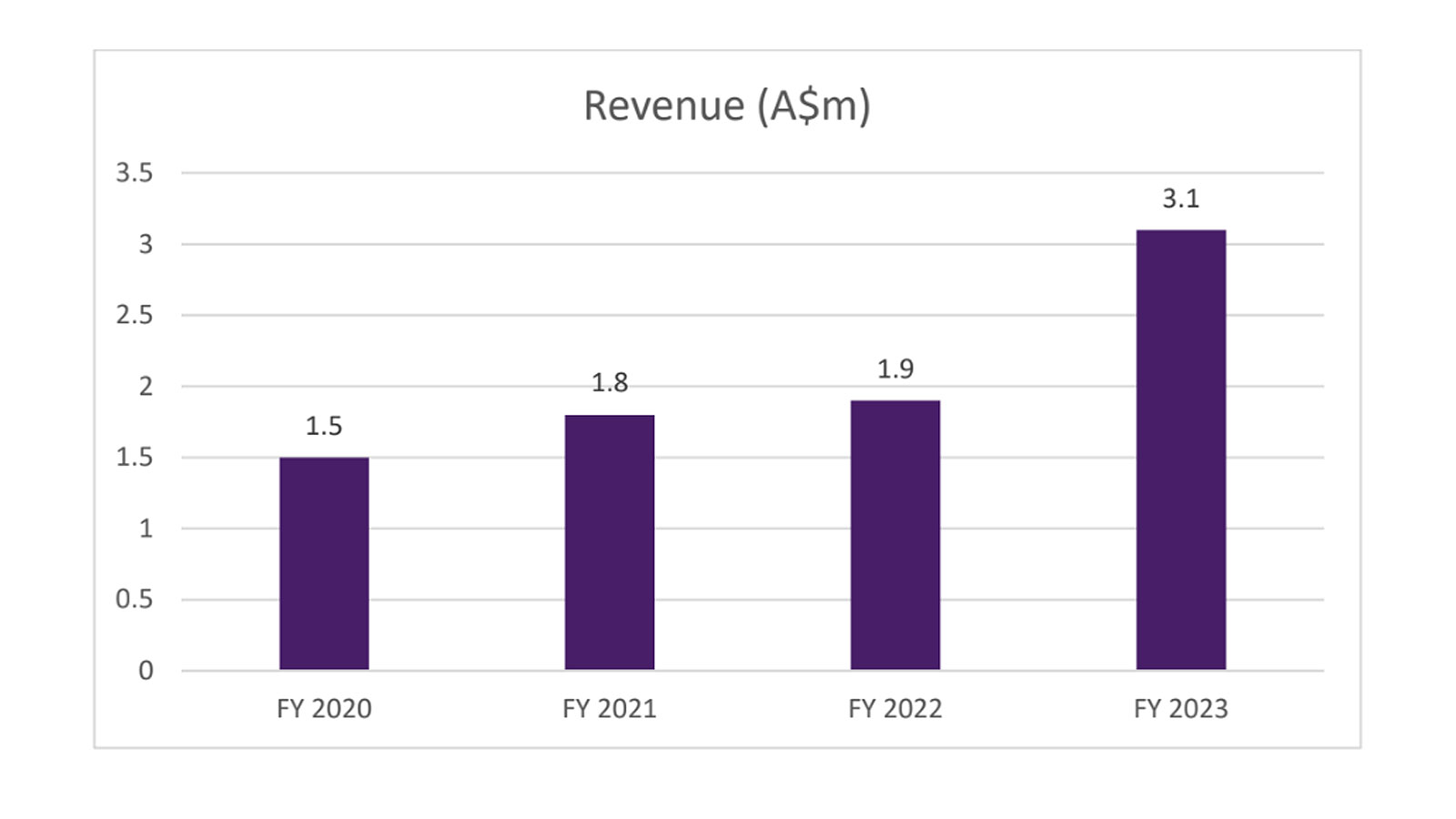

Reported revenue of $3.1 million, up 64% on pcp (FY22: A$1.88 million).

Global fintech leader in automated VAT claim and return solutions, Way2VAT Ltd, announced its full-year financial results for the 12 months ended 31 December 2023 (FY23).

Commenting on the company’s achievements in FY23, Way2VAT Founder & CEO, Amos Simantov, said: “This has been a considerable year for Way2VAT as our AI-powered technology platform has started to scale. Revenues have steadily increased, culminating in a record annual revenue of $3.1 million for FY23 – with the $1 million milestone reached in the last quarter. Our growth can be attributed to various factors including the return to pre-Covid operating conditions, significant new enterprise client wins, and of course the new markets we’ve entered and clients we’ve serviced through a full twelve months of integrated operations after our strategic acquisition of DevoluIVA.

