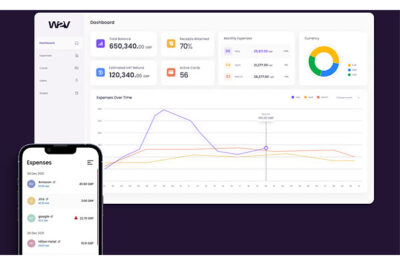

W2V Compliance automatically performs full auditing on accounts payable and domestic VAT/ GST invoices up to four years old

Leader in automated VAT claim and return solutions, Way2VAT Ltd, launches a new AI-driven automated accounts payable auditing product, AI-AP Compliance, to complement the company’s existing suite of AI-powered VAT/GST claim and return solutions.

Using a world-first ‘document first’ compliance technology, AI-AP Compliance verifies proper submission of AP and domestic VAT/GST expenses to tax authorities on invoices up to four years old. It checks for common mistakes, identifies wrongly submitted expenses, pinpoints errors, and then advises the required action for invoices across 80 countries. It creates a new revenue stream for Way2VAT based on fixed fee per audited invoice and 20% of unclaimed refunds. It is particularly aimed at large and multinational companies looking to maximise VAT/GST returns and ensure they’re meeting increasingly stringent compliance regulations across the many jurisdictions in which they trade.

AI-AP Compliance is the only automated compliance product for accounts payable and domestic VAT/GST that can manage regulations across any tax jurisdiction, manages the complexity involved in shipping goods, and ensures businesses account for reverse charges correctly.

Way2VAT CEO and Founder, Amos Simantov, said, “I’m thrilled to launch our latest AI-powered product, AI-AP Compliance. Our new automated product is the first of its kind, building on our existing technology platform to perform a full audit of all accounts payable and VAT/GST invoices across 80 countries for clients.

“Many companies use external advisors to perform invoice audits. This not only takes a lot of time and is costly, but opens a company to risk and potential fines for improper VAT/GST treatment as external advisors tend to only do spot checks on a sample of invoices.

“AI-AP Compliance operates at magnitudes quicker than manual auditing of spot invoices, reducing the time for processing from months to days. It significantly reduces risk by automatically ensuring all invoices are compliant with various VAT/GST rules and regulations, and verifying the correct amount of VAT/GST has been charged or paid. AI-AP Compliance incorporates different taxation jurisdictions and removes risk of error for enterprise and multinational organisations with entities in 80 countries around the world. Our product is useful for clients working across transport and logistics, raw materials, energy, products and equipment, leasing and licensing, services, security, maintenance and more. We have priced this product at a very competitive standard rate per invoice plus 20% of unclaimed refunds, and will work with clients with a minimum of 10,000 invoices to be checked. We will roll out AI-AP Compliance across our existing client base over the coming weeks and months.”

Wat2VAT product suite

Way2VAT’s unique AI-powered technology operates across foreign and domestic VAT/GST reclaim, accounts payable reclaim across 40 countries, and now, audits accounts payable

and domestic VAT/GST compliance for an additional 40 countries.

AI-AP Compliance – new product line

AI-AP Compliance runs automated scans and enrichment of submission reports, invoice and receipt images, checks against taxation and governance protocols across 80 countries. It generates audit and discrepancy reports that verify proper submission of AP expenses, identifies wrongly submitted expenses, unpaid invoices or redundant VAT recovery, pinpointing errors and rectifications needed.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.