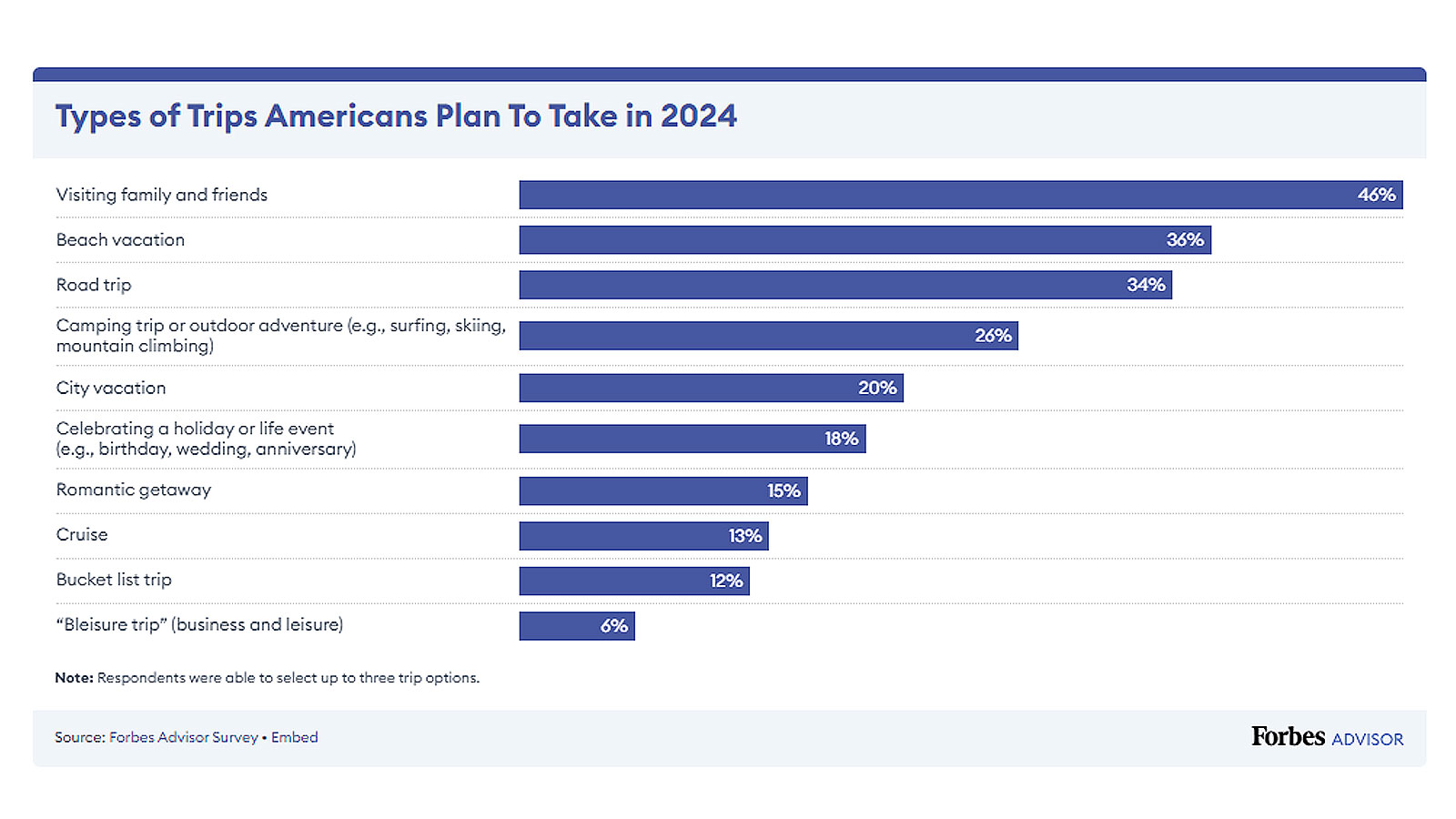

The survey highlights popular travel choices for 2024: visits to family and friends (46%), beach vacations (36%), and road trips (34%). These preferences align closely with the popular travel modes of 2023.

