CarTrawler 2023 global estimate of baggage fee revenue.

DUBLIN, IRELAND & SHOREWOOD, WISCONSIN – IdeaWorksCompany, the foremost consultancy on airline ancillary revenues, and CarTrawler, leading global B2B provider of car rental and mobility solutions to the travel industry, recently estimated ancillary revenue at $117.9 billion worldwide for 2023. This CarTrawler Global Estimate of Baggage Fee Revenue identifies baggage as a $33.3 billion component and provides a summary of baggage fee policies for 20 top airlines.

Each year IdeaWorksCompany analyzes the ancillary revenue disclosures for airlines all over the world. These results are applied to a larger list of carriers (which numbered 122 for 2022) to estimate ancillary revenue activity for the world’s airlines. Baggage activity for each category of airline is included in this analysis to calculate a global estimate. It’s a significant component of ancillary revenue and consists of three primary sources: checked baggage in the aircraft hold, added fees for heavy and extra-large bags, and for some, the price charged for larger carry-on bags.

Commenting on the findings, Aileen McCormack, Chief Commercial Officer at CarTrawler, said: “The CarTrawler Global Estimate of Baggage Fee Revenue highlights the shifting dynamics of airline revenue streams. Baggage fees, once dominant, now share the stage with assigned seating revenue, reflecting changing consumer behaviours. It is encouraging to see that global baggage fee revenue is almost $1 million ahead of 2019 pre-covid levels.

“At CarTrawler, we recognise the importance of tailored ancillary revenue strategies aligned with each carrier’s brand position. We build customised technology solutions for car rental and mobility while prioritizing the customer booking experience.”

