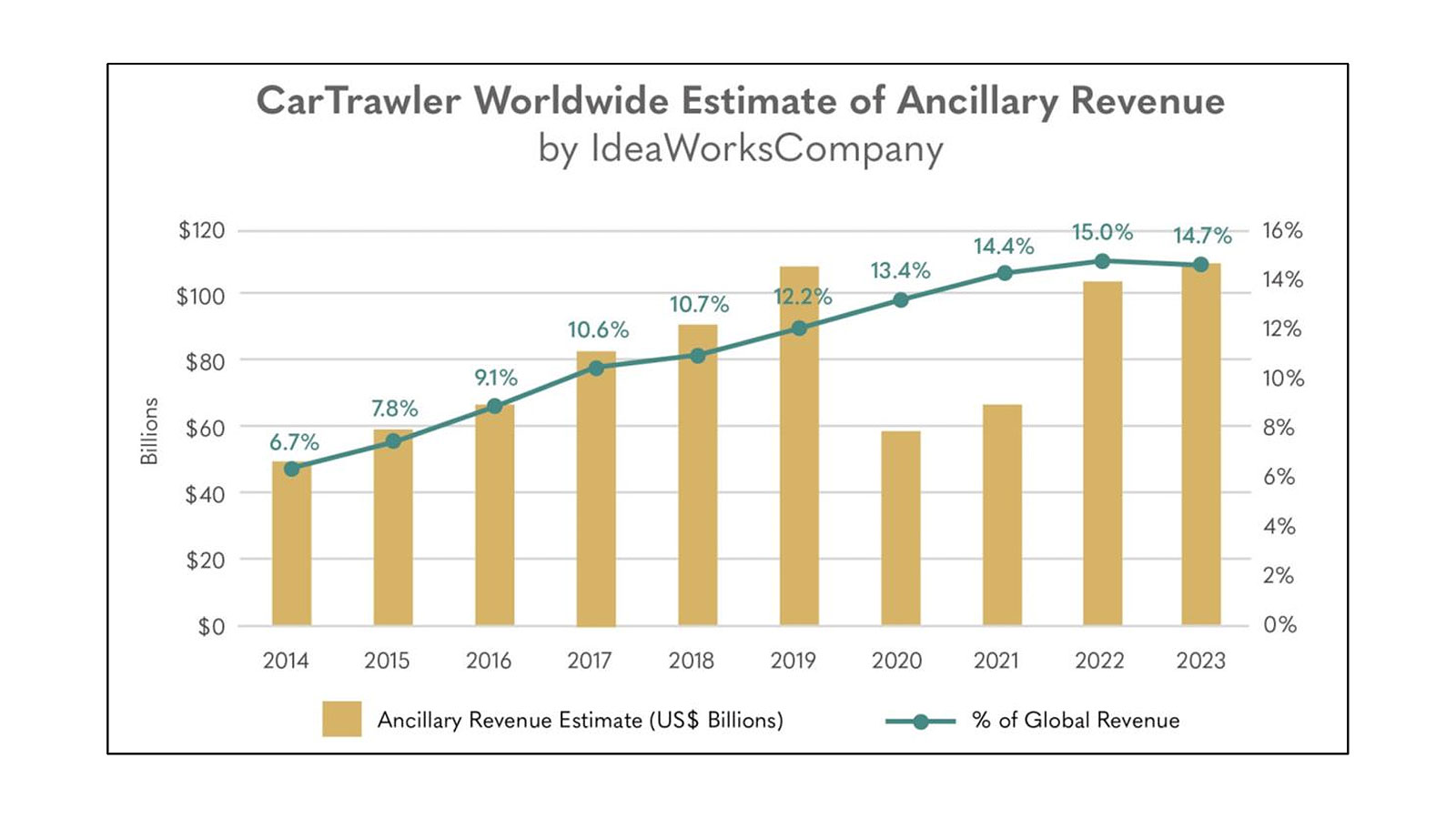

The CarTrawler worldwide estimate posts 7.7% increase above the previous record of $109.5 billion in the pre-pandemic year of 2019.

DUBLIN, IRELAND & SHOREWOOD, WISCONSIN – CarTrawler, the leading B2B provider of car rental and mobility solutions to the global travel industry, and IdeaWorksCompany, the foremost consultant on ancillary revenue, project airline ancillary revenue will increase to $117.9 billion worldwide for 2023, compared to $102.8 billion for 2022 and well above the previous $109.5 billion record in 2019. The CarTrawler Worldwide Estimate of Ancillary Revenue represents an increase largely built on 2023 passenger growth and increasing market share gains by low cost carriers.