“As the year progressed, our operating expenses continue to decrease as we implemented strategies to reduce costs, including moving functional operations to Romania and refining our onboarding processes for new clients, meaning we also generated revenue from them sooner. Our focus on cost management has resulted in a 16% YoY reduction in like-for-like total operating expenses from 2022 to 2023.”

“Operating conditions returned to normal, with business travel continuing to increase and the time taken for tax authorities to administer claims steadily averaging seven months, rather than the fifteen-month periods we were experiencing during Covid. We continue to expand our client base across Europe, which provides a solid base to widen our presence in the global market.

“We have also continued to invest in increasing our product offering and have just launched the latest AI-driven automated product, AI-AP Compliance. Building on our existing technology platform, AI-AP Compliance performs a full audit of all accounts payable invoices for clients, reducing risk and error of manual processing and ensuring the correct VAT/GST is charged across jurisdictions.”

Financial Highlights

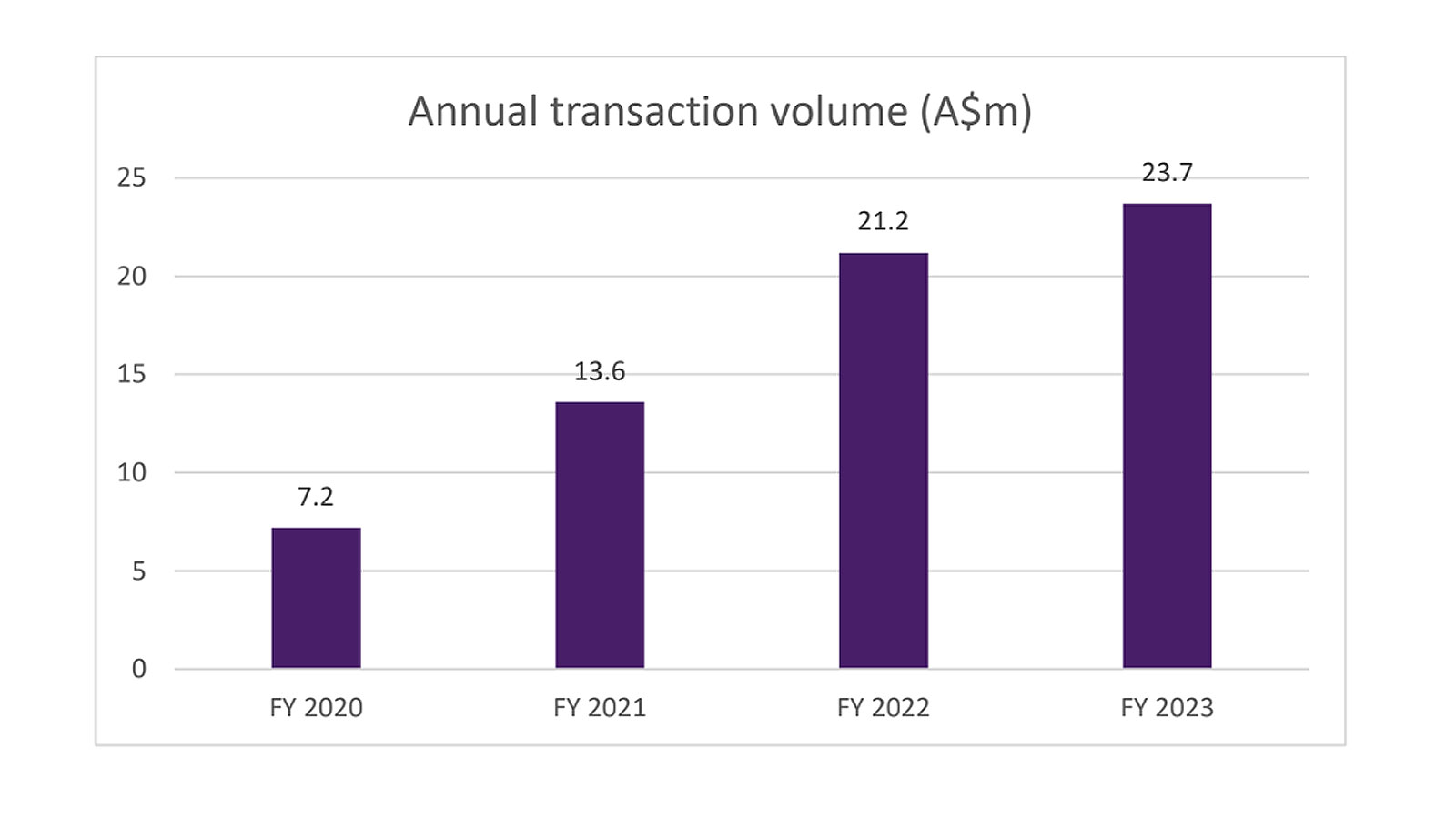

FY23 gross transaction value increased to $23.7 million, up 11 % (FY22: $21.2 million), attributable to the increasing client base and their increasing value claims, driven mainly by the return of the international travel of our customers during the year.

