BRUSSELS – European airport trade body, ACI Europe released its air traffic report for March and Q1. The report is the only air transport report which includes all types of civil aviation passenger flights: full service, low cost and charter. It reveals that during the first quarter of this year, passenger traffic at Europe’s airports grew by an average +7.6%. Non-EU Airports Outperforming Passenger traffic in the Non-EU market significantly outperformed the European average during Q1 – at +12.9%. This was mainly

BRUSSELS – European airport trade body, ACI Europe released its air traffic report for March and Q1. The report is the only air transport report which includes all types of civil aviation passenger flights: full service, low cost and charter. It reveals that during the first quarter of this year, passenger traffic at Europe’s airports grew by an average +7.6%.

Non-EU Airports Outperforming

Passenger traffic in the Non-EU market significantly outperformed the European average during Q1 – at +12.9%. This was mainly driven by rapidly increasing volumes at airports in Turkey, Ukraine, Israel, Georgia and Iceland – and to lesser extent in Russia, Moldova and Belarus.

Apart from Istanbul-Ataturk (see below), the highest increases in passenger traffic were notably achieved by Ankara (+41.3%), Tbilisi (+37%), Tel Aviv (+19.5%), Istanbul-Sabiha Gocken (+18.5%), Antalya (+16.7%), Kiev (+15.3%), Izmir (+15.1%) and Keflavik (+14.3%).

EU Airports Still Reporting Robust Growth

Meanwhile, the EU market maintained a dynamic growth trajectory with passenger traffic increasing by +6.2% during Q1. Some 14 EU national markets recorded double-digit growth – mostly in the Eastern and Southern parts of the bloc, along with Finland and Luxembourg.

Accordingly, the following capital airports posted significant results: Malta (+19.4%), Riga (+19.4%), Luxembourg (+18.8%), Bratislava (+18.6%), Vilnius (+17.1%), Budapest (+16.9%), Lisbon (+15.8%), Warsaw (+14.7%), Ljubljana (+14.2%), Zagreb (+13.8%), Larnaca (+12.8%), Helsinki (+12.3%) and Prague (+12.4%).

Conversely, passenger traffic at UK, German, Danish and Swedish airports grew at the slowest pace – in large part reflecting the impact of the bankruptcies of Monarch and Air Berlin and/or limited economic growth.

Majors & Regionals

Passenger traffic at the Majors (top 5 European airports) grew by an impressive +9.6% during Q1.

Istanbul-Ataturk led the league with passenger growth of +21.5%. This propelled the Turkish hub from the 5th to the 3rd position of the busiest European airports (compared to full year 2017) – snapping at the heels of Paris-CDG (+4.6%). Frankfurt (now in 5th position) grew by +10% on the back of both low cost carrier (LCC) expansion and a strong hub airline, while Amsterdam-Schiphol (4th position) expanded by +8.2%. London-Heathrow’s remained in the top position, but continued to grow at the slowest pace (+3.1%) due to capacity constraints.

Many regional airports achieved particularly impressive growth – often capitalising on their off-season potential as leisure destinations and yielding the results of proactive route development & marketing. These included: Varna (+90.8%), Naples (+46.1%), Heraklion (+41.2%), Sevilla (+30%), Valencia (+28.3%), Ibiza (+24.6%) Dubrovnik (+23.8%), Olbia (+23.8%), Krakow (+20.9%), Palermo (+20.4%), Nantes (+18.6%), Strasbourg (+16.2%), and Brindisi (+14.6%).

Olivier Jankovec, Director General of ACI Europe said “The momentum for continued passenger traffic growth is holding on. While economic growth is set to remain strong in Europe this year, its pace should moderate somehow – with slower freight traffic appearing to give credence to that. For now, the most significant downside risks for air traffic are coming from rising oil prices, trade disputes and Brexit.”

During Q1, airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between 5 and 10 million passengers (Group 3) and airports welcoming less than 5 million passengers per year (Group 4) reported an average adjustment +7.1%, +7.7%, +9.2% and +8.3%.

