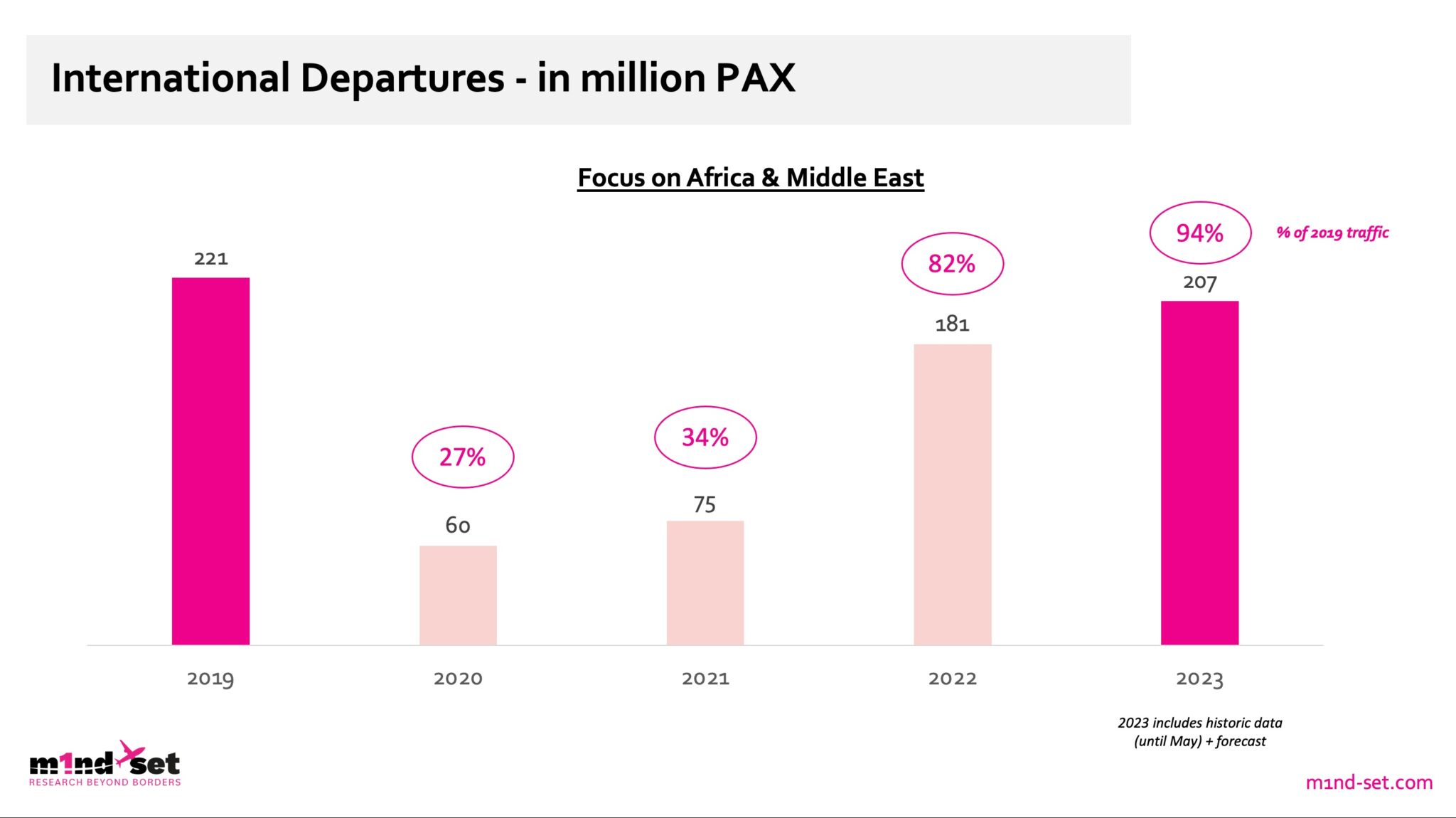

Travel and tourism in the Middle East and Africa region, the focus of another recent region-specific research study by m1nd-set, is experiencing a robust revival, according to the Swiss travel and travel retail research agency.