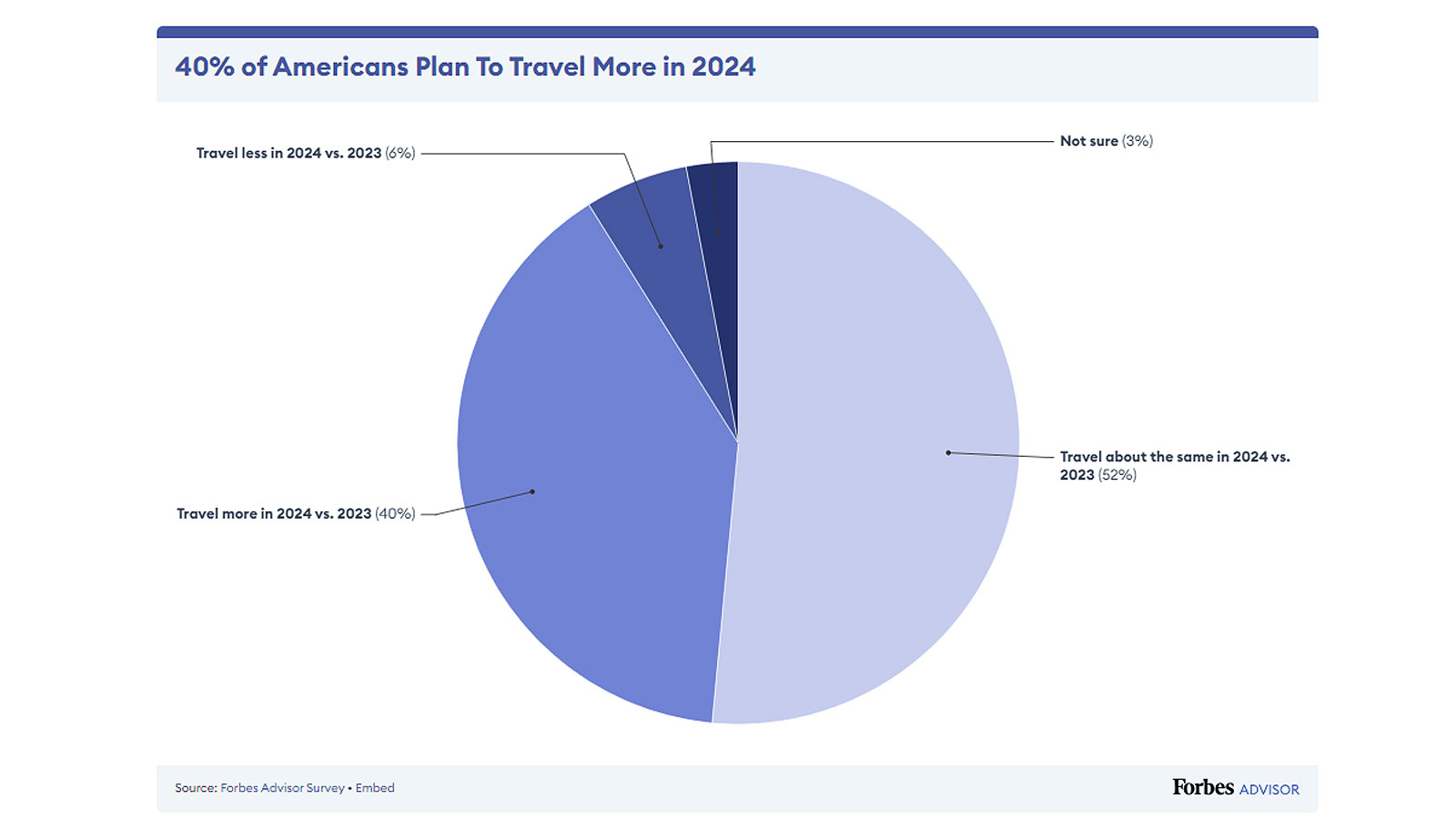

In a remarkable shift in leisure trends, a recent Forbes Advisor survey reveals that 40% of Americans are set to increase their travel activities in 2024 compared to 2023. This finding comes despite the backdrop of global unrest, frequent flight delays, and climbing prices, indicating that vacations remain a significant priority for U.S. citizens.

The survey, encompassing responses from 1,000 American travel enthusiasts, illustrates a consistent appetite for exploration and leisure. While 52% plan to maintain their 2023 travel frequency, an impressive 40% aim to surpass it. This slight decrease from the 49% who increased their travel from 2022 to 2023 nevertheless underscores a robust travel sector, with 63% of Americans undertaking at least two leisure trips in the previous year.

Key facts

- Americans took an average of 2.1 trips in 2023, with 36% of respondents traveling three or more times for leisure reasons.

- 92% of travelers expect to travel at least as much in 2024 as they did in the prior year. While a sizable 40% of respondents plan to travel more this year, that figure is down 9 percentage points compared to our 2023 survey findings.

- Roughly 39% of travelers say their budgets for travel in 2024 will be higher than their budgets from 2023. Comparatively, 45% of survey respondents said the same last year.

