Black Banx stands as a testament to the power of visionary leadership and the potential of fintech to drive positive change in the world.

Digital banking has undoubtedly revolutionized the banking industry in recent years, leading to significant environmental benefits. The transition to digital banking has notably reduced waste and improved sustainability by decreasing the reliance on paper transactions and physical branches.

The decrease in paper use in digital banking has positive environmental impacts by conserving resources like water, energy, and trees, reducing ink and energy consumption, and minimizing waste from physical bank statements. Moreover, the reduction in physical branches has led to decreased resource consumption for construction, maintenance, and operation, while also reducing the need for customers to travel to banks, thereby lowering carbon emissions from transportation.

However, digital operations are also still highly dependent on energy use, resulting in some institutions making it a point to embark on ‘sustainable finance.’

Among the leaders in this movement is the global digital banking company, the Black Banx Group.

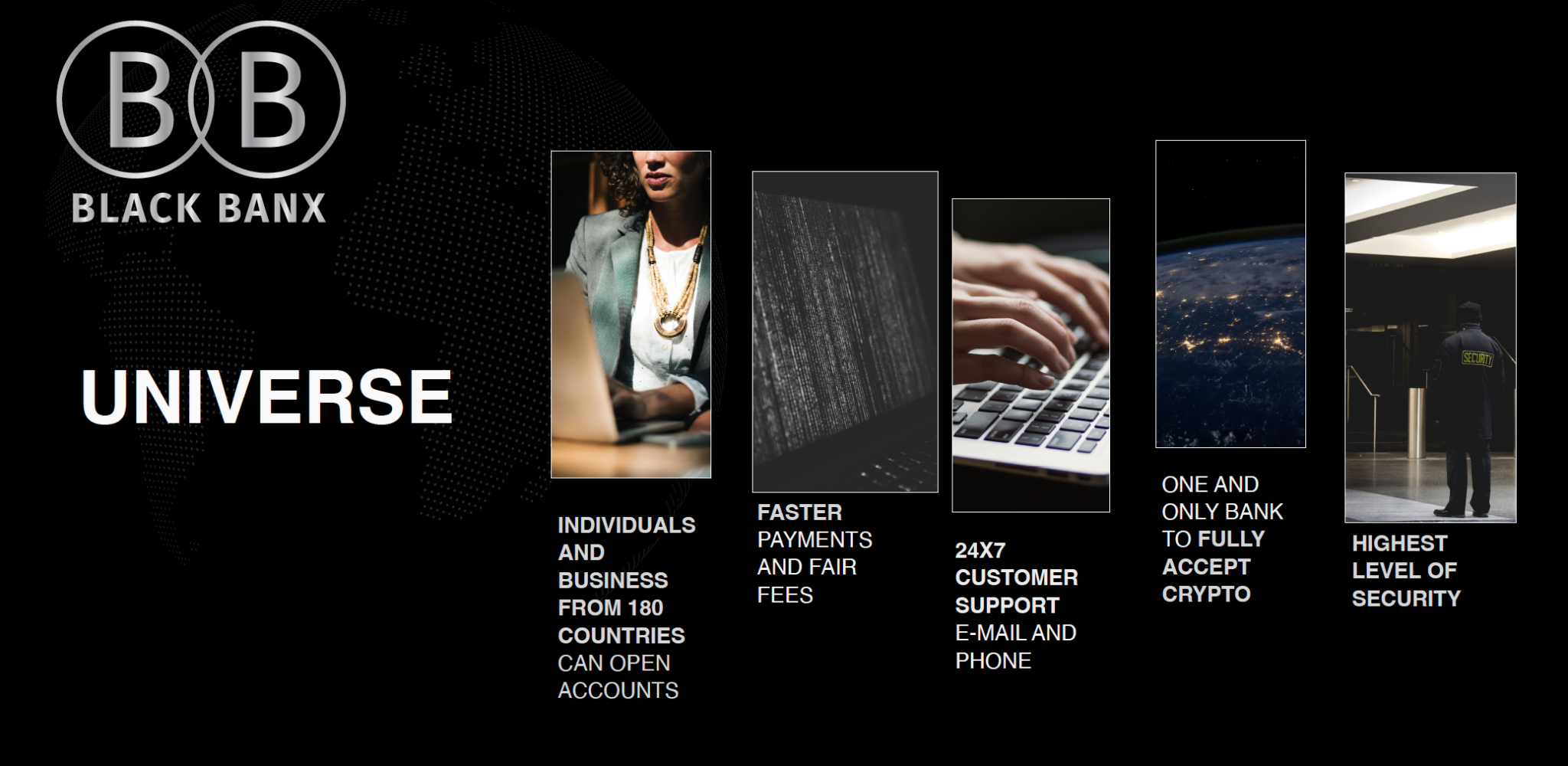

Founded by visionary entrepreneur Michael Gastauer, Black Banx is not just a digital banking platform; it’s a revolution in the fintech sector, combining cutting-edge financial services with a steadfast commitment to environmental stewardship and social responsibility. With an impressive trajectory that saw the company reach a staggering 39 million customers and generate US$2.3 billion in revenue by 2023, Black Banx has set a new benchmark for what it means to be a successful, forward-thinking financial institution.

Sustainable finance: A core philosophy

At the heart of Black Banx’s success is its unwavering dedication to sustainable finance. This commitment goes beyond mere corporate social responsibility initiatives; it’s embedded in the very DNA of the company. From its inception, Black Banx was designed to address the flaws of cross-border banking, offering services that not only meet the needs of its global clientele but do so in a way that promotes environmental sustainability and social inclusion. This is evidenced by their innovative banking solutions that cater to both fiat and cryptocurrency transactions, demonstrating an understanding of the modern financial ecosystem’s dynamics while championing eco-friendly practices.

Adding to their list of achievements, Black Banx has made significant strides in reducing its carbon footprint through initiatives such as the “Stay at Home” and “Go Digital” drives. These efforts, alongside their ambitious goal to achieve net-zero emissions by 2030, underscore the company’s commitment to leading the banking sector towards a more sustainable future. The integration of blockchain and AI technologies further exemplifies their innovative approach to minimizing environmental impact, while simultaneously enhancing the efficiency and security of their banking services.

Bridging the gap: Financial inclusion and environmental responsibility

One of the most commendable aspects of Black Banx’s operations is its dedication to bridging the gap between financial inclusion and environmental responsibility. Understanding the interconnectedness of these issues, the company has taken significant steps to ensure that its services are accessible to the unbanked and underbanked populations, particularly in regions where traditional banking services are scarce. This commitment to financial inclusion is not just about offering banking services; it’s about empowering individuals and communities with the financial tools they need to thrive in a rapidly changing world.

Moreover, Black Banx’s initiatives in sustainable banking have been instrumental in addressing the urgent challenges of climate change and the global debt crisis. By leveraging financial innovation and advocating for policies that support sustainable finance, Black Banx is not just contributing to the fight against climate change; it’s actively shaping a financial landscape where economic growth and environmental stewardship go hand in hand. This is further evidenced by their substantial investments in decarbonizing their operations and their support for projects and technologies that promote a greener future.

Black Banx stands as a testament to the power of visionary leadership and the potential of fintech to drive positive change in the world. Under the guidance of Michael Gastauer, Black Banx has transcended the traditional boundaries of banking, setting a new standard for success that balances profitability with a profound respect for the planet and its inhabitants. As Black Banx continues to expand its global footprint and explore new markets, its journey offers a compelling blueprint for how financial institutions can contribute to a more sustainable and equitable world.