The region will see international departure traffic for the Middle East and Africa combined fall just 6% short of 2019 levels, according to m1nd-set’s Business 1ntelligence Service (B1S) air traffic and forecasting tool, with traffic data provided by IATA. International departures for the Middle East alone already surpassed the 2019 level in Q1 this year. In Africa, air traffic was at around 88% of the same period in 2019 in Q1 2023.

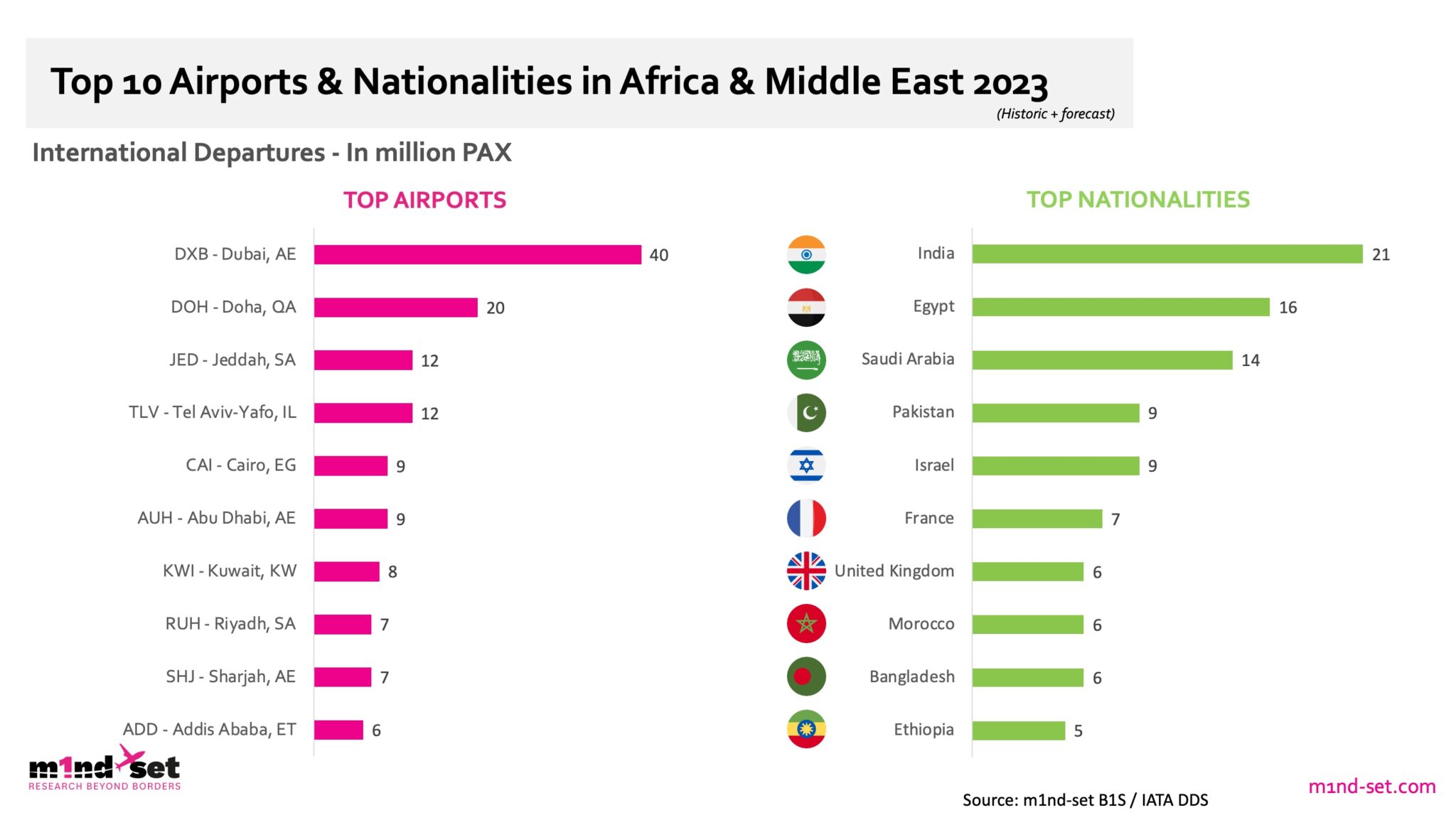

In terms of airports and nationalities in the Middle East & Africa region, based on traffic data for the first 5 months of 2023, Dubai is the clear frontrunner in the region according to m1nd-set. Dubai Airports will see around 40 million international departures this year, based on historic data between January and May this year and forecast traffic for the rest of the year. Doha is in second place with 20 million and Jeddah and Tel Aviv in joint third place with 12 million departures. Cairo and Abu Dhabi share fifth place with an estimated 9 million passengers in 2023. Kuwait, Riyadh, Sharjah and Addis Ababa complete the top 10 airports for international departures with between

6 and 8 million international departures.

The traffic data within the research reveals that Indians account for the highest number of international travellers when comparing the top nationalities departing on international flights across the region. The B1S data shows 21 million departing passengers in 2023. Egypt follows with 16 million and Saudi Arabia completes the top 3 with 14 million passengers departing internationally. Pakistan and Israel follow in joint fourth position with 9 million departing passengers. France, the UK, Morocco, Bangladesh and Ethiopia complete the top 10 ranking for

nationalities departing internationally across the Middle East and Africa, showing the very diverse composition of the traveller mix across the region.

