Q4 23 net revenues of $61.1m., up 78% from prior-year quarter, on gross Bookings of $619m.

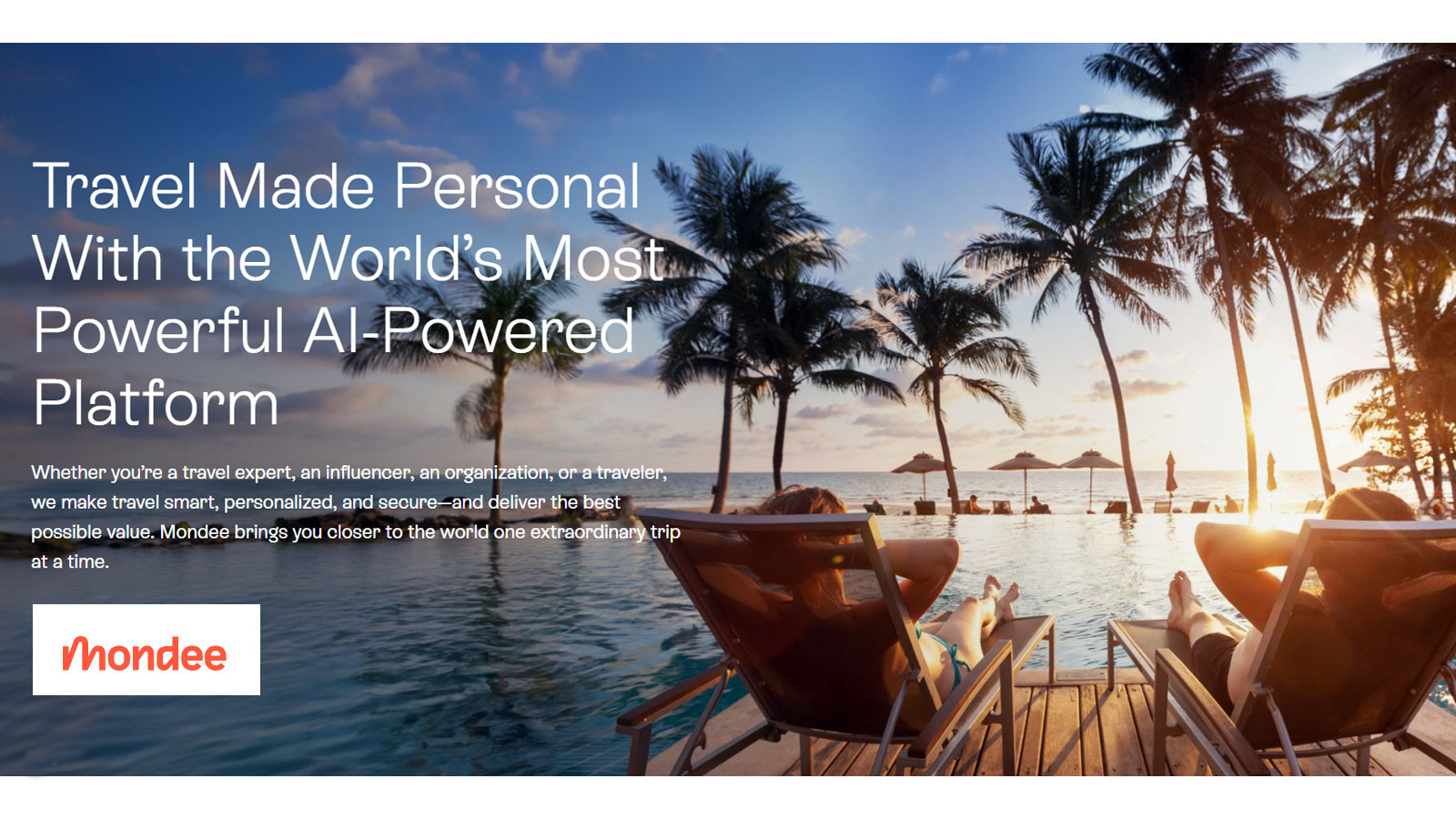

AUSTIN, TEXAS – Mondee Holdings, Inc., a leading travel marketplace and artificial intelligence (AI) technology company, announced preliminary unaudited financial results for the three-month period and full-year ended December 31, 2023.

“Mondee is pleased to report record net revenues and Adjusted EBITDA in Q4 and full year 2023 (“FY 23”), exceeding guidance. This strong year-over-year growth was fueled by product and geographic expansion of our marketplace, industry-leading technology advancements, and sustained leisure travel demand. We are focused on marketplace expansion in both content, geography and new-era distribution as well as widening our technology lead in AI with investments in Abhi, the first AI-powered travel platform and the acquisition of AI pioneer Purplegrids. These initiatives, coupled with sustained transaction growth, take rate improvement, and cost control are expected to enhance revenues and profitability,” said Founder, Chairman, and CEO Prasad Gundumogula.

“Mondee’s record financial performance continues, with gross bookings increasing by 24% in Q4 2023. The success of our monetization strategies led to a take rate of nearly 10%, double pre-pandemic levels, driving net revenue growth of 78%. Turning to profitability, 2023 Adjusted EBITDA of $21.0 million increased by 77% year-over-year. Looking forward, we remain committed to top-line growth, profitability, and cash flow generation,” said CFO Jesus Portillo.

Fourth-Quarter and Full-Year 2023 Preliminary Unaudited Financial Highlights1

- Gross bookings of $619 million expected for the quarter, an increase of 24% compared to $500 million in the fourth quarter of 2022 (“Q4 22”). FY 23 gross bookings of $2.6 billion grew 19% compared to full year 2022 (“FY 22”).