The airports that reported the highest increases in passenger traffic are as follows:

- Group 1: Istanbul IST (+21.5%), Istanbul SAW (+18.5%), Antalya (+16.5%), Lisbon (+15.8%) and Moscow SVO (+11.9%)

- Group 2: Ankara (+41.3%), Tel Aviv (+19.5%), Budapest (16.9%), Kiev (+15.3%) and Izmir (+15.1%)

- Group 3: Naples (+46.1%), Heraklion (+41.2%), Sevilla (+30%), Valencia (+28.3%), Ibiza (+24.6%)

- Group 4: Varna (+90.8%), Batumi (+55.1%), Lublin (+54.1%), Craiova (+52.5%) and Kefallinia (+43.3%)

March Figures

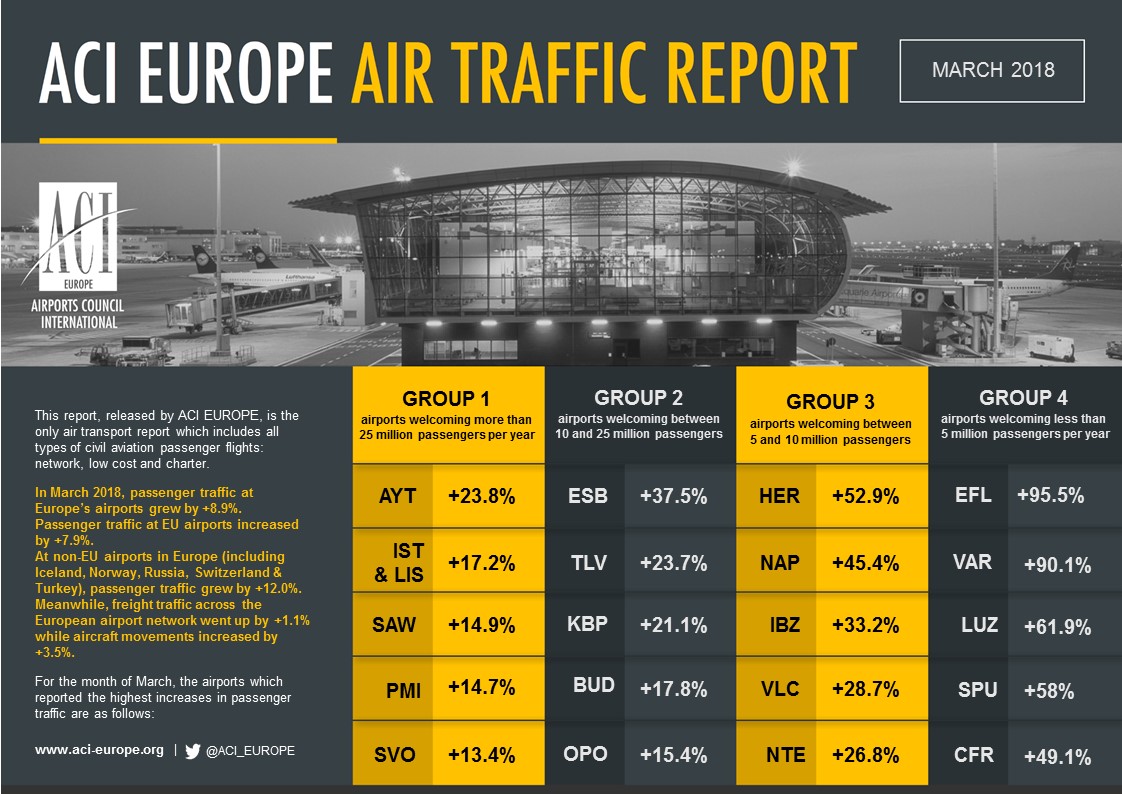

During the month of March, average passenger growth was +8.9% – benefitting from the Easter break starting at the end of the month rather than in April. EU airports grew by +7.9% and non-EU ones by +12%.

Airports welcoming more than 25 million passengers per year (Group 1), airports welcoming between 10 and 25 million passengers (Group 2), airports welcoming between 5 and 10 million passengers (Group 3) and airports welcoming less than 5 million passengers per year (Group 4) reported an average adjustment +8.5%, +9.3%, +10.3% and +7.7%.

For March, the airports which reported the highest increases in passenger traffic are as follows:

- Group 1: Antalya (+23.8%), Istanbul IST & Lisbon (+17.2%), Istanbul SAW (+14.6%), Palma De Mallorca (+14.7%) and Moscow SVO (+13.4%)

- Group 2: Ankara (+37.5%), Tel Aviv (+23.7%), Kiev (+21.1%), Budapest (+17.8%) and Porto (+15.4%)

- Group 3: Heraklion (+52.9%), Naples (+45.4%), Ibiza (+33.2%), Valencia (+28.7%) and Nantes (+26.8%)

- Group 4: Kefallinia (+95.5%), Varna (+90.1%), Lublin (+61.9%), Split (+58%) and Caen (+49.1%)

The 'ACI Europe Airport Traffic Report – March & Q1 2018’ includes 238 airports in total representing more than 88% of European air passenger traffic.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.