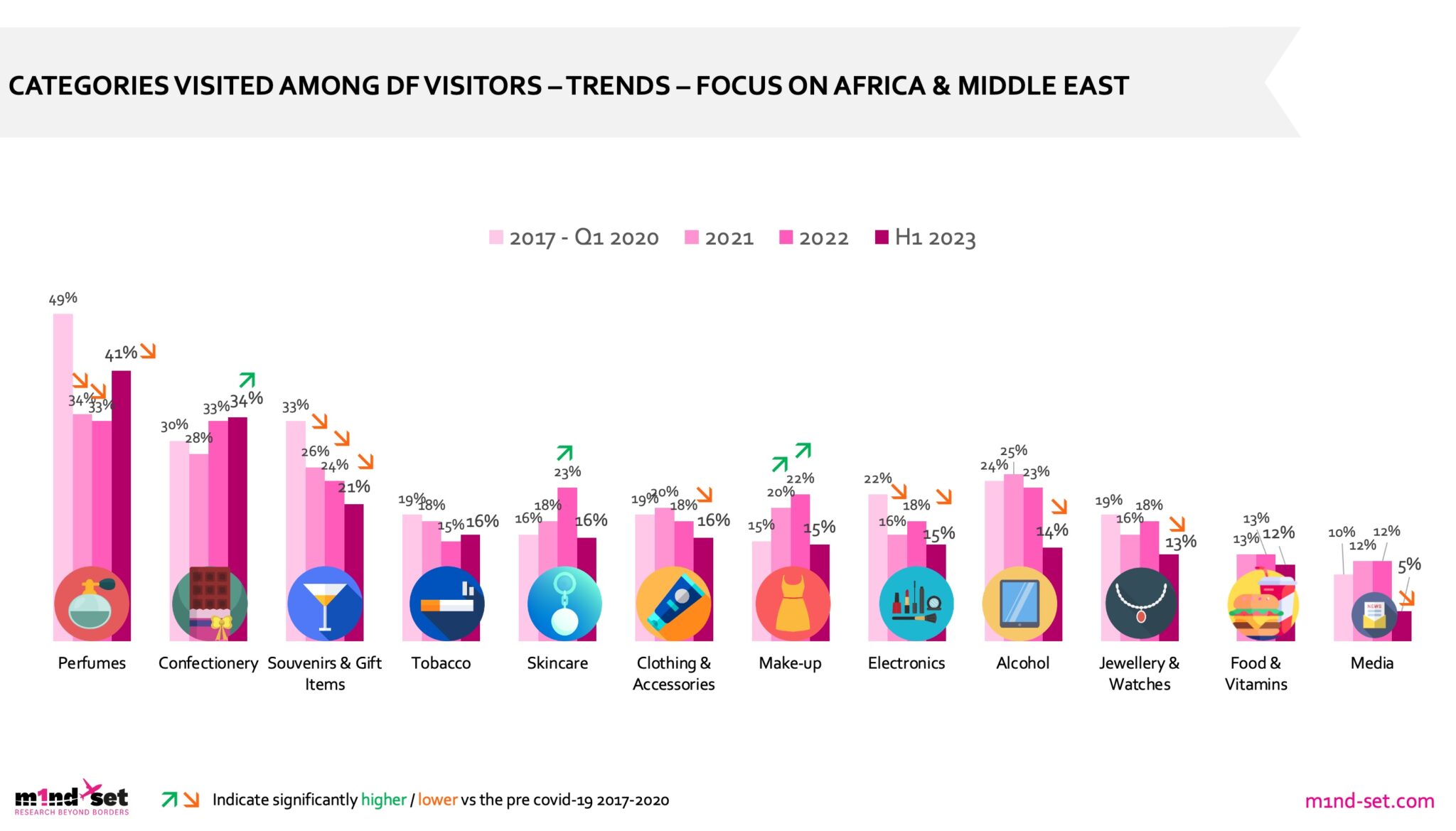

The shopping behaviour analysis in the research shows that Perfumes and Confectionery were the two most visited categories in H1 2023 in airports across the Middle East and Africa. The m1nd-set research also shows that while Perfumes is still the number one visited category in the region, Perfumes visitors have fallen quite significantly, from 49% to 41%, between the pre-pandemic era from 2017 – H1 this year.