Reported revenue increased significantly by 64% to $3.1 million on pcp (FY22: $1.88 million).

As previously disclosed, the company reduced operating expenses in Q4 FY23 on a cash basis by 7% compared to the previous quarter. In addition, the company also achieved a significant YoY reduction of total pro forma USD operating costs of 16% in FY23, as it integrated the acquired DevoluIVA business into its core operations. Due to the weaker Australian dollar in 2023 (versus 2022), this translated to a 13% YoY decrease in total pro forma AUD operating costs in FY23.

Total operating costs for FY23 were $9.0 million including a full year of operating costs for the acquired DevoluIVA business, compared to $8.4 million for FY22 which included only one quarter of DevoluIVA operating costs of $1.0m. On an unaudited full-year pro forma basis, the operating costs of DevoluIVA were reduced significantly by 31% from $2.9 million in FY22 to $2.0 million in FY23 through the successful integration with Way2VAT. The operating costs of W2V standalone were also reduced by 5% from $7.4 million in FY22 to $7.0 million in FY23 through cost control measures.

Operational Highlights

Enterprise clients

In FY2023, Way2VAT secured major multinational clients increasing the enterprise client count to 345, a 38% increase over 12 months. Significant clients include Eli Lilly, Nestlé Spain, Camper (Spanish footwear company), Serveo (Spanish facility and infrastructure management), Sony Spain, SecuritasDirect (Europe-based security provider), PGIM (asset management and insurance), Globalia Handling (airline, hotel and travel agency operator), Marine Harvest ASA (seafood producer), Lion Television and Lime Pictures (television production), Primaflor, Frit Ravich and Broges (fresh produce, food and beverage), Espa and Mase Automation (manufacturing), and Comantur (renewable energy).

DevoluIVA integration with Way2VAT

Over the period, the full integration of DevoluIVA progressed as planned with the consolidation of support functions completed and sales teams now coordinating new business development opportunities.

New patent taking patents to six on the AI-powered technology platform

The United States Patent and Trademark Office has granted a new patent (US Pat. No. 11,676,411) to Way2VAT for ‘Systems and Methods for Neuronal Visual-Linguistic Data Retrieval from an Imaged Document.’ This is the company’s sixth patent in its technology platform, supporting its automated approach to VAT reclaim submissions. The AI-based Automated Invoice Analyzer (AIA) can take multi-invoice pages, crop them into individual files, and then use optical character recognition to match invoices to the corresponding expense line in the report.

A$4.044 million raised to accelerate growth opportunities for expanding product suite

During FY2023 Way2VAT raised A$4.04 million before costs via strongly supported private and oversubscribed share placements with new and existing sophisticated investors joining the register. Funds raised are being used for accelerated sales and marketing campaigns, increasing the company’s key product suite and adding new features to the Ai-powered and patented technology platform.

In January 2024, subsequent to the end of the reporting period, the company has received firm commitments to raise an additional $1.1 million (before minimal costs) via the issue of Convertible Notes to certain key shareholders, including cornerstone investor Thorney Investment Group. The company has already received $800k with the balance due 29 February 2024. Conversion of the Convertible Notes will be subject to the company obtaining shareholder approval. Proceeds raised will be used to increase the company’s focus on sales and marketing, facilitate inorganic growth,

launch an AI-powered compliance product in Q1 FY24, and for working capital purposes.

Launch of new AI-driven automated auditing product, AI-AP Compliance

In February 2024, subsequent to the reporting period, Way2VAT launched a new AI-driven automated accounts payable auditing product, AI-AP Compliance, to complement the company’s existing suite of AI-powered VAT/GST claim and return solutions. AI-AP Compliance verifies proper submission of AP expenses to tax authorities. Aimed at large and multinational companies looking to maximise VAT/GST returns, AI-AP Compliances creates a new revenue stream for Way2VAT based on fixed costs per audited invoice.

Outlook

Way2VAT Founder & CEO, Amos Simantov, said: “We expect to see our growth trajectory continue to accelerate over the coming year. Our enterprise client pipeline continues to grow in multiple jurisdictions, and we are selling more products to more clients as our AI-powered technology platform seamlessly integrates all VAT/GST travel and expense and accounts payable reclaim needs for clients. We also expect a healthy uptake of our new compliance-based AI-driven product, W2V Compliance, as it is rolled out across the client base.

“In addition, our more integrated onboarding procedures are allowing us to generate cash receipts and revenue quicker. We have several cash-flow management initiatives in place to expedite our pathway to profitability and remain on the lookout for possible acquisition opportunities, where it adds shareholder value, where we can take advantage of our ability to scale much quicker than competitors, due to our AI-powered process and platform.”

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.