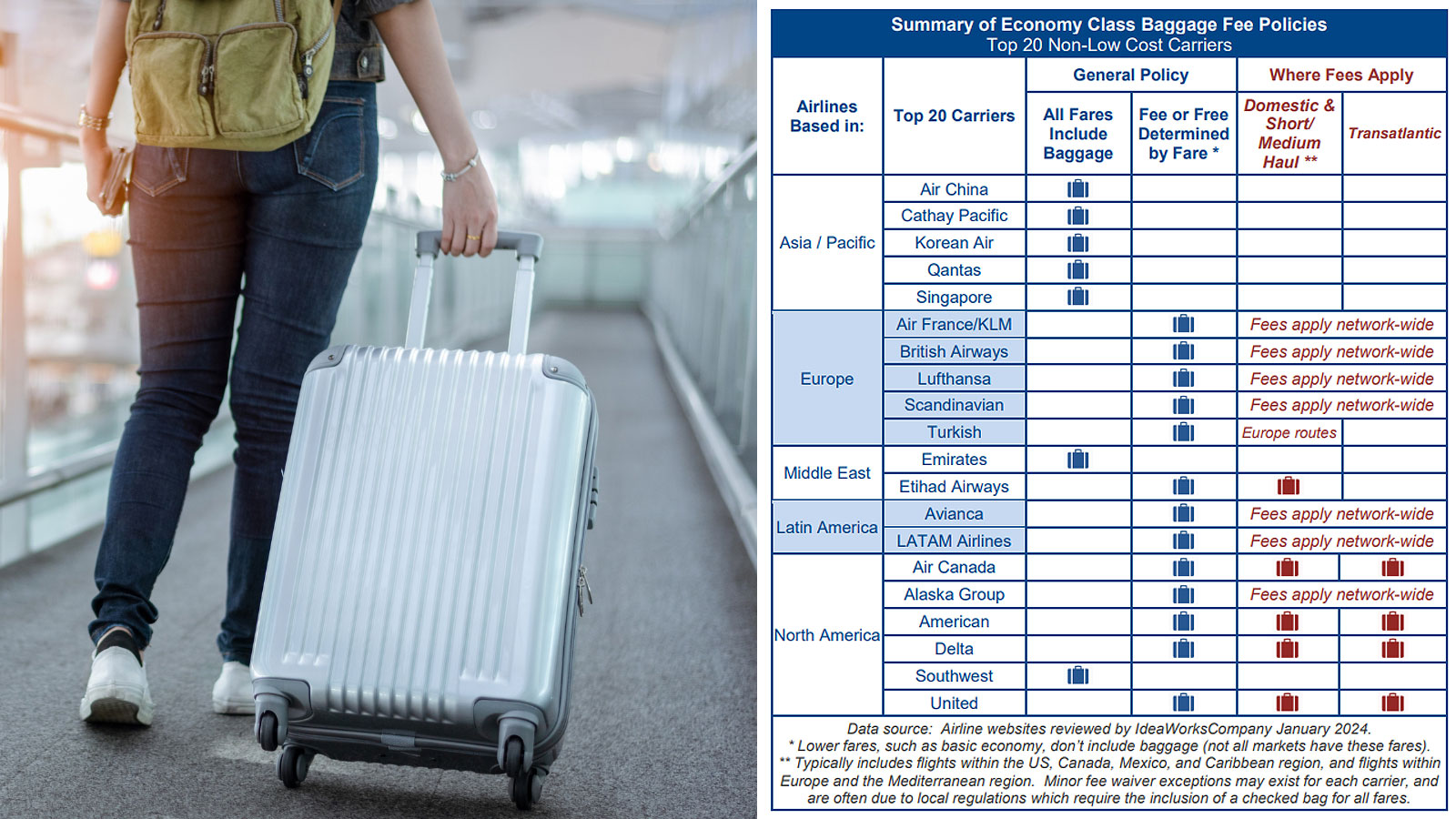

Baggage fees for the first piece checked are a regular revenue source for airlines in Europe, North America, and Latin America. For global network carriers, these are typically associated with “basic economy” fares; for low cost carriers (LCCs), baggage fees are typically charged to all consumers. The table below lists the bag fee policies for 20 top non-low cost carriers.

Fees for checked baggage first started as an economic necessity for traditional airlines seeking relief from a dramatic jump in fuel prices during the oil shock of 2007 and 2008. Within a matter of months, major carriers in the US went from including 2 checked pieces with every fare, to charging for the first bag checked by travelers. Since then, fees for checked baggage have been adopted by airlines all over the world. However, as shown in the table above, traditional airlines in Asia include a checked bag with all passenger fares (the same is true in Africa). US carriers are surprisingly reluctant to add bag fees to all long-distance routes. Transatlantic routes are the exception where bag fees are very prevalent. Baggage fees also have become one of the criteria used to define the category of low cost carriers.

Revenue from baggage fees long represented the single largest ancillary revenue category. However, this began to change during the pandemic when traditional airlines embraced fees for assigned seats. This had been accepted practice for LCCs for a decade; the speed at which global network carriers added these fees has been surprising. Sitting near the front of the cabin, for earlier deplaning upon arrival, became a matter of personal choice and safety during the pandemic. Likewise, choosing an extra leg room seat became an attractive way to create more personal space. Both habits continued through the end of the pandemic, and global revenue from assigned seating may now very well compare to the $30+ billion generated by baggage.

Consumers have reacted to bag fees by wanting to carry more bags into the cabin to avoid charges. Travelers love the convenience of carry-ons, and even load up the cabin on airlines that don’t charge for checked bags. For all airlines, from global network carriers to LCCs, this has become an operational challenge and customer pain point. Many carriers limit carry-ons to 7kgs (15 pounds) and allow an additional personal item such as a purse or laptop bag that can fit under the seat.

Basic economy fares have become a tool used by global network carriers to compete with LCCs through a no-frills offer. This has prompted some airlines to further tighten carry-on policies to encourage consumers to upgrade from lowest basic economy price to a less-restrictive economy fare. For example, consumers buying basic economy fares on Avianca, Etihad, LATAM, SAS Scandinavian, and United are limited to a personal item as their only carry-on. Enforcing this policy can be a challenge; United requires basic economy travelers to check with a counter agent at the airport before receiving a boarding pass.

LCCs encourage consumers to pay for checked bags and have enjoyed success here. Global network carriers now know that capturing this revenue requires more effort than originally anticipated. The reluctance of carriers in some regions of the world may reflect an admission of these difficulties. Perhaps the industry is nearing the limits of borrowing from the LCC playbook of a la carte fees. Or maybe it’s an acknowledgement that changing long-established baggage policies can create unattractive branding and operational outcomes. Ancillary revenue should never

represent a one-size-fits-all solution in which all carriers seek to maximize profits by merely copying every element of the LCC model. Rather, a carrier must first define its brand position and then design an ancillary revenue strategy to fit that role.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.