Healthy growth for Confectionery

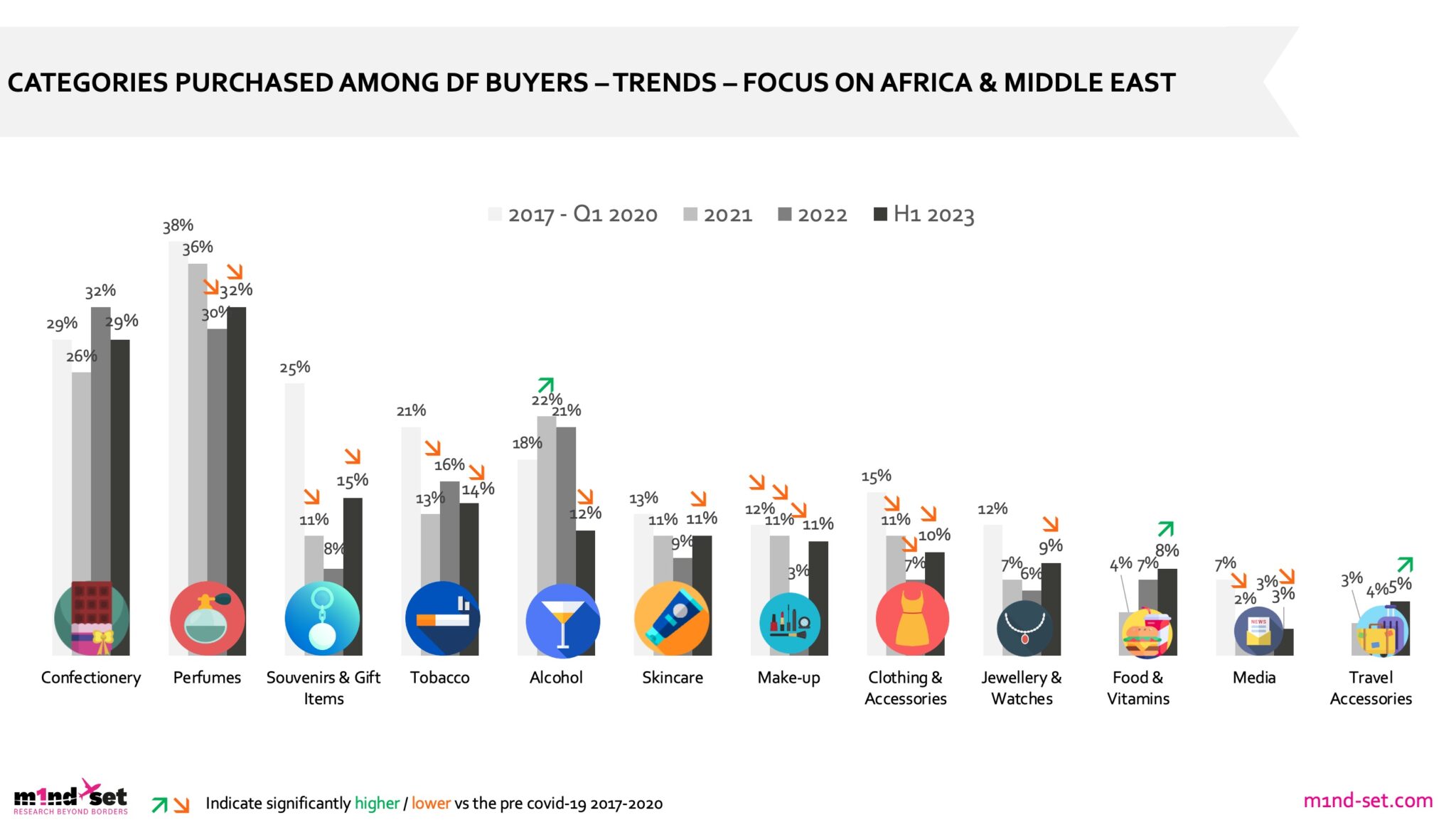

Confectionery on the other hand has seen a strong increase in visitors to the category in 2023 compared to pre-Covid, with a 4% increase in visitors, up from 30% to 34%. Confectionery is also among the top 4 categories purchased by shoppers from the Middle East and Africa in H1 2023, alongside Perfumes, Souvenirs and Tobacco. As with the visitor rates, there is an increase in the share of Confectionery shoppers, up from 29% pre-pandemic to 32% in 2022, before falling to the same level as pre-pandemic in H1 this year. The percentage of Perfumes buyers declined by 6% from 38% pre-pandemic to 32% in H1 2023. Souvenirs & Gifts, Alcohol, Tobacco and Fashion have also experienced a significant decline in shoppers since the pre-pandemic period. The only categories to see an increase are Food & Vitamins and Travel Accessories.

Share of wallet among Middle East and Africa shoppers in H1 2023 is dominated by the Perfumes category with a 22% share, followed by both Jewellery and Watches and Fashion with 12% and Alcohol with 11%. The share of wallet has increased significantly compared to the pre-Covid level for Jewellery & Watches (up from 6% pre-Covid) and Confectionery (up from 3% to 6%), as well as for Perfumes (up 2% to 22%) and Alcohol (up 3%). Other categories that have seen an increase in share of wallet since before the pandemic are Food & Vitamins and Travel Accessories. The category to suffer the most in terms of share of wallet is Souvenirs & Gifts, which has fallen from 12% to 6%.

Peter Mohn, CEO and Owner at m1nd-set commented on the latest Middle East and Africa shopper research: “The research reveals some interesting behavioural trends and evolutions, including how footfall and conversion is performing across the region, the evolution of the

passenger profiles and how these change the dynamics of the customer segmentation modelling for the Middle East & Africa. We see for example in Africa a rise in sustainable tourism and increasing sensitivity to sustainability among shoppers in the region.”

Mohn also highlighted a trend that requires urgent attention among industry stakeholders: “Although shoppers across the region are significantly more likely to interact with the sales staff than they used to prior to the pandemic, this trend is on the decline, falling 6% since last year. It’s vital that retail and promotional staff within the stores continue to engage with customers; engaged and engaging frontline staff are of paramount importance for converting browsers into buyers.

“It’s equally important,” Mohn continued, “to ensure staff are continuously trained on how to interpret different shopper segments and understand their priorities and passions. The impact of staff engagement has consistently increased and is well ahead of where it was pre-pandemic, with 80% of shoppers reporting a positive impact of the staff interaction, compared to 62% before the pandemic” Mohn concluded.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.