Earlier this year, CarTrawler and IdeaWorksCompany reported the ancillary revenue disclosed by 65 airlines for 2022. These statistics were applied to a larger list of 125 airlines to provide a global projection of ancillary revenue by the world’s airlines for 2023. Ancillary revenue is generated by activities and services that yield cashflow beyond the transportation of customers from A to B. This wide range of activities includes commissions gained from hotel bookings, the sale of frequent flyer miles to partners, and a la carte services. It’s the a la carte portion, which includes baggage and seat assignment fees, that represents the share directly paid by consumers.

Chief Commercial Officer of CarTrawler, Aileen McCormack, commented: “Ancillary revenue continues to be a consistent and predictable revenue driver for airlines in the face of unpredictable fare price fluctuations. Although the global airline industry is yet to fully recover post-Covid and return to the heights of 2019, 2023 is expected to see ancillary revenue reach a record high of $117.9 billion worldwide – up from the previous record of $109 billion in 2019 – demonstrating the increasing importance for airlines to identify additional revenue streams.

“Low-cost carriers continue to have the edge on driving ancillary revenue streams, accounting for approximately 31% of market share in this area. However, we are increasingly seeing US airlines gaining momentum with the successful roll out of loyalty programmes and frequent flyer benefits. I expect airlines in Europe and the rest of the world are taking note of this development and evidence of the real returns it’s bringing in terms of yield.

“As we see passenger numbers continue to rise, we expect airlines to continue to pivot and devise new ancillary revenue streams. Within our own partner base at CarTrawler, we’re seeing greater demand for the inclusion of car rental services in loyalty programmes, so airlines and hotel groups can reach a wider customer base with the most relevant rewards. Next year, we expect this area of our business to expand further as we continue to invest and deliver on our company strategy, by enhancing our proposition through innovation.”

Record Result is Built Upon Solid Fundamentals The world’s airline industry has not yet recovered to 2019’s record results for traffic and passenger revenue. This will likely occur in 2024, so chart-topping ancillary revenue for 2023 might appear to many as a surprise. The following four factors are the primary contributors to the big gain anticipated for 2023:

- Many more people are flying. IATA predicts a larger than 28% increase for global airline traffic in 2023 compared to 2022 with an amazing gain of more than 800 million passengers.

- Low carriers are grabbing travelers. For 2020, IdeaWorksCompany calculated global low cost carrier market share at 25%. By 2022 the LCC share jumped above 31%. Simply said, coming out of the pandemic, the best ancillary revenue producers are carrying more passengers than ever.

- Assigned seat fees are being adopted by more carriers. Once largely limited to LCCs, fees for assigned seating now appear in the booking paths of global network carriers. For many airlines, the revenue rivals that of checked baggage. The trend has become so widespread that some carriers now are charging fees for “better” seats in business class.

- Co-branded cards deliver billions more. 15 top performing airlines disclosed a year-over-year frequent flyer program revenue gain of $8.3 billion for 2022, for a giant 41% increase. The carriers include American, GOL, LATAM, Qantas, and United. Continuing growth of this activity is also expected in 2023.

With the passing of every year, ancillary revenue is less revolutionary and becomes more of an everyday component of the airline business. It dependably delivers revenue in good times and bad.