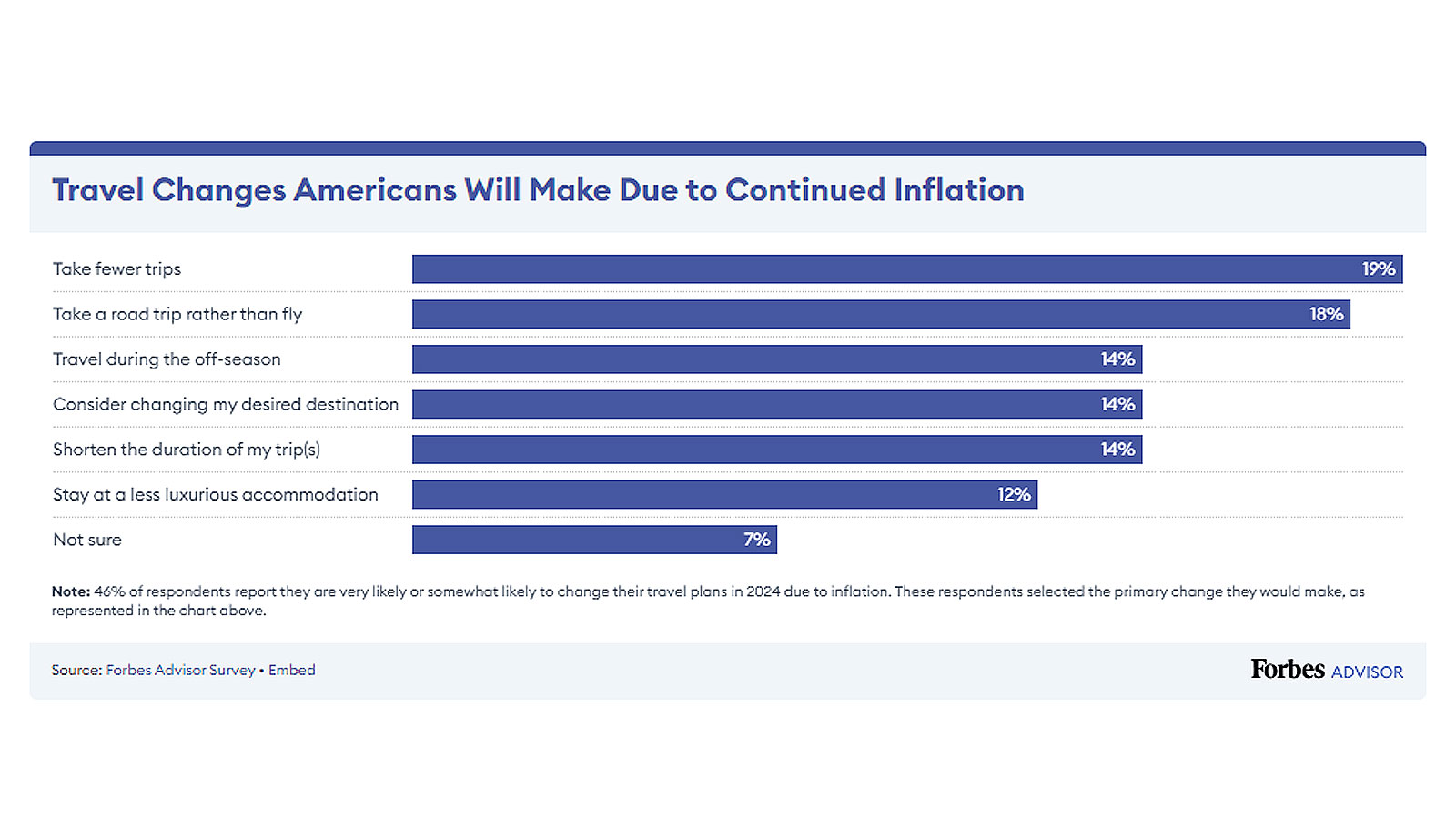

- Of the 46% of respondents who said they are very or somewhat likely to change their 2024 travel plans due to continued inflation, 19% said they’d take fewer trips and 18% claimed they’d take a road trip rather than fly.

