Not long ago, ancillary sales by OTAs were negligible. Today, we see cases in which 15 out of every 100 air bookings by OTAs include an ancillary sale, and that figure rises to 30 or 40 for certain carriers. In addition, there are three times more OTAs with integrated airline ancillaries in 2015 compared to 2014.

MADRID – Online Travel Agencies (OTAs) are spearheading a dramatic shift towards online merchandising in 2015. In the first three quarters of this year, Amadeus IT Group saw an 85% increase in the amount of ancillaries being sold via travel agencies. This trend suggests that OTAs are becoming a big player in the merchandising market.

Not long ago, ancillary sales by OTAs were negligible. Today, we see cases in which 15 out of every 100 air bookings by OTAs include an ancillary sale, and that figure rises to 30 or 40 for certain carriers. In addition, there are three times more OTAs with integrated airline ancillaries in 2015 compared to 2014.

Pedro Espin, associate director for merchandising and personalization at Amadeus, says this change is being fuelled by customer demand, and by the significant number of airlines that have made their ancillary content available in the GDS.

“Online travel agencies constantly need to improve their user experience to stay competitive. If I want to book a window seat or bring one extra bag, and an OTA does not give me that option, I can find another travel vendor in just a few clicks,” says Espin.

OTAs have also recognized that merchandising is simply good business.

Logitravel, for example, has stated that the company expects revenues to climb between 5% and 15% thanks to the integration of ancillaries and Fare Families on their website.

The good news is that airlines are benefitting from this trend as well. More than 60 airlines already sell their ancillaries and Fare Families through the Amadeus system, and another 40 airlines have signed and are in the process of being integrated. It is too early to know how much revenue airlines generated through ancillary sales in 2015, but in 2014, IdeaWorks says a sample of 63 airlines made a total of $38.1 billion, which equates to $17.5 per passenger, with year-over-year growth of 21%.

“The selling of merchandising is the first step that OTAs are taking in offering travellers great personalization in their air bookings,” says Pedro Espin. “This trend will benefit everyone: travellers, OTAs and airlines.”

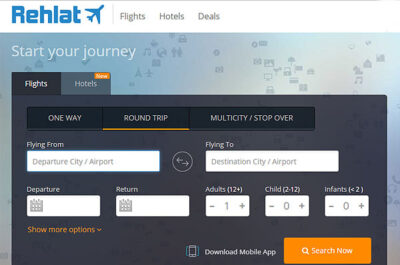

To put this trend into context, in December 2014 there were only 11 OTAs, which had integrated ancillaries, and no airlines were sharing Fare Families. By the end of 2015, Amadeus expects to have 30 OTAs with ancillaries integrated, and 6 with Fare Families. This trend is being driven by some of the world’s largest OTAs: Expedia, eDreams ODIGEO, Fareportal/CheapOair, Logitravel, Voyage Prive and Tripsta are just some of the OTAs selling ancillaries or Fare Families.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.