The Hotel Brand sub-index jumped 7.4% from May to 10,545, while the Hotel REIT sub-index grew 1.8% to 1,072.

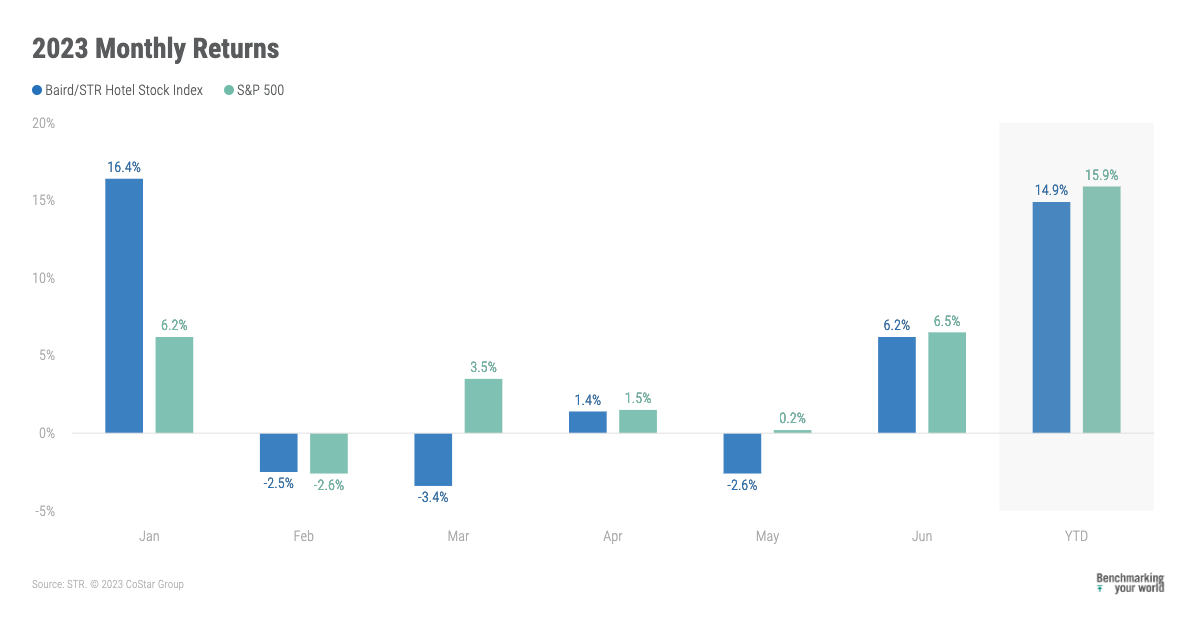

HENDERSONVILLE, TENNESSEE, and MILWAUKEE – The Baird/STR Hotel Stock Index grew 6.2% in June to a level of 5,615. “Hotel stocks extended their year-to-date gains in June as the broader market moved higher on fading recession fears,” said Michael Bellisario, senior hotel research analyst and director at Baird. “Macroeconomic concerns have continued to subside, but recently normalizing leisure travel patterns domestically have weighed on the hotel REITs’ relative performance, particularly compared to the global hotel brands that are still benefitting from recovering international markets and cross-border demand.”

“U.S. hotel room demand fell 0.3% in the second quarter, a result of a calendar shift in April along with flat year-over-year comparisons in May and June,” said Amanda Hite, STR president. “While concerning, we believe the recent demand trends signal a return to industry normalcy as the traveler mix, market blend and day-of-week levels stabilize. Conversely, RevPAR grew 2.5% in Q2, slightly below our expectations, while up 8.7% year to date, which is ahead of our full-year forecast.”

In June, the Baird/STR Hotel Stock Index lagged the S&P 500 (+6.5%) but outperformed the MSCI US REIT Index (+4.3%).

The Hotel Brand sub-index jumped 7.4% from May to 10,545, while the Hotel REIT sub-index grew 1.8% to 1,072.

Theodore is the Co-Founder and Managing Editor of TravelDailyNews Media Network; his responsibilities include business development and planning for TravelDailyNews long-term opportunities.