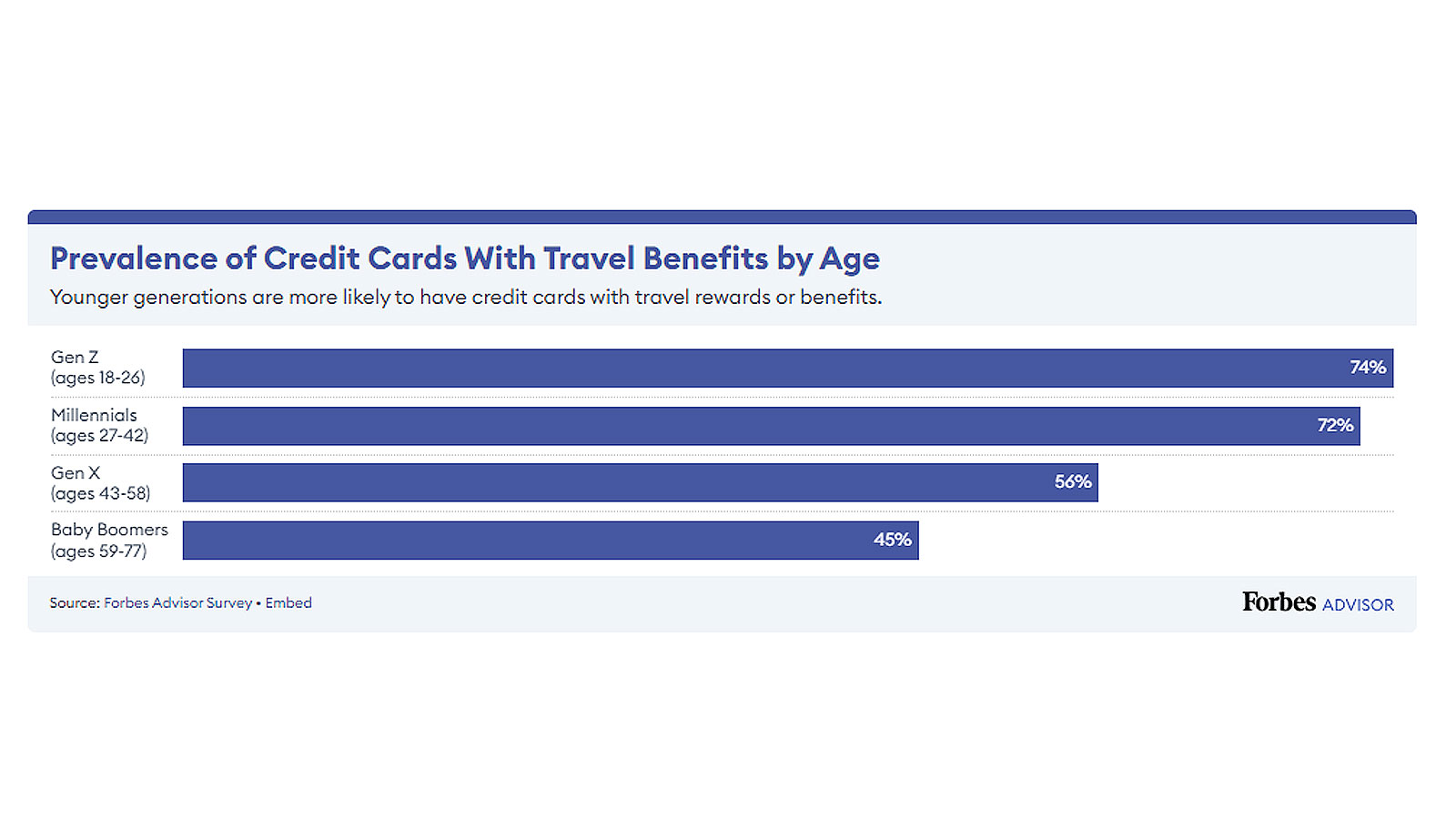

- Of those who pay for travel with a credit card, 57% use cards with travel benefits, down from 66% in 2023.

Generational trends show that younger groups, particularly Gen Z (56%) and Millennials (49%), are leading the charge in upscaling travel plans, whereas older demographics like Gen X and Baby Boomers exhibit more static travel intentions.

Financial planning for travel also emerges as a key theme. Despite broader inflationary pressures, 39% of respondents anticipate increasing their travel budgets, with 35% planning to spend similarly to last year. This economic resilience is further evidenced by 72% of participants expecting to allocate over $2,000 for travel in 2024, and nearly half (48%) earmarking a minimum of $4,000. This trend is most pronounced among Millennials and Gen Z, who are more likely to allocate upwards of $4,000.

However, the impact of inflation is not overlooked. Approximately 46% of travelers are considering adjustments to their travel plans, with strategies like reducing trip frequency, shortening trip durations, opting for driving over flying, and choosing more affordable destinations or accommodations.

A notable 30% of respondents are adopting a “wait and see” approach regarding inflation, indicating a strong inclination to prioritize travel when financially viable. This group is particularly interested in maximizing the use of miles and points for potential last-minute trips.

Payment methods for travel reveal a preference for credit cards, with 60% of respondents favoring this option, notably for the travel benefits attached to many credit cards. The trend is especially prevalent among younger travelers, with a majority holding cards offering travel rewards.

Despite the inclination towards card payments, many travelers still plan to use cash (38%) or Buy Now, Pay Later services (12%).

The report emphasizes strategic financial management as key to realizing travel goals amidst high costs. Savvy planning, price tracking, and destination selection based on affordability are recommended strategies. The use of credit cards for travel expenses is advised only when backed by sufficient funds to avoid interest charges and maximize card benefits.

In conclusion, the survey paints a picture of a resilient American travel sector, where increased spending and strategic adjustments coexist with the challenges of inflation. As travelers navigate these complexities, the importance of careful financial planning and informed choice of travel rewards cards becomes increasingly evident.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.