Dubai recorded an occupancy level of 86.3%, which was a 2.7% uplift compared with Q1 2016. Average daily rate (ADR) was down 6.4% over the same time period to an actual level of AED795.00.

DUBAI, United Arab Emirates – The hotel industry in Dubai, United Arab Emirates, recorded strong occupancy levels during the first quarter of 2017 despite continued and significant supply growth, according to data from STR.

Based on preliminary data, Dubai recorded an occupancy level of 86.3%, which was a 2.7% uplift compared with Q1 2016. Average daily rate (ADR) was down 6.4% over the same time period to an actual level of AED795.00. As a result, revenue per available room (RevPAR) decreased 3.9% to AED686.00. Because Dubai has seen two years with consistent RevPAR declines, STR analysts see the Q1 occupancy growth as an indicator of performance recovery.

“A factor that likely played a big role in Dubai’s occupancy growth was the UAE government’s recent decisions to grant visas on arrival for Chinese and Russian nationals,” said Philip Wooller, STR’s area director for the Middle East and Africa. “While Dubai continues to add new supply, it also continues to add new leisure attractions, and expanding the market’s range of potential visitors can only help drive hotel demand and profitability.”

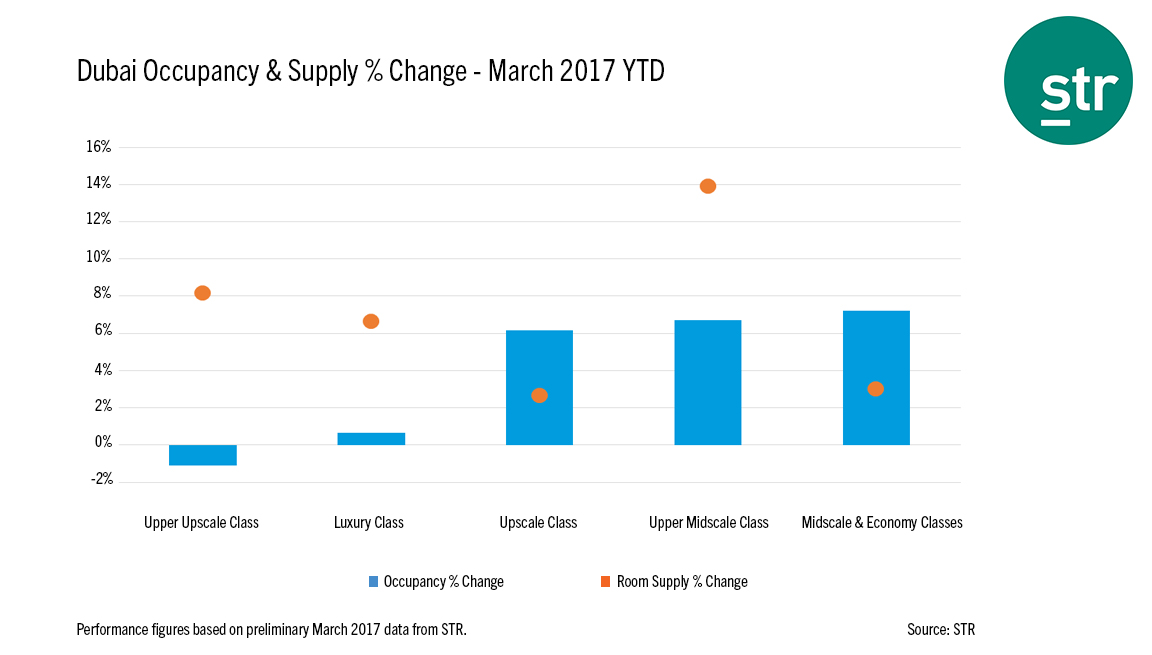

Occupancy increases were mainly pushed by the middle and lower tier hotel classes. Dubai’s Midscale and Economy classes experienced a combined 7.2% year-over-year increase in occupancy, while Luxury hotels posted more moderate growth of 0.7%. Upper Upscale hotels reported a 1.1% decline. STR analysts note that the Midscale and Economy classes experienced less substantial supply growth compared with other classes during Q1, although the Upper Midscale class, which recorded the highest rate of supply growth (+13.9%), also posted a substantial increase in occupancy (+6.7%).

Ahead of his presentation at the Arabian Hotel Investment Conference (AHIC) on Wednesday, 26 April, Robin Rossmann, STR’s managing director, notes that Dubai’s strong demand is impressive considering the significance of supply growth in the market.

“With more than 42,000 rooms currently Under Contract, Dubai has the largest pipeline of any city in the world,” Rossmann said. “The market faces several challenges over the next few years in maintaining a demand level that can offset some of this supply growth. On the positive side, Dubai continues to attract substantial leisure business, so this is definitely one of the top markets in the industry to keep an eye on from both a supply development and performance perspective.”

Global Hotel Study: 2016 in Review

STR has undertaken its first-ever global year-end review of the hotel industry. The report includes regional overviews, ranking which markets reported the strongest and weakest performances by region for 2016, as well as supply growth, compression and forecast insights for the top three markets to watch in each region. The Middle East & Africa section contains valuable insights on Dubai, Cairo and Cape Town.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.