- Net revenues of $61.1 million expected for the quarter, an increase of 78% compared to $34.2 million in Q4 22. FY 23 net revenue of $222.3 million grew 39% compared to FY 22 and exceeded guidance of $217 million.

- Net Loss of $(12.5) million expected for the quarter, which included $11.3 million of non-cash and/or non-recurring items, such as $3.4 million of stock-based compensation and $2.8 million of intangible assets amortization, among others. FY 23 net loss was $(60.1) million, a year-over-year improvement of $30.1 million.

- Adjusted EBITDA of $6.9 million expected for the quarter, an increase of 338% compared to $1.6 million in Q4 22. FY 23 adjusted EBITDA of $21.0 million nearly doubled from 2022 and exceeded guidance of $19.7 million.

- Operating cash flow of $(10.6) million expected for the quarter, compared to $(9.9) million in Q4 22. FY 23 operating cash flow was $(24.0) million versus FY 22’s $(10.6) million. This lower cash flow was primarily driven by a higher interest payment of $5.7 million (mainly due to conversion from PIK to cash interest), a change in net working capital of $6.3 million, and payments related to the LBF divestiture of $7.7 million. Adjusting for these, Operating Cash Flow would have improved from 2022’s level by $6.3 million.

Financial Summary and Operating Results 1,2

(unaudited)

| For the three months ended December 31 |

Year-Over-Year Change | ||||||||||

| 2023 | 2022 | % | |||||||||

| Transactions | 829,698 | 533,110 | 296,588 | 56% | |||||||

| Gross Bookings | $619,284 | $499,847 | $119,437 | 24% | |||||||

| Net Revenues | $61,053 | $34,248 | $26,805 | 78% | |||||||

| Net Loss 3 | $(12,526) | $(16,526) | $4,000 | NA | |||||||

| Loss per share (EPS) | $(0.21) | $(0.20) | $(0.01) | NA | |||||||

| Adjusted EBITDA | $6,947 | $1,585 | $5,362 | 338% | |||||||

| Adjusted Net Loss | $(6,383) | $(6,288) | $(95) | NA | |||||||

| Adjusted Loss per Share 5 | $(0.13) | $(0.10) | $(0.03) | NA | |||||||

| Net cash from (used in) operating activities | $(10,593) | $(9,922) | $(671) | NA | |||||||

| For the twelve months ended December 31 |

Year-Over-Year Change | ||||||||||

| 2023 | 2022 | % | |||||||||

| Transactions | 2,912,029 | 2,137,530 | 774,499 | 36% | |||||||

| Gross Bookings | $2,564,058 | $2,148,801 | $415,257 | 19% | |||||||

| Net Revenues | $222,285 | $159,484 | $62,801 | 39% | |||||||

| Net Loss 3,4 | $(60,148) | $(90,238) | $30,090 | NA | |||||||

| Loss per share (EPS) | $(0.93) | $(1.34) | $0.41 | NA | |||||||

| Adjusted EBITDA | $21,043 | $11,881 | $9,162 | 77% | |||||||

| Adjusted Net Loss | $(20,384) | $(20,080) | $(304) | NA | |||||||

| Adjusted Loss per Share | $(0.41) | $(0.32) | $(0.09) | NA | |||||||

| Net cash from (used in) operating activities5 | $(23,993) | $(10,612) | $(13,381) | NA | |||||||

1 Note that results are preliminary unaudited. Mondee’s first and second quarters of 2022 financial results were prior to the Company’s listing on the NASDAQ.

2 In $ thousands except for EPS.

3 4Q 2023 Net Loss included included $11.3 million of non-cash and/or non-recurring items, such as $3.4 million of stock-based compensation and $2.8 million of intangible assets amortization, among others.

4 2022 included a one-time stock-based compensation of $55.2 million related to Mondee’s business combination and NASDAQ listing.

5 2023 net cash used in operating activities includes higher interest payment of $5.7 million (mainly due to conversion from PIK to cash interest), a change in net working capital of $6.3 million, and payments related to the LBF divestiture of $7.7 million.

Fourth Quarter 2023 Business Highlights and Subsequent Events

- Maturity Extended for Term Loan. The Company amended its term loan agreement, extending the maturity to March 31, 2025, whilst it works to finalize a long-term facility.

- Acquired Purplegrids, a leading AI-platform and team. Founded in 2017 by Joseph Vijay Raj John, after a successful 12-year career at Apple, Purplegrids boasts a team with AI professionals from Google, Apple, Meta, PayPal and Oracle. Purplegrids’ platform offers a humanized AI-driven user experience combining the benefits of large language and generative models with business intelligence and robotic processing automation (RPA) to automate user experiences. It is expected that the integration of Mondee’s AI capabilities with Purplegrids will not only expand the AI travel platform but also speed up our roadmap to bring AI to more, and ultimately all, aspects of Mondee’s business.

- Share Repurchase and Preferred Financing: During Q4 2023, the company raised $11.3 million in preferred financing, $10 million of which was used in share buybacks as part of our inaugural share buyback program approved by our Board of Directors.

2024 Financial Outlook

The company’s guidance for fiscal year 2024, is as follows:

- Net revenues of approximately $250 million to $255 million, representing an increase of 14% versus 2023 net revenues, measured at the midpoint.

- Adjusted EBITDA of approximately $30 million to $35 million, representing an increase of 24% versus 2023 Adjusted EBITDA, measured at the midpoint.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.