2023 Marks a Return to Normalcy

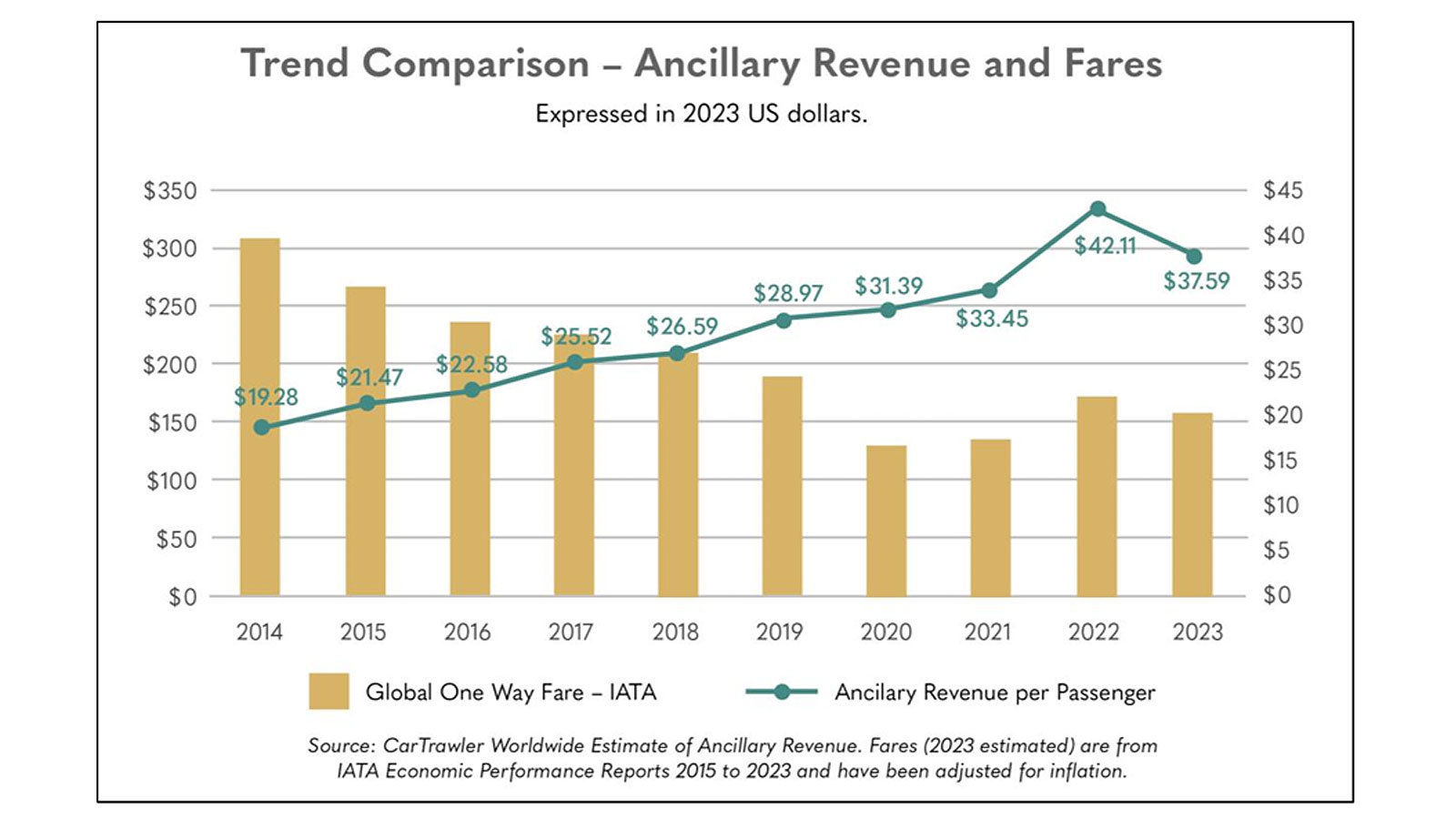

Airline traffic and passenger fares have been topsy-turvy since 2019. Traffic has been restored unevenly across the world, and airfares have dipped or jumped as determined by demand and capacity fluctuations. Airline revenue is directly driven by this often unpredictable activity. The fortunate development for the industry has been the ability of ancillary revenue to grow in good times and in bad.

The chart below displays two truths presented to consumers for the past decade. Globally, passenger fares are on a declining trend. Secondly, ancillary revenue is a contrasting revenue source and has increased in the past decade. 2022 was clearly an outlying year when airlines generated big yields from a surge of consumer demand. Likewise, pandemic-period travel changed the a la carte buying behaviors of travelers. They eagerly purchased the extra comforts and conveniences offered by early boarding, extra leg room seats, and assigned seating in the front of the cabin. This explains the 2022 blip in the red line of per passenger ancillary revenue.

Last year it was unknown if this higher level of activity would continue. 2023 reveals consumers reverting to traditional buying patterns with per passenger ancillary revenue returning to a predictable trend line. Likewise, global one way fares are dipping off the aberration of 2022 and one can anticipate 2024 fares will drop even further. But the last four years have certainly taught the industry an important lesson – ancillary revenue has proven to be a very resilient source of income.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.