Delivered as an end-to-end platform that handles all mobile-digital transactions, CellPoint Mobile's converged payments solution can help airlines reduce and streamline their dependency on payment service providers (PSPs) while maintaining a secure and user-friendly digital experience for passengers.

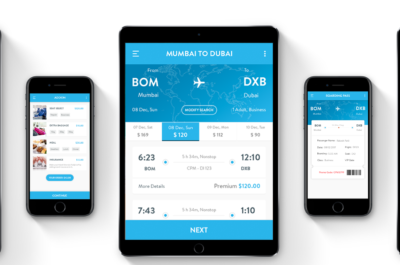

LONDON – In response to airlines’ increasingly complex mobile payments ecosystem, CellPoint Mobile has announced a converged payments solution that securely and seamlessly processes passengers’ mobile payments and digital transactions, regardless of mobile device or the disparate array of underlying data sources and mobile payment technologies, including ApplePay, PayPal, MCX, credit-debit cards and others.

Delivered as an end-to-end platform that handles all mobile-digital transactions, CellPoint Mobile’s converged payments solution can help airlines reduce and streamline their dependency on payment service providers (PSPs) while maintaining a secure and user-friendly digital experience for passengers, according to Kristian Gjerding, CEO of CellPoint Mobile, a global firm specializing in mobile payments technologies and solutions for the airline and transportation industry.

Data from CPM clients using converged payment solutions shows that 97% of ancillary revenue and 71% of total revenue is generated by passengers who store their payment data, according to Gjerding. Earlier in 2014, CPM’s solution was deployed at Emirates, enabling the airline to store payment data securely and conveniently for members of the Emirates Skywards frequent flyer programme. The solution simplified the process by which they browse, book and pay for tickets and ancillary services from the Emirates website, mobile app and call centre.

To date, 40% of premier Skywards members have used the solution to store their payment data. Start-to-finish project implementation took less than six months and resulted in a 50% reduction in time-to-market for stored payments and 60% increase in efficiency around data streamlining and integration, Gjerding said.

The airline industry faces numerous challenges, Gjerding pointed out, including passengers’ preferences and demands for the ability to research, book and pay for travel from a variety of devices (smartphones, cell phones, tablets, PCs) and an increasingly complex array of currencies (credit-debit, points, PayPal, alternate payments) – all supported by numerous, disparate mobile payment vendors (Google Wallet, Apple Pay, PayPal, MCX, etc.). Airlines also face ongoing challenges to increase revenues, boost margins and trim costs.

At the forefront of mobile technologies since 2007, CellPoint Mobile’s deploys its mPoint solution and underlying Commerce Orchestration Platform to integrate, normalize and process digital transactions and payments from disparate payments sources and systems. At Emirates, the company’s solutions create a passenger-friendly experience with no additional training for airline employees because current data sources and business process are supported by the CellPoint Mobile platform. CPM also provides mobile ticketing and payment solutions to Danish Rail.

“We can help airlines significantly reduce their dependency on PSPs by managing all transactions centrally, making sure that payments and transactions are executed cost-effectively from a single interface, and ensuring that updates and enhancements are rolled out easily and securely,” Gjerding said.

During the opening session of 8th Annual Global Airline and Travel Payments Summit (ATPS) in San Francisco, Gjerding and an Emirates representative will discuss the company’s Case Study on Stored Capability Project.

Vicky is the co-founder of TravelDailyNews Media Network where she is the Editor-in Chief. She is also responsible for the daily operation and the financial policy. She holds a Bachelor's degree in Tourism Business Administration from the Technical University of Athens and a Master in Business Administration (MBA) from the University of Wales.

She has many years of both academic and industrial experience within the travel industry. She has written/edited numerous articles in various tourism magazines.